Question: Provide your answers from here. Workings are not required. Current Tax Worksheet table [ [ Accounting profit before income tax,, 4 2 , 0

Provide your answers from here. Workings are not required.

Current Tax Worksheet

tableAccounting profit before income tax,,Add:Bad debts expense,Fines and penalties expense,Depreciation expense Plant,Gonverment grant exempt from taxRent expense,Annual leave expense,Deduct:Tax deduction for plants,Taxable profit lossCurrent tax

Journal entry:

tableIncome tax expense currentCurrent tax liability,,

Question

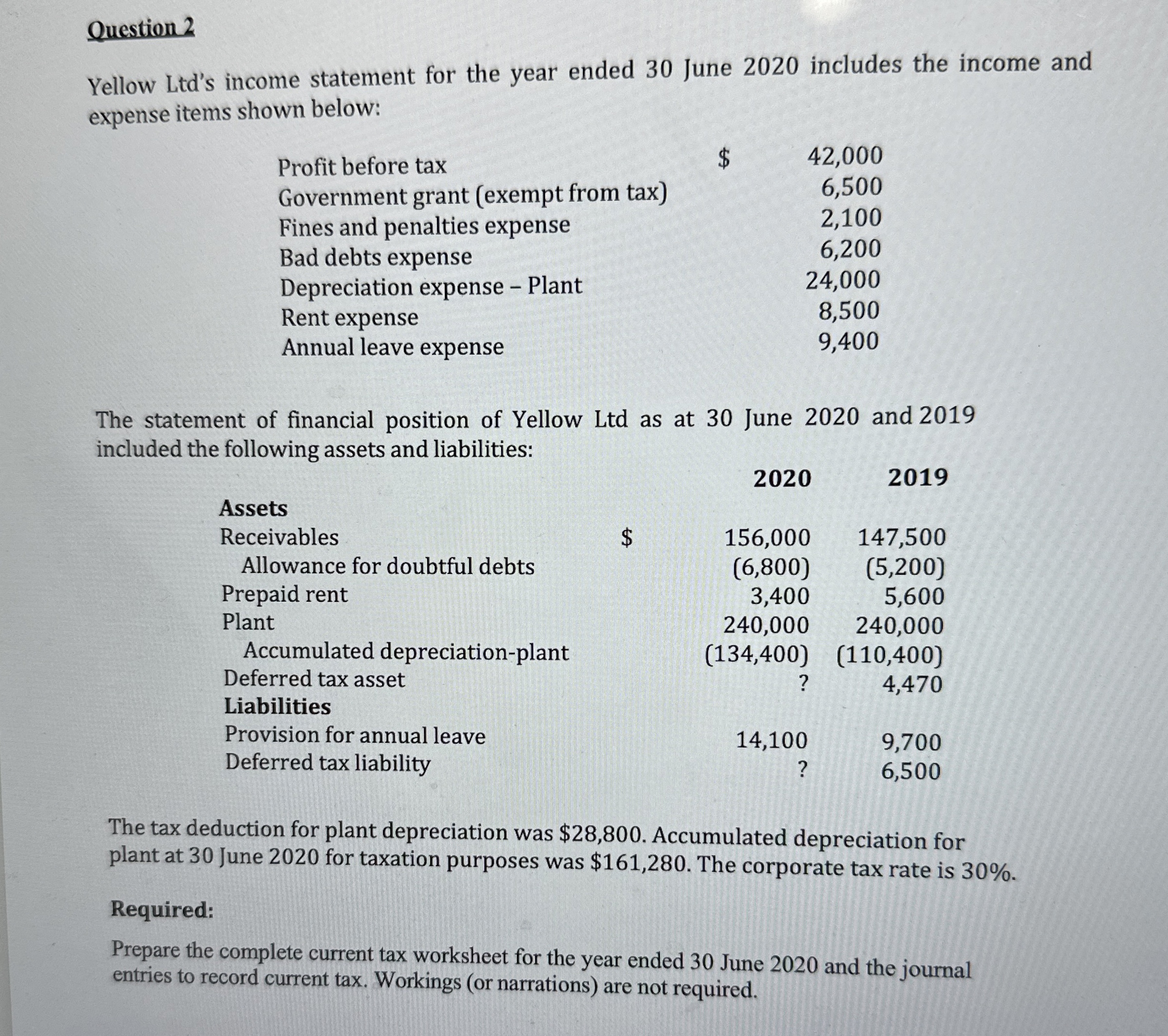

Yellow Ltds income statement for the year ended June includes the income and expense items shown below:

tableProfit before tax,Government grant exempt from taxFines and penalties expense,Bad debts expense,Depreciation expense Plant,Rent expense,Annual leave expense,

The statement of financial position of Yellow Ltd as at June and included the following assets and liabilities:

tableAssetsReceivables$Allowance for doubtful debts,,Question

Yellow Ltds income statement for the year ended June includes the income and expense items shown below:

tableProfit before tax,Government grant exempt from taxFines and penalties expense,Bad debts expense,Depreciation expense Plant,Rent expense,Annual leave expense,

The statement of financifl position of Yellow Ltd as at June and included the following assets and liabilities:

tableAssets Receivables$Allowance for doubtful debts,,

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock