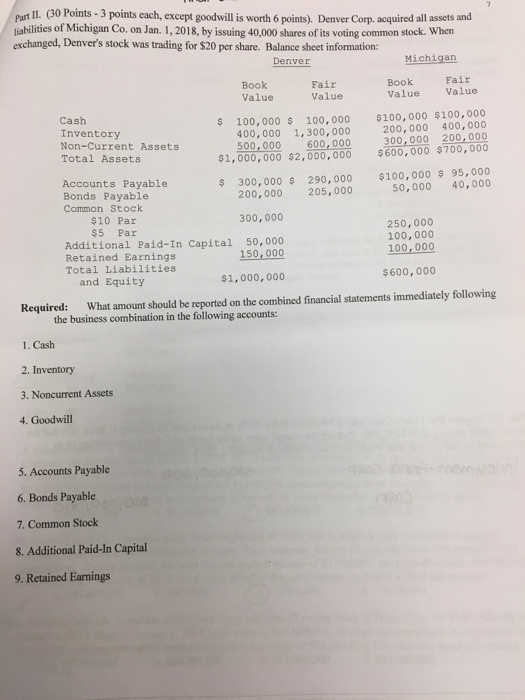

Question: purt II. (30 Points -3 points each, except goodwill is worth 6 points). Denver Corp. acquired all assets and liabilities of Michigan Co. on Jan.

purt II. (30 Points -3 points each, except goodwill is worth 6 points). Denver Corp. acquired all assets and liabilities of Michigan Co. on Jan. 1, 2018, by issuing 40,000 shares of its voting common stock. When exchanged, Denver's stock was trading for $20 per share. Balance sheet information: Denver Michigan Book Value Fair Value Book Value Fair Value Cash Inventory Non-Current Assets Total Assets s 100,000 100,000 $100,000 $100,000 400, 000 1,300,000 200,000 400,000 300,000 200,000 1, 000, 000 $2, 000,000 $600,000 $700,000 s 300,000 290,000 $100,000 $ 95,000 500,000 600,000 Accounts Payable Bonds Payable Common Stock 200,000 205, 000 50,000 40,000 $10 Par 300,000 250,000 100,000 $5 Par Additional Paid-In Capital 50,000 150,000 Retained Earnings Total Liabilities and Equity $1,000, 000 $600,000 Required: What amount should be reported on the combined financial statements immediately following the business combination in the following accounts: 1. Cash 2. Inventory 3. Noncurrent Assets 4. Goodwill 5. Accounts Payable 6. Bonds Payable 7. Common Stock 8. Additional Paid-In Capital 9. Retained Earnings

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts