Question: pter 17 HW Saved Help Save & Exit Submit Check my work 1 Pant arences Robbins Petroleum Company is five years in arrears on

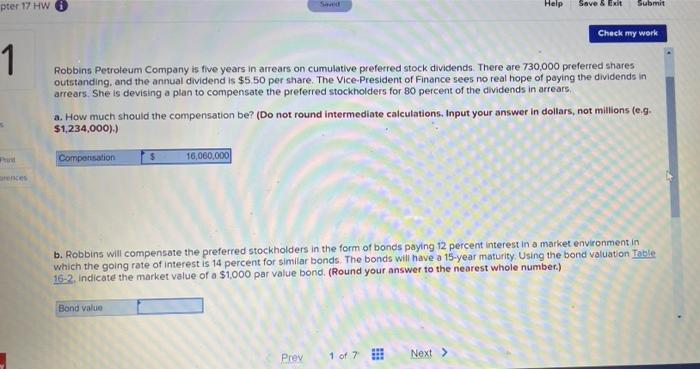

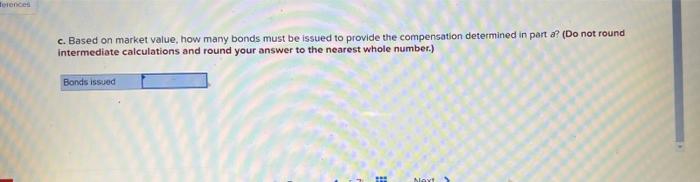

pter 17 HW Saved Help Save & Exit Submit Check my work 1 Pant arences Robbins Petroleum Company is five years in arrears on cumulative preferred stock dividends. There are 730,000 preferred shares outstanding, and the annual dividend is $5.50 per share. The Vice-President of Finance sees no real hope of paying the dividends in arrears. She is devising a plan to compensate the preferred stockholders for 80 percent of the dividends in arrears. a. How much should the compensation be? (Do not round intermediate calculations. Input your answer in dollars, not millions (e.g. $1,234,000).) Compensation 16,060,000 b. Robbins will compensate the preferred stockholders in the form of bonds paying 12 percent interest in a market environment in which the going rate of interest is 14 percent for similar bonds. The bonds will have a 15-year maturity. Using the bond valuation Table 16-2, indicate the market value of a $1,000 par value bond. (Round your answer to the nearest whole number.) Bond value Previ 1 of 7 Next >

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts