Question: Provide your answer in the following format: 1. Your recommendation of which company is more suitable (1 mark) 2. Information to support your recommendation with

Provide your answer in the following format:

1. Your recommendation of which company is more suitable (1 mark)

2. Information to support your recommendation with reference to the ratios (3 marks,

one per supporting explanation)

3. Is your recommendation worth investing in? Or is no investment a better option. Why or why not?

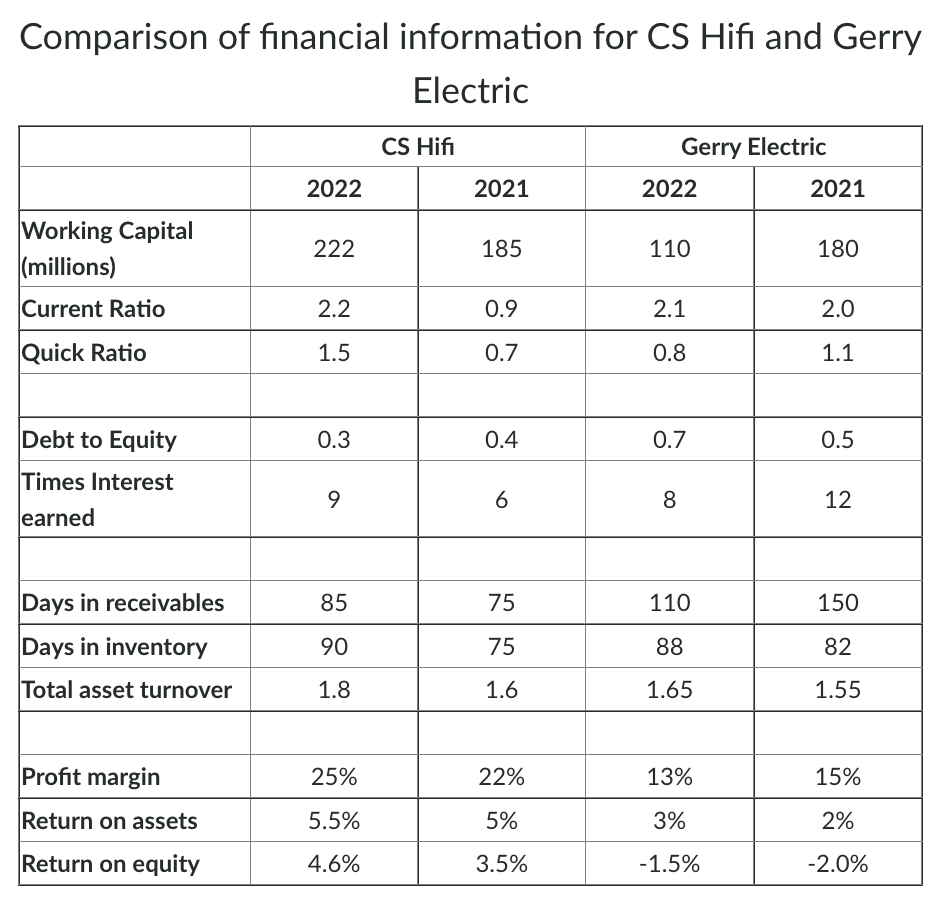

Comparison of financial information for CS Hifi and Gerry Electric Gerry Electric 2022 2021 Working Capital 222 185 (millions) Current Ratio 2.2 0.9 Quick Ratio 1.5 0.7 Debt to Equity 0.3 0.4 Times Interest 9 6 earned Days in receivables 85 75 Days in inventory 90 75 Total asset turnover 1.8 1.6 Profit margin 25% 22% Return on assets 5.5% 5% Return on equity 4.6% 3.5% CS Hifi 2022 110 2.1 0.8 0.7 8 110 88 1.65 13% 3% -1.5% 2021 180 2.0 1.1 0.5 12 150 82 1.55 15% 2% -2.0%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts