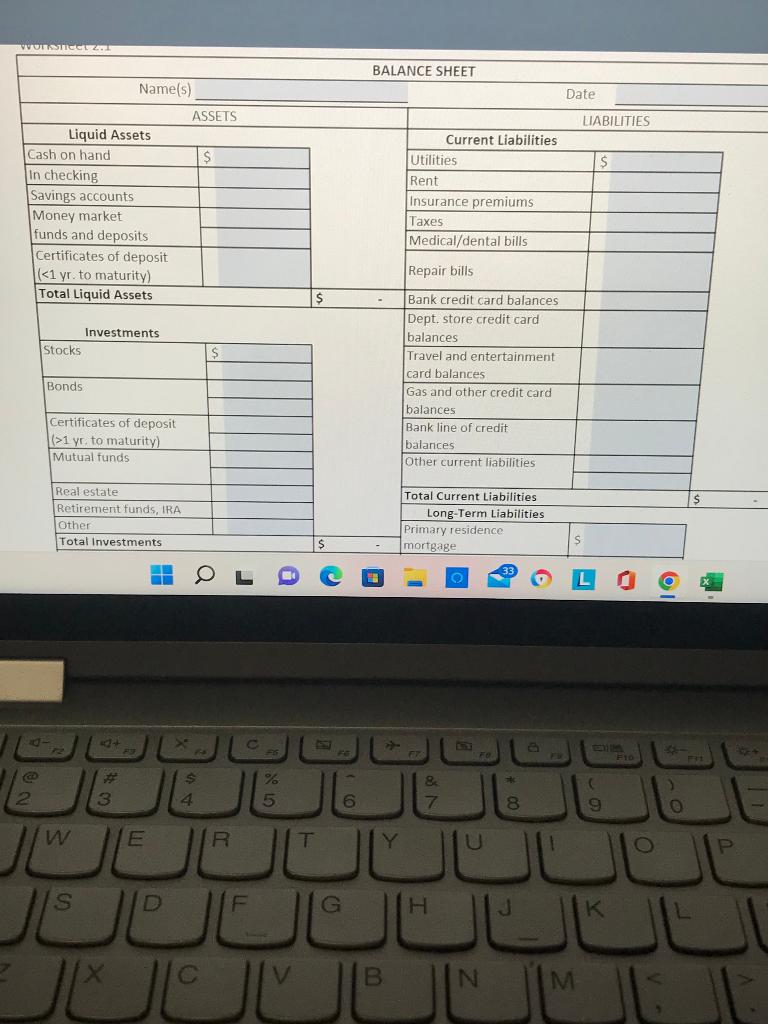

Question: Put yourself 10 years into the future. Construct a detailed and realistic balance sheet reflecting what you would like to achieve by that time WUIKSTICet

Put yourself 10 years into the future. Construct a detailed and realistic balance sheet reflecting what you would like to achieve by that time

Put yourself 10 years into the future. Construct a detailed and realistic balance sheet reflecting what you would like to achieve by that time

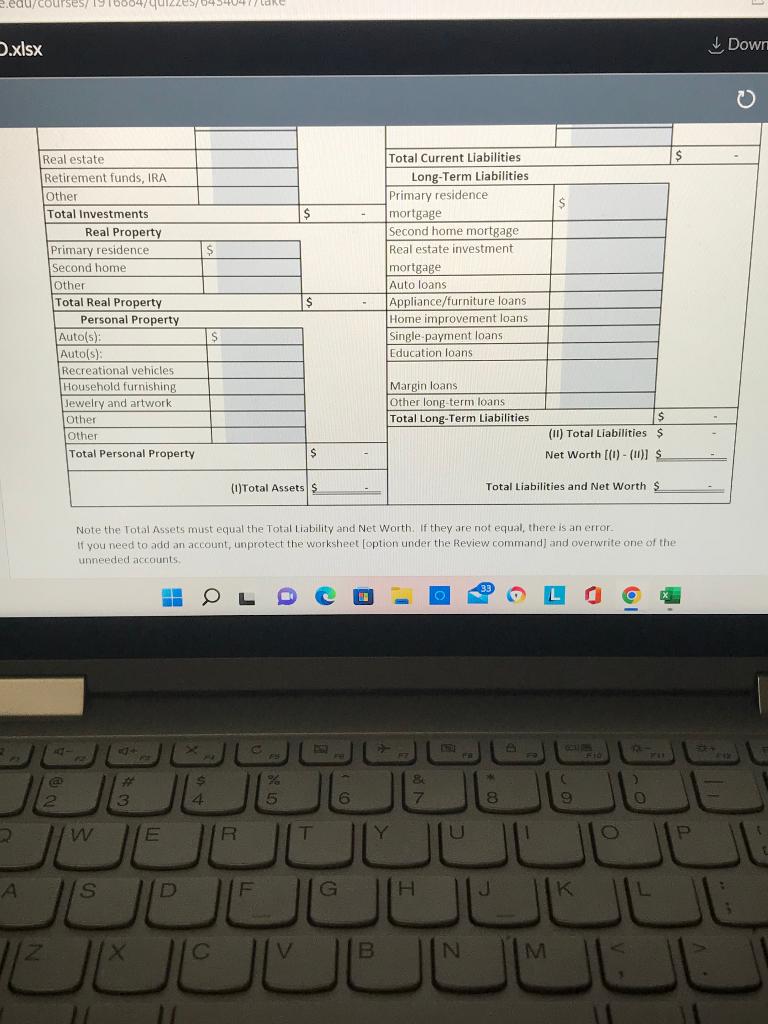

WUIKSTICet 2.1 Cash on hand In checking Savings accounts Money market funds and deposits Certificates of deposit (1 yr. to maturity) Mutual funds Real estate Retirement funds, IRA Other Total Investments H 2 Liquid Assets W # 3 Name(s) X E ASSETS $ D $ 4 C R 205 $ % BALANCE SHEET Utilities Rent Insurance premiums Taxes Medical/dental bills Repair bills Bank credit card balances Dept. store credit card balances Travel and entertainment card balances Gas and other credit card balances Bank line of credit balances Other current liabilities Total Current Liabilities Long-Term Liabilities. Primary residence mortgage FO V - 4 & 6 7 8 T JOUL G H J Current Liabilities B N * o 1 Date M LIABILITIES $ ( 9 K O O F10 O ) O F31 L I P 49 2.edu/courses/1916664/quizzes/ D.xlsx Real estate Total Current Liabilities. Long-Term Liabilities Retirement funds, IRA Other Primary residence Total Investments mortgage Second home mortgage Primary residence Real estate investment Second home mortgage Other Auto loans Total Real Property Appliance/furniture loans Personal Property Auto(s): Home improvement loans. Single-payment loans Education loans Auto(s): Recreational vehicles. Household furnishing Margin loans Jewelry and artwork Other long-term loans. Total Long-Term Liabilities. Other Other (II) Total Liabilities $ Total Personal Property. $ Net Worth [(1)-(11)] $ (1)Total Assets $ Total Liabilities and Net Worth S Note the Total Assets must equal the Total Liability and Net Worth. If they not equal, there is an error. If you need to add an account, unprotect the worksheet [option under the Review command] and overwrite one of the unneeded accounts, X 4- 44 & * ( % 5 6 7 8 9 R T Y JUL JUL G H J K V @ 2 Real Property W Phot # 3 E A S EL 11 D $ $ 4 C $ $ 4 B N M $ A 3 ) O L P Down 47100 A WUIKSTICet 2.1 Cash on hand In checking Savings accounts Money market funds and deposits Certificates of deposit (1 yr. to maturity) Mutual funds Real estate Retirement funds, IRA Other Total Investments H 2 Liquid Assets W # 3 Name(s) X E ASSETS $ D $ 4 C R 205 $ % BALANCE SHEET Utilities Rent Insurance premiums Taxes Medical/dental bills Repair bills Bank credit card balances Dept. store credit card balances Travel and entertainment card balances Gas and other credit card balances Bank line of credit balances Other current liabilities Total Current Liabilities Long-Term Liabilities. Primary residence mortgage FO V - 4 & 6 7 8 T JOUL G H J Current Liabilities B N * o 1 Date M LIABILITIES $ ( 9 K O O F10 O ) O F31 L I P 49 2.edu/courses/1916664/quizzes/ D.xlsx Real estate Total Current Liabilities. Long-Term Liabilities Retirement funds, IRA Other Primary residence Total Investments mortgage Second home mortgage Primary residence Real estate investment Second home mortgage Other Auto loans Total Real Property Appliance/furniture loans Personal Property Auto(s): Home improvement loans. Single-payment loans Education loans Auto(s): Recreational vehicles. Household furnishing Margin loans Jewelry and artwork Other long-term loans. Total Long-Term Liabilities. Other Other (II) Total Liabilities $ Total Personal Property. $ Net Worth [(1)-(11)] $ (1)Total Assets $ Total Liabilities and Net Worth S Note the Total Assets must equal the Total Liability and Net Worth. If they not equal, there is an error. If you need to add an account, unprotect the worksheet [option under the Review command] and overwrite one of the unneeded accounts, X 4- 44 & * ( % 5 6 7 8 9 R T Y JUL JUL G H J K V @ 2 Real Property W Phot # 3 E A S EL 11 D $ $ 4 C $ $ 4 B N M $ A 3 ) O L P Down 47100 A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts