Question: Purchasing Power Parity (PPP) can be determined by comparing the prices of identical products in different currencies. Example: The PPP theory predicts that the Euro/US

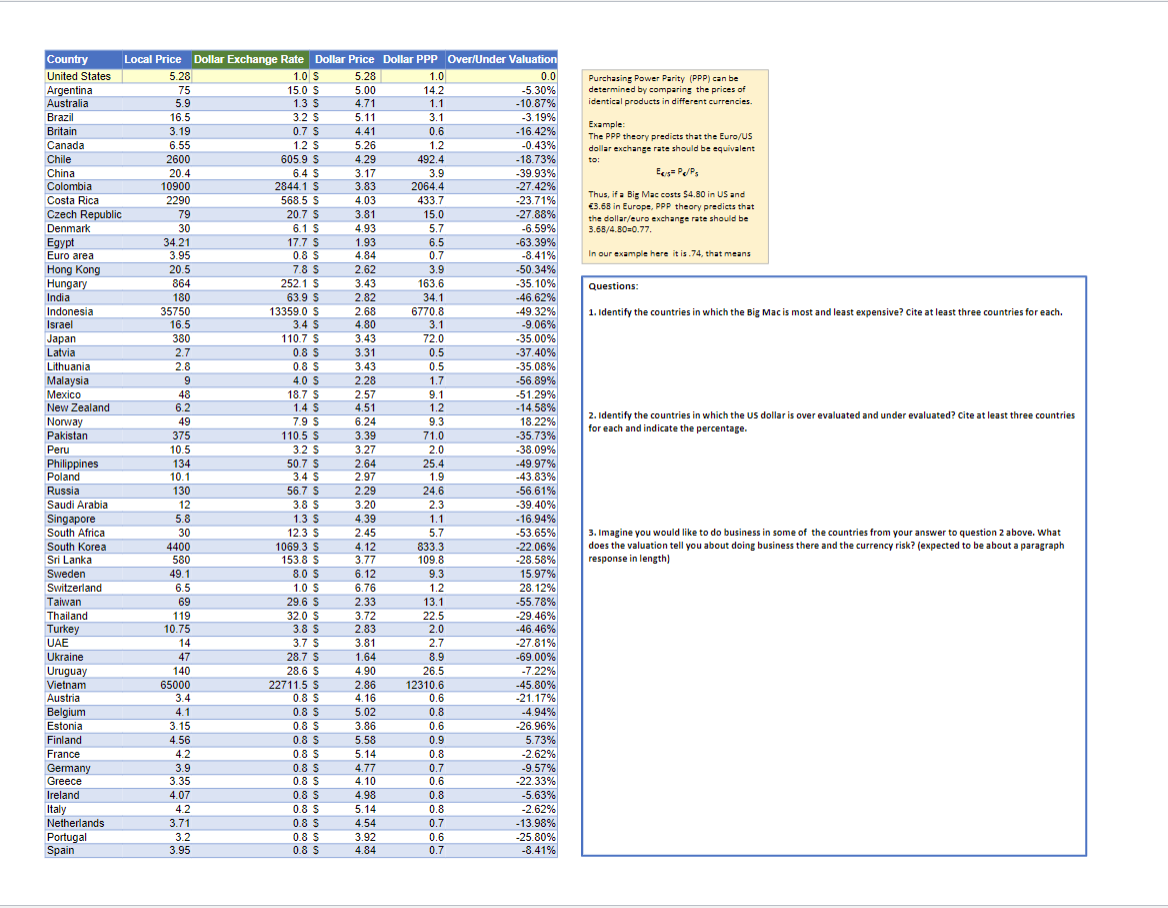

Purchasing Power Parity (PPP) can be determined by comparing the prices of identical products in different currencies. Example: The PPP theory predicts that the Euro/US dollar exchange rate should be equivalent to: EC/s=Pd/P3 Thus, if a Big Mac costs $4.80 in US and E3.6B in Europe, PPP theory prediets that the dollar/euro exchange rate should be 3.68/4.80=0.77. In our example here it is .74, that means Questions: 1. Identify the countries in which the Big Mac is most and least expensive? cite at least three countries for each. 2. Identify the countries in which the us dollar is over evaluated and under evaluated? cite at least three countries for each and indicate the percentage. 3. Imagine you would like to do business in some of the countries from your answer to question 2 above. What does the valuation tell you about doing business there and the currency risk? (expected to be about a paragraph response in length]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts