Question: Put-call option parity formula: S + P-C = Ke-rt Black-Scholes option pricing formula: rt2t/2 - log(K/s) Delta: (1) Suppose the prices of a security follow

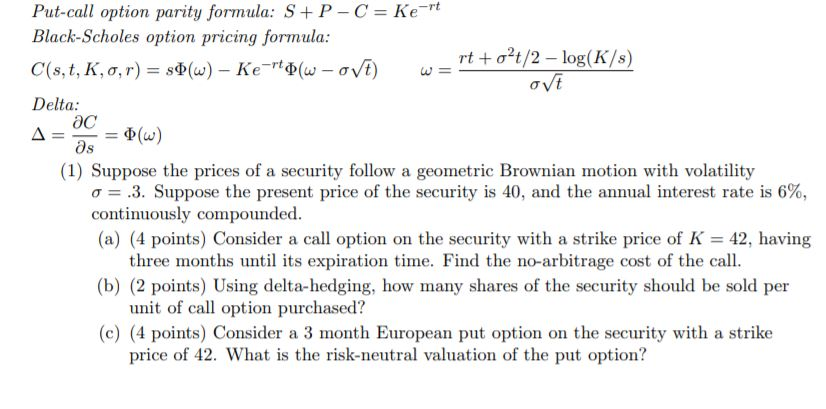

Put-call option parity formula: S + P-C = Ke-rt Black-Scholes option pricing formula: rt2t/2 - log(K/s) Delta: (1) Suppose the prices of a security follow a geometric Brownian motion with volatility .3. Suppose the present price of the security is 40, and the annual interest rate is 6%, continuously compounded. (a) (4 points) Consider a call option on the security with a strike price of K = 42, having three months until its expiration time. Find the no-arbitrage cost of the call unit of call option purchased? price of 42. What is the risk-neutral valuation of the put option? (b) (2 points) Using delta-hedging, how many shares of the security should be sold per (c) (4 points) Consider a 3 month European put option on the security with a strike Put-call option parity formula: S + P-C = Ke-rt Black-Scholes option pricing formula: rt2t/2 - log(K/s) Delta: (1) Suppose the prices of a security follow a geometric Brownian motion with volatility .3. Suppose the present price of the security is 40, and the annual interest rate is 6%, continuously compounded. (a) (4 points) Consider a call option on the security with a strike price of K = 42, having three months until its expiration time. Find the no-arbitrage cost of the call unit of call option purchased? price of 42. What is the risk-neutral valuation of the put option? (b) (2 points) Using delta-hedging, how many shares of the security should be sold per (c) (4 points) Consider a 3 month European put option on the security with a strike

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts