Question: Put Call Parity. Please help me solve this problem? Problem 5-4 Put-Call Parity The current price of a stock is $32, and the annual risk-free

Put Call Parity. Please help me solve this problem?

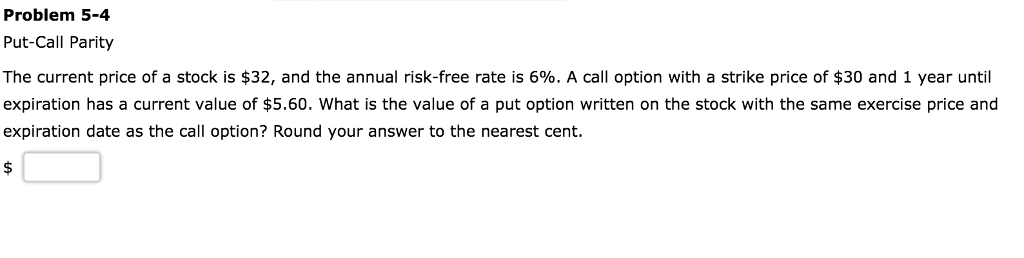

Problem 5-4 Put-Call Parity The current price of a stock is $32, and the annual risk-free rate is 6%. A call option with a strike price of $30 and 1 year until expiration has a current value of $5.60. What is the value of a put option written on the stock with the same exercise price and expiration date as the call option? Round your answer to the nearest cent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts