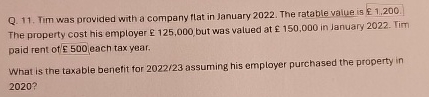

Question: Q . 1 1 . Tim was provided with a company flat in January 2 0 2 2 . The ratable value is 1 ,

Q Tim was provided with a company flat in January The ratable value is The property cost his employer but was valued at in January Tim paid rent of each tax year.

What is the taxable benefit for assuming his employer purchased the property in

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock