Question: Put-Call Parity PLEASE HELP ANSWER THIS QUESTION IN RELATION TO THE 2 ANSWERS/QUESTIONS BELOW. Use put-call parity to verity the call option price from question

Put-Call Parity

PLEASE HELP ANSWER THIS QUESTION IN RELATION TO THE 2 ANSWERS/QUESTIONS BELOW. Use put-call parity to verity the call option price from question 6 and the put option price from question 7 are valid since they are both based on the same underlying stock with the same maturity.

Question 6 is:

Option Pricing -- Replicating Portfolio

You try to price the call option on XYZ corp. The current stock price of XYZ is $100/share. The risk-free rate is 3%. What is the appropriate price of the 1 year call option of XYZ corp with a strike price of $110 using replicating portfolio approach? You project the stock price of XYZ will either be $100 or $140 in a year. Assume you can borrow or lend money at risk-free rate

ANSWER IS: 2.21

Question 7 is:

Option Pricing -- Risk Neutral

You try to price the put option on XYZ corp. The current stock price of XYZ is $100/share. The risk-free rate is 3%. What is the appropriate price of the 1 year put option of XYZ corp with a strike price of $110 using risk neutral approach? You project the stock price of XYZ will either be $100 or $140 in a year. Assume we live in a risk-neutral world where the returns on all assets are equal to the risk-free rate.

Put Option Price = Strike price X e-Rf*t - Stock Price

Stock price = $100, Strike Price =$110 , Rf = 3% =0.04 , t = 1

Put Option Price = $15 X e-0.04 X 1/12

= $110 X e-0.00333 -$100

=$110 X 0.99667 - $100

=$109.63 - $100

Answer=9.63

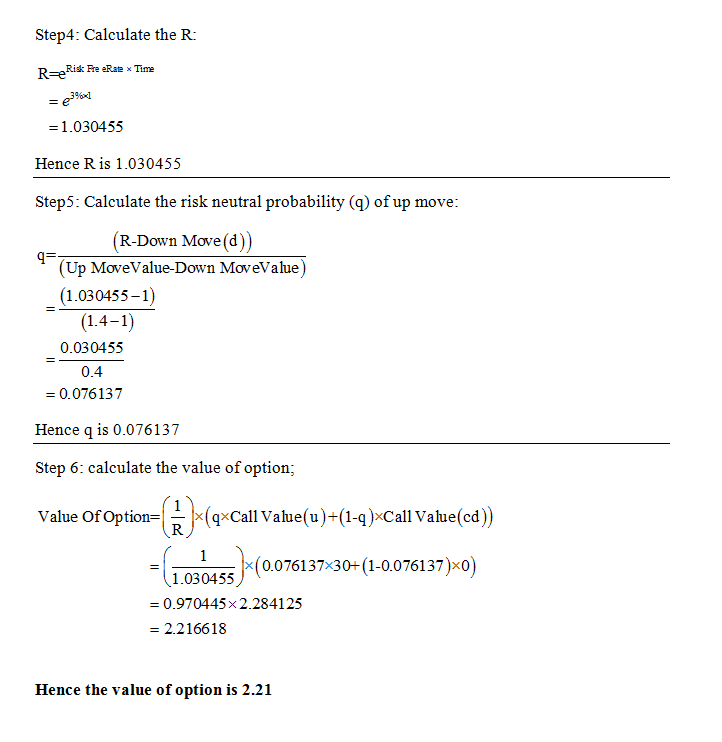

Step4: Calculate the R: Risk Free eRae x Time R-er 1.030455 Hence R is 1.030455 Step5: Calculate the risk neutral probability (q) of up move: own Move (d R-Do Up Move Value-Down MoweValue) (1.030455-1) (1.4-1 0.030455 0.4 0.076137 Hence q is 0.076137 Step 6: calculate the value of option; Value of Option (qxcall value (u)+(1-q)xcallvalue(cd)) 0.076137x30 (1-0.076137)xo) 1.030455 0.970445 x 2.284125 2.216618 Hence the value of option is 2.21

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts