Question: Provide the correct Answer with explanation and don't use chatGPT/AI bot other wise down vote. thank you Aruru, LLC (Aruru or the Company) produces a

Provide the correct Answer with explanation and don't use chatGPT/AI bot other wise down vote. thank you

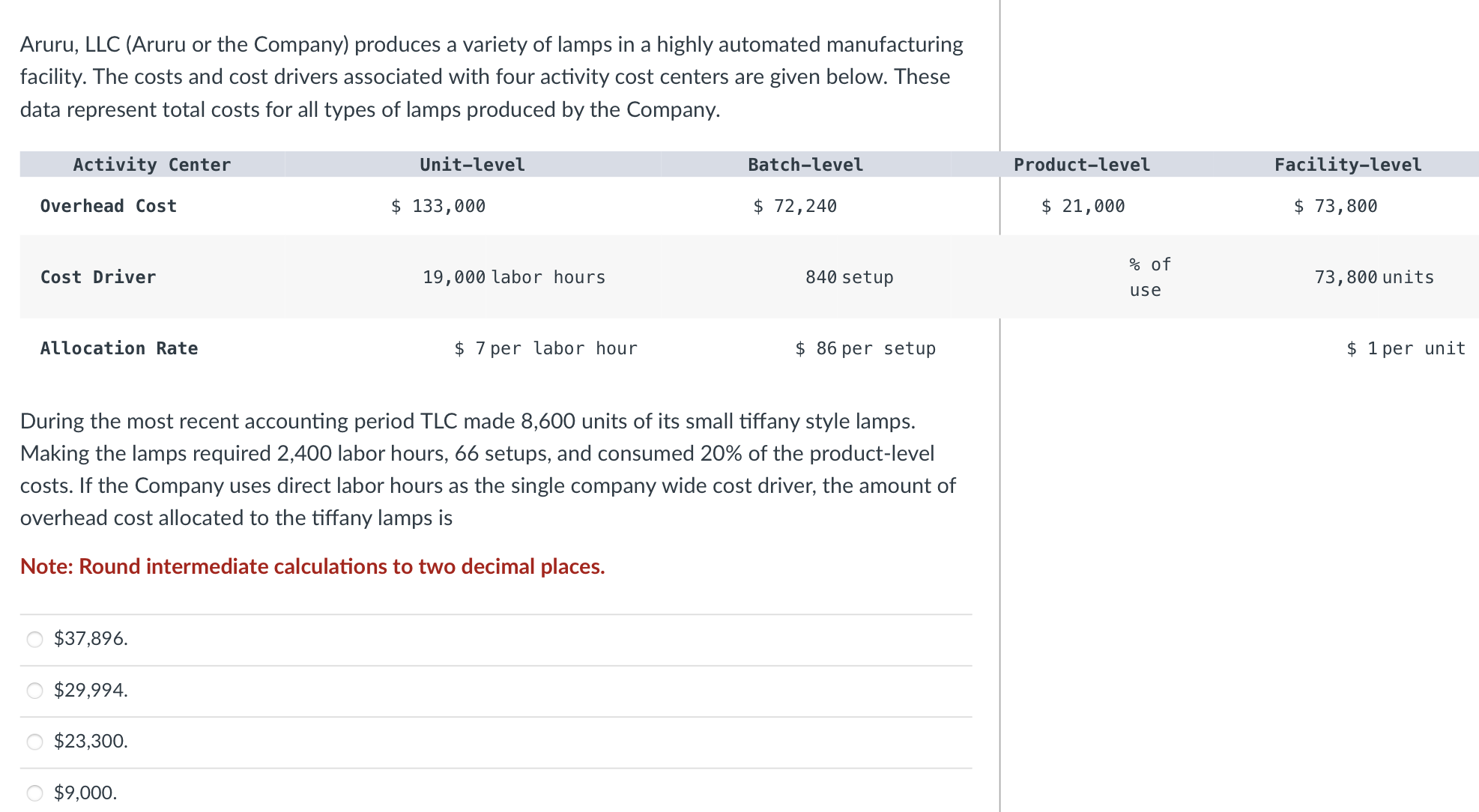

Aruru, LLC (Aruru or the Company) produces a variety of lamps in a highly automated manufacturing facility. The costs and cost drivers associated with four activity cost centers are given below. These data represent total costs for all types of lamps produced by the Company. Activity Center Unitlevel Batchlevel. Overhead Cost $ 133,000 $ 72,240 Cost Driver 19,0001abor hours 840 setup Allocation Rate $ 7per Labor hour $ 86 per setup During the most recent accounting period TLC made 8,600 units of its small tiffany style lamps. Making the lamps required 2,400 labor hours, 66 setups, and consumed 20% of the product-level costs. If the Company uses direct labor hours as the single company wide cost driver, the amount of overhead cost allocated to the tiffany lamps is Note: Round intermediate calculations to two decimal places. $3739a $29994 $23,300. $9,000. Productlevel. $ 21,092 95 of use Faci'Lit y-leve'L $ 73,800 73,800 units $ 1 per unit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts