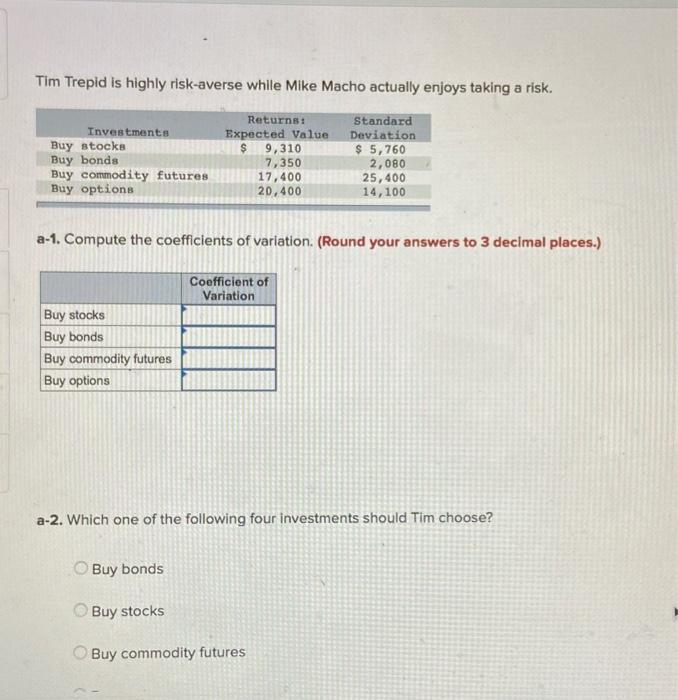

Question: Tim Trepid is highly risk-averse while Mike Macho actually enjoys taking a risk. Investments Buy stocks Buy bonds Buy commodity futures Buy options Returns: Expected

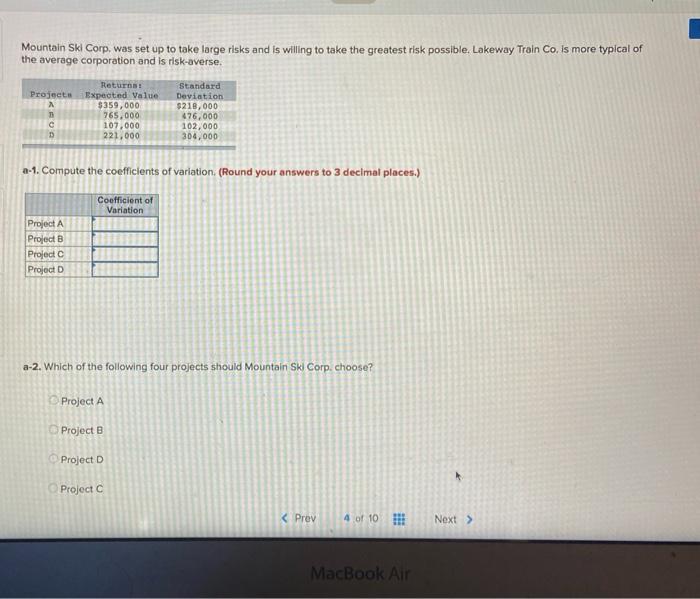

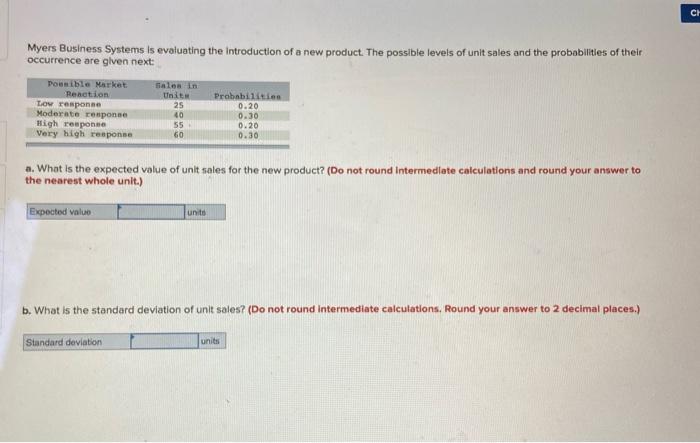

Tim Trepid is highly risk-averse while Mike Macho actually enjoys taking a risk. Investments Buy stocks Buy bonds Buy commodity futures Buy options Returns: Expected Value $ 9,310 7,350 17,400 20,400 Standard Deviation $ 5,760 2,080 25,400 14,100 a-1. Compute the coefficients of variation. (Round your answers to 3 decimal places.) Coefficient of Variation Buy stocks Buy bonds Buy commodity futures Buy options a-2. Which one of the following four investments should Tim choose? Buy bonds Buy stocks Buy commodity futures Mountain Ski Corp, was set up to take large risks and is willing to take the greatest risk possible. Lakeway Train Co. is more typical of the average corporation and is risk-averse. Returns Projects Expected Value $ 359,000 765.000 C 107,000 D 221,000 Standard Deviation $218,000 476,000 102,000 304,000 a-1. Compute the coefficients of variation (Round your answers to 3 decimal places.) Coefficient of Variation Project A Project B Project Project D a-2. Which of the following four projects should Mountain Ski Corp. choose? Project A Project B Project D Project MacBook Air CH Myers Business Systems is evaluating the Introduction of a new product. The possible levels of unit sales and the probabilitles of their occurrence are given next: salos in Poenible Market Reaction Tow response Moderate response High response Very high response 25 40 55 60 Probabilities 0.20 0.30 0.20 0.30 a. What is the expected value of unit sales for the new product? (Do not round Intermediate calculations and round your answer to the nearest whole unit.) Expected value un to b. What is the standard deviation of unit sales? (Do not round Intermediate calculations. Round your answer to 2 decimal places.) Standard deviation units

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts