Question: Provide the correct Answer with explanation. Don't use chatGPT/AI bot other wise down vote and report this Answer. Thank you Question 20 1 pts Smithson

Provide the correct Answer with explanation. Don't use chatGPT/AI bot other wise down vote and report this Answer. Thank you

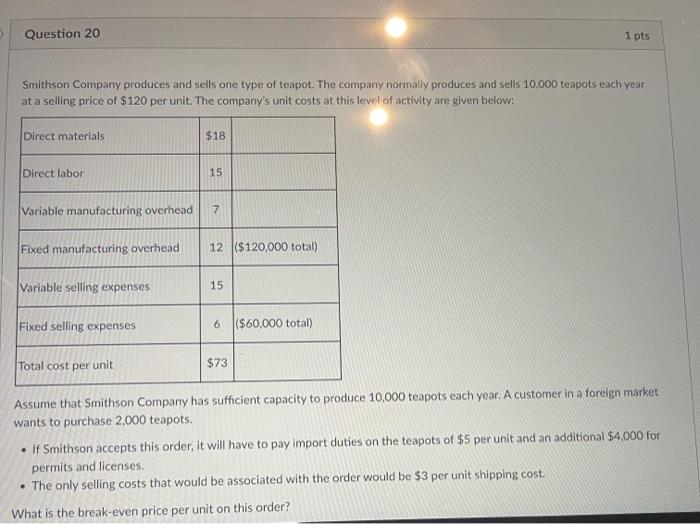

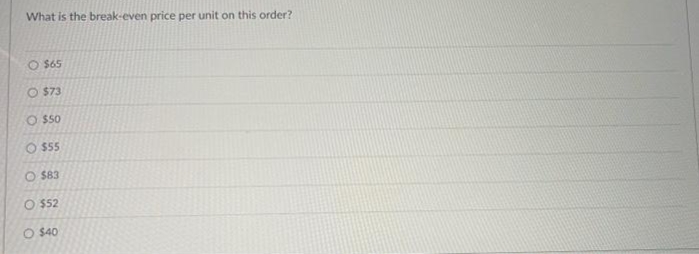

Question 20 1 pts Smithson Company produces and sells one type of teapot. The company normally produces and sells 10.000 teapots each year at a selling price of $120 per unit. The company's unit costs at this level of activity are given below: Direct materials $18 Direct labor 15 Variable manufacturing overhead 7 Fixed manufacturing overhead 12 ($120,000 total) Variable selling expenses 15 Fixed selling expenses 6 ($60,000 total) Total cost per unit $73 Assume that Smithson Company has sufficient capacity to produce 10,000 teapots each year, A customer in a foreign market wants to purchase 2,000 teapots. . If Smithson accepts this order, it will have to pay import duties on the teapots of $5 per unit and an additional $4,000 for permits and licenses. . The only selling costs that would be associated with the order would be $3 per unit shipping cost. What is the break-even price per unit on this order?What is the break-even price per unit on this order? O $65 O $73 O $50 $55 O $83 O $52 O $40

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts