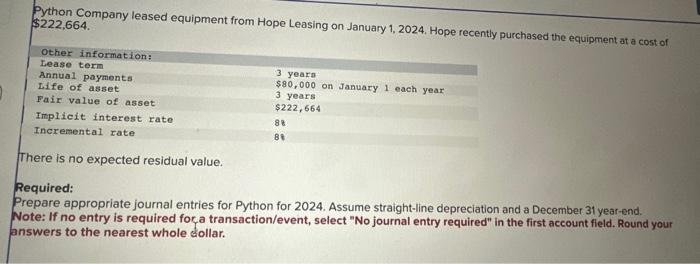

Question: Python Company leased equipment from Hope Leasing on January 1, 2024. Hope recently purchased the equipment at a cost of $222,664 There is no expected

Python Company leased equipment from Hope Leasing on January 1, 2024. Hope recently purchased the equipment at a cost of $222,664 There is no expected residual value. Required: Prepare appropriate journal entries for Python for 2024. Assume straight-line depreciation and a December 31 year-end. Note: If no entry is required foc a transaction/event, select "No journal entry required" in the first account field. Round your answers to the nearest whole dollar. Note: If no entry is requir for Python for 2024. Assume answers to the nequired for a transaction/event, select "No answers to the nearest whole dollar. Record the entry to lease the equipment from Hope Leasing on January 01, 2024. Record the cash paid for annual payment. Record the adjusting entry. Record the entry for amortization expense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts