Question: PSA12.1Here are comparative statement data for Spencer Ltd and Forrester Ltd, two competitors. All data relating to the statement of financial position are as

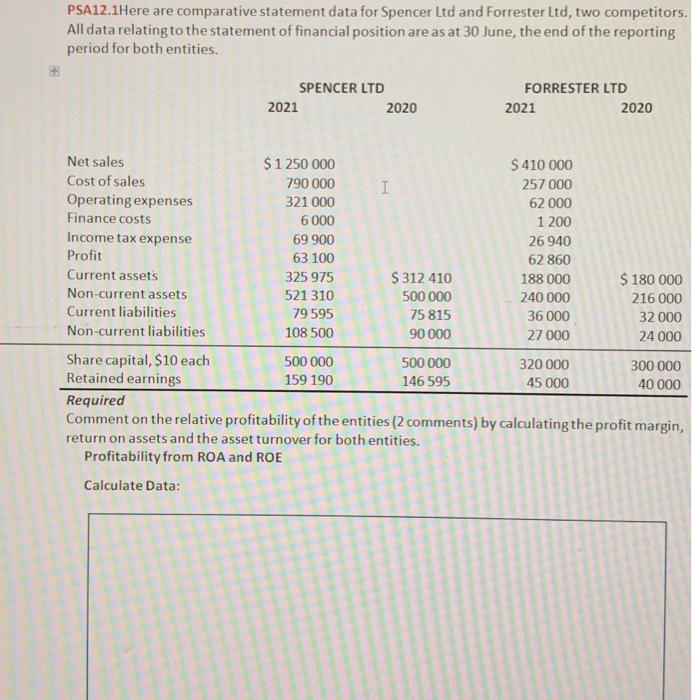

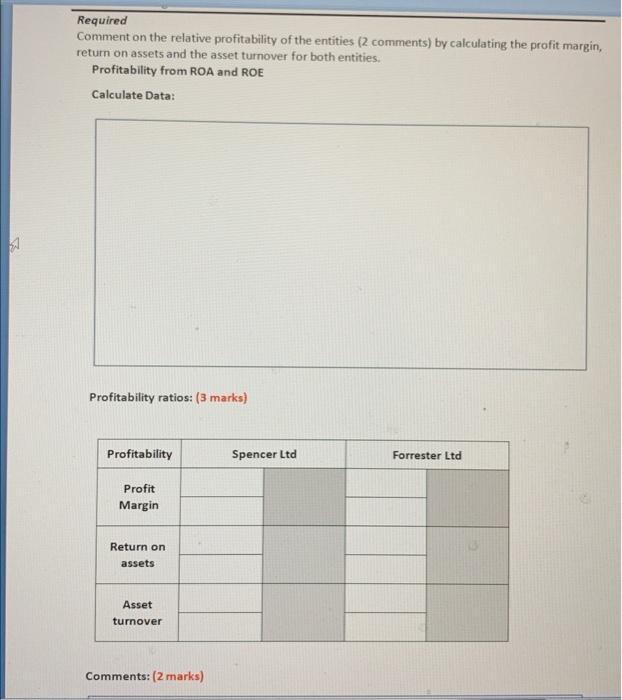

PSA12.1Here are comparative statement data for Spencer Ltd and Forrester Ltd, two competitors. All data relating to the statement of financial position are as at 30 June, the end of the reporting period for both entities. SPENCER LTD FORRESTER LTD 2021 2020 2021 2020 Net sales Cost of sales Operating expenses Finance costs 6000 $1250 000 $ 410 000 790 000 I 321 000 257 000 62 000 1200 Income tax expense 69 900 26 940 Profit 63 100 62 860 Current assets 325 975 $ 312 410 188 000 $ 180 000 Non-current assets 521 310 500 000 240 000 Current liabilities 79 595 75 815 36 000 216 000 32.000 Non-current liabilities 108 500 90 000 27 000 24 000 Share capital, $10 each 500 000 500 000 320 000 300 000 Retained earnings 159 190 146 595 45 000 40 000 Required Comment on the relative profitability of the entities (2 comments) by calculating the profit margin, return on assets and the asset turnover for both entities. Profitability from ROA and ROE Calculate Data:

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts