Question: Provide thr correct Answer with explanation. And don't use chatGPT/AI bot other wise report this Answer. Thank you (provide the B and C Answer )

Provide thr correct Answer with explanation. And don't use chatGPT/AI bot other wise report this Answer. Thank you (provide the B and C Answer)

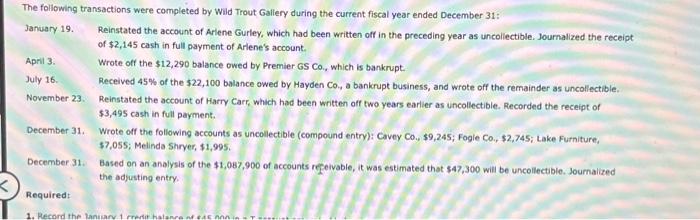

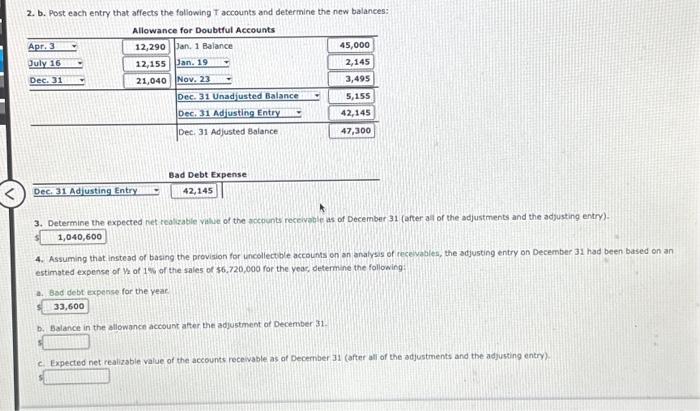

The following transactions were completed by Wild Trout Gallery during the current fiscal year ended December 31: January 19. Reinstated the account of Arlene Gurley, which had been written off in the preceding year as uncollectible. Journalized the receipt of $2,145 cash in full payment of Arlene's account. April 3. Wrote off the $12,290 balance owed by Premier GS Co., which is bankrupt. July 16. Received 45% of the $22,100 balance owed by Hayden Co., a bankrupt business, and wrote off the remainder as uncollectible. November 23. Reinstated the account of Harry Carr, which had been written off two years earlier as uncollectible. Recorded the receipt of $3,495 cash in full payment. December 31. Wrote off the following accounts as uncollectible (compound entry): Cavey Co., $9,245; Fogle Co., $2,745; Lake Furniture, $7,055; Melinda Shryer, $1,995. December 31 Based on an analysis of the $1,087,900 of accounts receivable, it was estimated that $47,300 will be uncollectible. Journalized the adjusting entry. Required: 1. Record the Janiun HE MA2. b. Post each entry that affects the following T accounts and determine the new balances: Allowance for Doubtful Accounts Apr. 3 12,290 Jan. 1 Balance 45,000 July 16 12,155 Jan. 19 2,145 Dec. 31 21,040 Nov. 23 3,495 Dec. 31 Unadjusted Balance 5,155 Dec. 31 Adjusting Entry 42,145 Dec. 31 Adjusted Balance 47,300 Bad Debt Expense Dec. 31 Adjusting Entry 42.145 3. Determine the expected net realcable ville of the accounts receivable as of December 31 (after all of the adjustments and the adjusting entry). 1,040,600 Assuming that instead of basing the provision for uncollectible accounts on an analysis of receivables, the adjusting entry on December 31 had been based on an estimated expense of is of 1%% of the sales of $6. 720,090 for the year, determine the following: Bad debt expense for the year 33,600 Balance in the allowance account after the adjustment of December 31- Expected net realizable value of the accounts receivable as of December 31 (after all of the adjustments and the adjusting entry)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts