Question: purchasing first 4page is wrong uploading...please read only last 4 page Best Practice+ x Corporation and B Steel . . Faced with intense competition, increasing

purchasing

first 4page is wrong uploading...please read only last 4 page

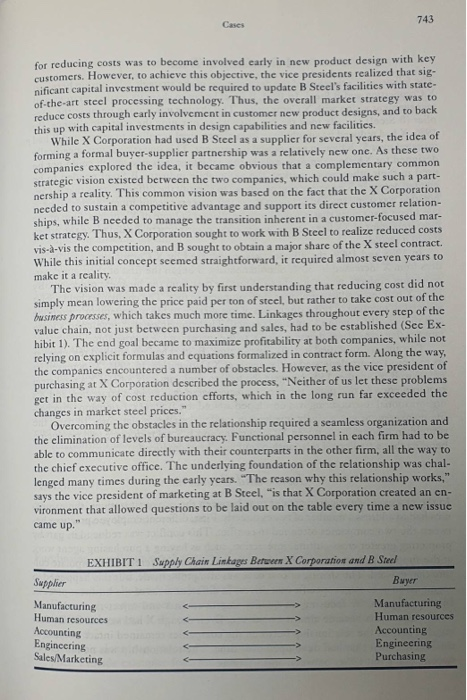

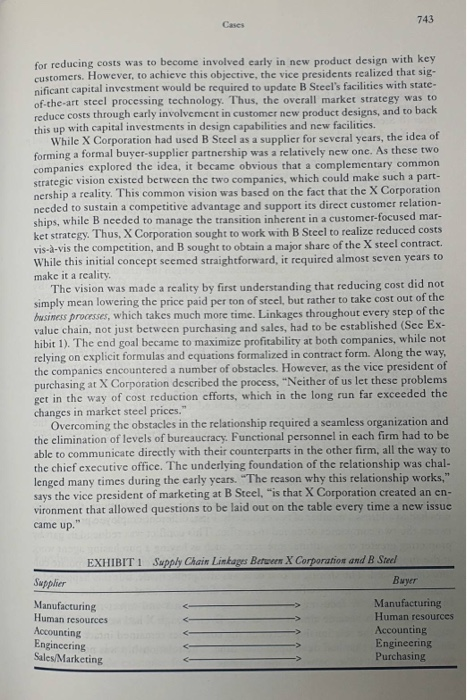

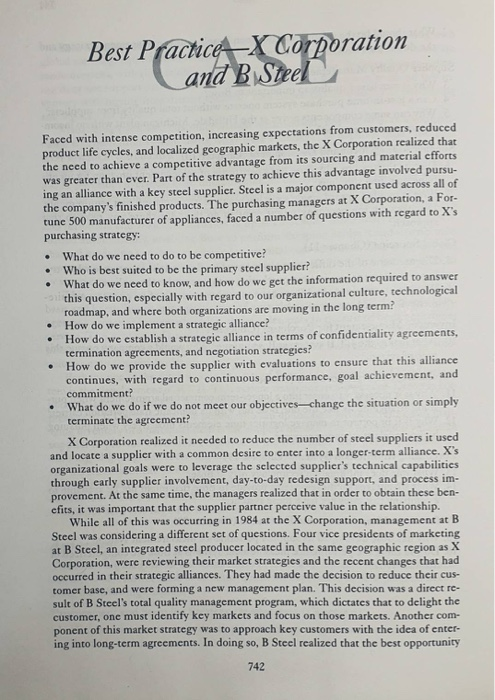

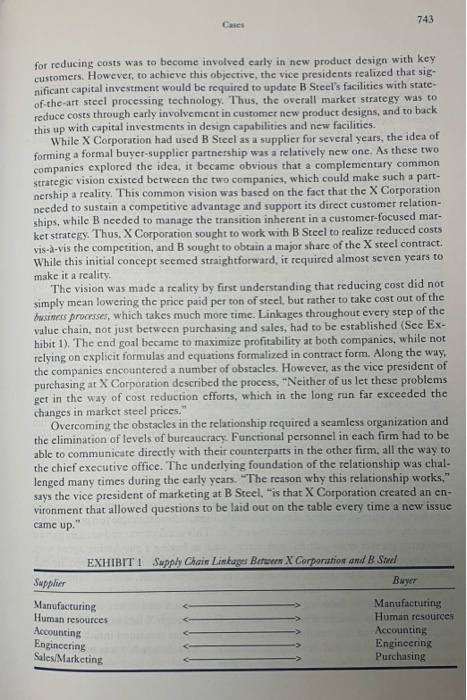

Best Practice+ x Corporation and B Steel . . Faced with intense competition, increasing expectations from customers, reduced product life cycles, and localized geographic markets, the X Corporation realized that the need to achieve a competitive advantage from its sourcing and material cfforts was greater than ever. Part of the strategy to achieve this advantage involved pursu- ing an alliance with a key steel supplier. Steel is a major component used across all of the company's finished products. The purchasing managers at X Corporation, a For- tune 500 manufacturer of appliances, faced a number of questions with regard to X's purchasing strategy What do we need to do to be competitive? Who is best suited to be the primary steel supplier? What do we need to know, and how do we get the information required to answer - this question, especially with regard to our organizational culture, technological roadmap, and where both organizations are moving in the long term? How do we implement a strategic alliance? How do we establish a strategic alliance in terms of confidentiality agreements, termination agreements, and negotiation strategies? How do we provide the supplier with evaluations to ensure that this alliance continues, with regard to continuous performance, goal achievement, and commitment? What do we do if we do not meet our objectiveschange the situation or simply terminate the agreement? X Corporation realized it needed to reduce the number of steel suppliers it used and locate a supplier with a common desire to enter into a longer-term alliance. X's organizational goals were to leverage the selected supplier's technical capabilities through early supplier involvement, day-to-day redesign support, and process im- provement. At the same time, the managers realized that in order to obtain these ben- efits, it was important that the supplier partner perceive value in the relationship. While all of this was occurring in 1984 at the X Corporation, management at B Steel was considering a different set of questions. Four vice presidents of marketing at B Steel, an integrated steel producer located in the same geographic region as X Corporation, were reviewing their market strategies and the recent changes that had occurred in their strategic alliances. They had made the decision to reduce their cus- tomer base, and were forming a new management plan. This decision was a direct re- sult of B Steel's total quality management program, which dictates that to delight the customer, one must identify key markets and focus on those markets. Another com- ponent of this market strategy was to approach key customers with the idea of enter- ing into long-term agreements. In doing so, B Steel reali that best opportunity 742 Cases 743 for reducing costs was to become involved early in new product design with key customers. However, to achieve this objective, the vice presidents realized that sig- nificant capital investment would be required to update B Steel's facilities with state- of-the-art steel processing technology. Thus, the overall market strategy was to reduce costs through early involvement in customer new product designs, and to back this up with capital investments in design capabilities and new facilities. While X Corporation had used B Steel as a supplier for several years, the idea of forming a formal buyer-supplier partnership was a relatively new one. As these two companies explored the idea, it became obvious that a complementary common strategic vision existed between the two companies, which could make such a part- nership a reality. This common vision was based on the fact that the X Corporation needed to sustain a competitive advantage and support its direct customer relation- ships, while B needed to manage the transition inherent in a customer-focused mar- ket strategy. Thus, X Corporation sought to work with B Steel to realize reduced costs vis-a-vis the competition, and B sought to obtain a major share of the X steel contract. While this initial concept seemed straightforward, it required almost seven years to make it a reality The vision was made a reality by first understanding that reducing cost did not simply mean lowering the price paid per ton of steel, but rather to take cost out of the business processes, which takes much more time. Linkages throughout every step of the value chain, not just between purchasing and sales, had to be established (See Ex- hibit 1). The end goal became to maximize profitability at both companies, while not relying on explicit formulas and equations formalized in contract form. Along the way, the companies encountered a number of obstacles. However, as the vice president of purchasing at X Corporation described the process, "Neither of us let these problems get in the way of cost reduction efforts, which in the long run far exceeded the changes in market steel prices." Overcoming the obstacles in the relationship required a seamless organization and the elimination of levels of bureaucracy. inctional personnel in each firm had to be able to communicate directly with their counterparts in the other firm, all the way to the chief executive office. The underlying foundation of the relationship was chal- lenged many times during the early years. "The reason why this relationship works," says the vice president of marketing at B Steel, "is that X Corporation created an en- vironment that allowed questions to be laid out on the table every time a new issue came up. EXHIBIT 1 Supply Chain Linkages Between X Corporation and B Steel Buyer Supplier Manufacturing Human resources Accounting Engineering Sales/Marketing Manufacturing Human resources Accounting Engineering Purchasing Cases 743 for reducing costs was to become involved early in new product design with key customers. However, to achieve this objective, the vice presidents realized that sig- nificant capital investment would be required to update B Steel's facilities with state- of-the-art steel processing technology. Thus, the overall market strategy was to reduce costs through early involvement in customer new product designs, and to back this up with capital investments in design capabilities and new facilities. While X Corporation had used B Steel as a supplier for several years, the idea of forming a formal buyer-supplier partnership was a relatively new one. As these two companies explored the idea, it became obvious that a complementary common strategic vision existed between the two companies, which could make such a part- nership a reality. This common vision was based on the fact that the X Corporation needed to sustain a competitive advantage and support its direct customer relation- ships, while B needed to manage the transition inherent in a customer-focused mar- ket strategy. Thus, X Corporation sought to work with B Steel to realize reduced costs vis-a-vis the competition, and B sought to obtain a major share of the X steel contract. While this initial concept seemed straightforward, it required almost seven years to make it a reality The vision was made a reality by first understanding that reducing cost did not simply mean lowering the price paid per ton of steel, but rather to take cost out of the business processes, which takes much more time. Linkages throughout every step of the value chain, not just between purchasing and sales, had to be established (See Ex- hibit 1). The end goal became to maximize profitability at both companies, while not relying on explicit formulas and equations formalized in contract form. Along the way, the companies encountered a number of obstacles. However, as the vice president of purchasing at X Corporation described the process, "Neither of us let these problems get in the way of cost reduction efforts, which in the long run far exceeded the changes in market steel prices." Overcoming the obstacles in the relationship required a seamless organization and the elimination of levels of bureaucracy. inctional personnel in each firm had to be able to communicate directly with their counterparts in the other firm, all the way to the chief executive office. The underlying foundation of the relationship was chal- lenged many times during the early years. "The reason why this relationship works," says the vice president of marketing at B Steel, "is that X Corporation created an en- vironment that allowed questions to be laid out on the table every time a new issue came up. EXHIBIT 1 Supply Chain Linkages Between X Corporation and B Steel Buyer Supplier Manufacturing Human resources Accounting Engineering Sales/Marketing Manufacturing Human resources Accounting Engineering Purchasing Cases 745 B Steel was also concerned that a single-sourcing policy might cause it to lose touch with the market, and was concerned with confidentiality of information. At the same time, X was concerned about the technological risks of relying on only one supplier. However, these concerns were ultimately dwarfed by the belief that both companies would be low-cost producers in the long-term because of the relationship Mechanisms to Support the Relationship Executive management at both companies recommend that organizations consider- ing pursuing partnerships need to think carly on how they will deal with issues such as those just mentioned. Although there are no single or right answers, there are dif- ferent approaches to these issues that must be tailored to the specific situation. For example, significant organizational realignment was needed so that people could work specifically with their counterparts in the other firm. The creation of a supplier council was also instrumental to the relationship. This approach permitted the sharing of strategies and tactics so that each party became aware of each other's activities. Senior management discussion, both structured pe- riodic meetings and informal spontaneous telephone conversations, also helped promote greater trust. Quarterly performance reviews by X were helpful to B for un- derstanding how well B was meeting its performance expectations. Representatives from B also worked at X's development center, which created many other informal avenues for communication. The underlying outcome for both parties is that the relationship became viewed as a covenant, which implies a greater commitment than a contract. Moreover, a covenant implies a promise that is enduring and provides a way to manage expecta- tions. The single most important tenct of the relationship is the need to satisfy the end consumer who purchases the finished appliance. By focusing on this covenant, the relationship should survive and prosper over the long term. Assignment The following questions relate to ideas and concepts presented throughout this book. Answer some or all of the questions depending on your progress in covering the fol- lowing chapters. Purchasing as a Boundary-Spanning Function 1. Discuss what the following statement means: It can take years for a buyer/seller partnership to begin delivering results. 2. Discuss the advantages of having point-to-point contact (Exhibit 1) between functional groups at different companies. Are there any disadvantages to this approach? 3. What role does trust play in the relationship between X Corporation and B Sup- plier? Provide examples from the case that illustrate trust within this relationship. Best Practice+ x Corporation and B Steel . . Faced with intense competition, increasing expectations from customers, reduced product life cycles, and localized geographic markets, the X Corporation realized that the need to achieve a competitive advantage from its sourcing and material cfforts was greater than ever. Part of the strategy to achieve this advantage involved pursu- ing an alliance with a key steel supplier. Steel is a major component used across all of the company's finished products. The purchasing managers at X Corporation, a For- tune 500 manufacturer of appliances, faced a number of questions with regard to X's purchasing strategy What do we need to do to be competitive? Who is best suited to be the primary steel supplier? What do we need to know, and how do we get the information required to answer - this question, especially with regard to our organizational culture, technological roadmap, and where both organizations are moving in the long term? How do we implement a strategic alliance? How do we establish a strategic alliance in terms of confidentiality agreements, termination agreements, and negotiation strategies? How do we provide the supplier with evaluations to ensure that this alliance continues, with regard to continuous performance, goal achievement, and commitment? What do we do if we do not meet our objectiveschange the situation or simply terminate the agreement? X Corporation realized it needed to reduce the number of steel suppliers it used and locate a supplier with a common desire to enter into a longer-term alliance. X's organizational goals were to leverage the selected supplier's technical capabilities through early supplier involvement, day-to-day redesign support, and process im- provement. At the same time, the managers realized that in order to obtain these ben- efits, it was important that the supplier partner perceive value in the relationship. While all of this was occurring in 1984 at the X Corporation, management at B Steel was considering a different set of questions. Four vice presidents of marketing at B Steel, an integrated steel producer located in the same geographic region as X Corporation, were reviewing their market strategies and the recent changes that had occurred in their strategic alliances. They had made the decision to reduce their cus- tomer base, and were forming a new management plan. This decision was a direct re- sult of B Steel's total quality management program, which dictates that to delight the customer, one must identify key markets and focus on those markets. Another com- ponent of this market strategy was to approach key customers with the idea of enter- ing into long-term agreements. In doing so, B Steel reali that best opportunity 742 Cases 743 for reducing costs was to become involved early in new product design with key customers. However, to achieve this objective, the vice presidents realized that sig- nificant capital investment would be required to update B Steel's facilities with state- of-the-art steel processing technology. Thus, the overall market strategy was to reduce costs through early involvement in customer new product designs, and to back this up with capital investments in design capabilities and new facilities. While X Corporation had used B Steel as a supplier for several years, the idea of forming a formal buyer-supplier partnership was a relatively new one. As these two companies explored the idea, it became obvious that a complementary common strategic vision existed between the two companies, which could make such a part- nership a reality. This common vision was based on the fact that the X Corporation needed to sustain a competitive advantage and support its direct customer relation- ships, while B needed to manage the transition inherent in a customer-focused mar- ket strategy. Thus, X Corporation sought to work with B Steel to realize reduced costs vis-a-vis the competition, and B sought to obtain a major share of the X steel contract. While this initial concept seemed straightforward, it required almost seven years to make it a reality The vision was made a reality by first understanding that reducing cost did not simply mean lowering the price paid per ton of steel, but rather to take cost out of the business processes, which takes much more time. Linkages throughout every step of the value chain, not just between purchasing and sales, had to be established (See Ex- hibit 1). The end goal became to maximize profitability at both companies, while not relying on explicit formulas and equations formalized in contract form. Along the way, the companies encountered a number of obstacles. However, as the vice president of purchasing at X Corporation described the process, "Neither of us let these problems get in the way of cost reduction efforts, which in the long run far exceeded the changes in market steel prices." Overcoming the obstacles in the relationship required a seamless organization and the elimination of levels of bureaucracy. inctional personnel in each firm had to be able to communicate directly with their counterparts in the other firm, all the way to the chief executive office. The underlying foundation of the relationship was chal- lenged many times during the early years. "The reason why this relationship works," says the vice president of marketing at B Steel, "is that X Corporation created an en- vironment that allowed questions to be laid out on the table every time a new issue came up. EXHIBIT 1 Supply Chain Linkages Between X Corporation and B Steel Buyer Supplier Manufacturing Human resources Accounting Engineering Sales/Marketing Manufacturing Human resources Accounting Engineering Purchasing Cases 744 A Roadmap to Trust The following is a timeline of the development of the strategic relationship between X Corporation and B Steel. In 1984, B Steel began to share its market strategy and management vision with X Corporation. The sharing was unique because the sup- plier (B Steel) actually took the initiative when pursuing the strategic alliance. By 1986, X had reduced its supply-base from eleven steel suppliers to seven, and B had invested over $1 billion in new capital investment. This investment was specifically designed for X's steel requirements in the appliance industry, which could not be used in their other major market, the automobile industry. B Steel needed to be granted access to X's engineering personnel to identify the different ways that X Cor- poration was using steel and convert these into process specifications. At this point, B was given assurances that it would receive a larger volume of X's orders. One of the most important of X's later actions was that the company actually did place the orders it said it would In 1988 and 1989, the alliance was reevaluated by X Corporation, and B's or- ders from X increased by 30%. Simultaneously, B began the first of their joint cost- reduction projects, which sought to eliminate cost from the business processes. By 1990, X had reduced its number of steel suppliers to four. The companies held a joint leadership meeting to bring discussion of the alliance to top management's attention and to formally develop a supplier council. The companies also developed a long- range vision, which was deemed critical to the success of the partnership. The alliance solidified in 1993. By this time, B Steel had established resources at its technical center dedicated to the needs of X Corporation. In 1994, X increased its orders to B by another 15%, bringing the total to approximately 80% of X's total steel requirements. At this point, the two companies were sharing joint strategies, and X's organizational restructuring was developed around the B Steel relationship. Purchas- ing management was actively involved in top-level strategic planning. To date, the strategic relationships between X Corporation and B Steel is in place and producing benefits that a traditional relationship could not have produced. Issues and Concerns In the process of developing greater trust between the two organizations, the compa- nies had to address a number of issues directly. First, different employee practices be- tween the two companies often led to conflict. This conflict was reduced in part by promoting greater cross-cultural interaction, such as having a purchasing agent work at the supplier's plant, which helped to smooth over any differences in corporate cul- ture that existed. The sharing of cost data was also problematic, but this happened in segments so as to target specific cost drivers in different areas of the business process. In the long run, by focusing on quality improvements and reject-rate reduction, hourly labor costs became almost a nonissue. Even though X had several CEOs dur- ing this period, the relationship between the companies remained intact because of the level of trust that had developed over time. The relationship was no longer be- tween people but rather between organizations. Cases 745 B Steel was also concerned that a single-sourcing policy might cause it to lose touch with the market, and was concerned with confidentiality of information. At the same time, X was concerned about the technological risks of relying on only one supplier. However, these concerns were ultimately dwarfed by the belief that both companies would be low-cost producers in the long-term because of the relationship Mechanisms to Support the Relationship Executive management at both companies recommend that organizations consider- ing pursuing partnerships need to think carly on how they will deal with issues such as those just mentioned. Although there are no single or right answers, there are dif- ferent approaches to these issues that must be tailored to the specific situation. For example, significant organizational realignment was needed so that people could work specifically with their counterparts in the other firm. The creation of a supplier council was also instrumental to the relationship. This approach permitted the sharing of strategies and tactics so that each party became aware of each other's activities. Senior management discussion, both structured pe- riodic meetings and informal spontaneous telephone conversations, also helped promote greater trust. Quarterly performance reviews by X were helpful to B for un- derstanding how well B was meeting its performance expectations. Representatives from B also worked at X's development center, which created many other informal avenues for communication. The underlying outcome for both parties is that the relationship became viewed as a covenant, which implies a greater commitment than a contract. Moreover, a covenant implies a promise that is enduring and provides a way to manage expecta- tions. The single most important tenct of the relationship is the need to satisfy the end consumer who purchases the finished appliance. By focusing on this covenant, the relationship should survive and prosper over the long term. Assignment The following questions relate to ideas and concepts presented throughout this book. Answer some or all of the questions depending on your progress in covering the fol- lowing chapters. Purchasing as a Boundary-Spanning Function 1. Discuss what the following statement means: It can take years for a buyer/seller partnership to begin delivering results. 2. Discuss the advantages of having point-to-point contact (Exhibit 1) between functional groups at different companies. Are there any disadvantages to this approach? 3. What role does trust play in the relationship between X Corporation and B Sup- plier? Provide examples from the case that illustrate trust within this relationship Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock