Question: Q# 01: Select the right answer. 1. Which items are used to calculate cost of goods sold? a. carriage on purchases, carriage on sales,

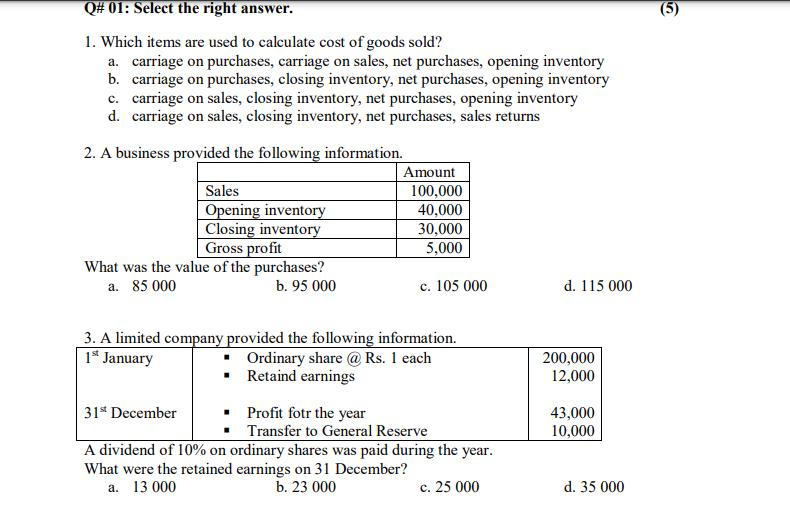

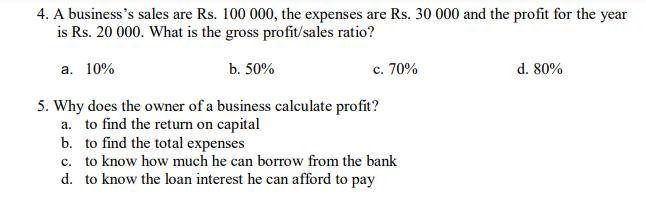

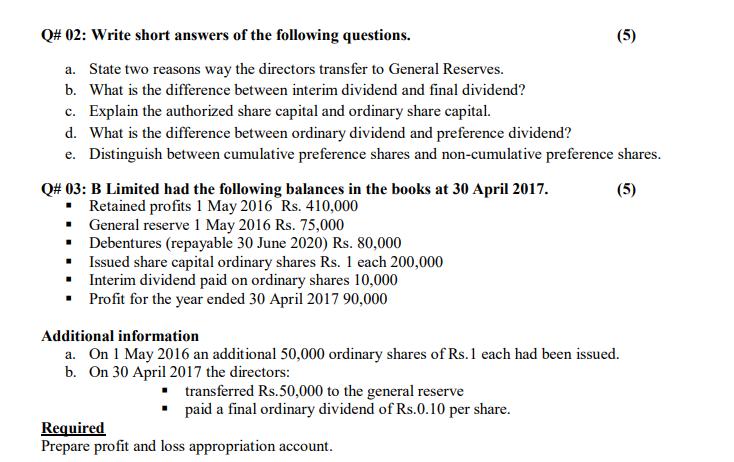

Q# 01: Select the right answer. 1. Which items are used to calculate cost of goods sold? a. carriage on purchases, carriage on sales, net purchases, opening inventory b. carriage on purchases, closing inventory, net purchases, opening inventory c. carriage on sales, closing inventory, net purchases, opening inventory d. carriage on sales, closing inventory, net purchases, sales returns 2. A business provided the following information. Sales Opening inventory Closing inventory Gross profit What was the value of the purchases? a. 85 000 b. 95 000 Amount 100,000 40,000 30,000 5,000 c. 105 000 3. A limited company provided the following information. 1st January Ordinary share @ Rs. 1 each Retaind earnings 31st December A dividend of 10% on ordinary shares was paid during the year. What were the retained earnings on 31 December? a. 13 000 b. 23 000 c. 25 000 Profit fotr the year Transfer to General Reserve d. 115 000 200,000 12,000 43,000 10,000 d. 35 000 (5) 4. A business's sales are Rs. 100 000, the expenses are Rs. 30 000 and the profit for the year is Rs. 20 000. What is the gross profit/sales ratio? a. 10% b. 50% c. 70% 5. Why does the owner of a business calculate profit? a. to find the return on capital b. to find the total expenses c. to know how much he can borrow from the bank d. to know the loan interest he can afford to pay d. 80% Q# 02: Write short answers of the following questions. a. State two reasons way the directors transfer to General Reserves. b. What is the difference between interim dividend and final dividend? c. Explain the authorized share capital and ordinary share capital. d. What is the difference between ordinary dividend and preference dividend? e. Distinguish between cumulative preference shares and non-cumulative preference shares. (5) Q# 03: B Limited had the following balances in the books at 30 April 2017. Retained profits 1 May 2016 Rs. 410,000 General reserve 1 May 2016 Rs. 75,000 Debentures (repayable 30 June 2020) Rs. 80,000 Issued share capital ordinary shares Rs. 1 each 200,000 Interim dividend paid on ordinary shares 10,000 Profit for the year ended 30 April 2017 90,000 (5) Additional information a. On 1 May 2016 an additional 50,000 ordinary shares of Rs.1 each had been issued. b. On 30 April 2017 the directors: transferred Rs.50,000 to the general reserve paid a final ordinary dividend of Rs.0.10 per share. Required Prepare profit and loss appropriation account. Q# 04: Rabia provided the following information. At 1 April 2016 Opening inventory 27 000 For the year ended 31 March 2017 Expenses 35 000 Revenue 240 000 At 31 March 2017 Trade payables 20 000 Trade receivables 16 000 Bank 2 000 Debit Closing inventory 21 000 Rabia uses a mark-up of 25%. Calculate the following for the year ended 31 March 2017. a. Cost of Sales b. Profit for the year Q# 05: What is the difference between current ratio and liquid ratio? (1)

Step by Step Solution

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Question 1 Items are used to calculate cost of goods sold a carriage on purchases carriage on sales net purchases opening inventory b carriage on purchases closing inventory net purchases opening inve... View full answer

Get step-by-step solutions from verified subject matter experts