Question: Q. 1 Based on your personal experience or on conversations with work or school colleagues, select a current problem in a computer facility at work,

Q. 1

Based on your personal experience or on conversations with work or school colleagues, select a current problem in a computer facility at work, in a lab at school, or in a training facility. The problem you choose could be with hardware performance, software availability, network connectivity, operating policies, staffing, or services. Meet with a group of your colleagues to perform the first several steps in a needs assessment project aimed at solving the problem you selected. First, make sure your group has a clear definition of the root problem. Then, identify the stakeholders and sources of information available to you. Brainstorm alternative solutions to the problem, and analyze the feasibility of each alternative. Finally, answer the following questions:

Are some alternatives more feasible than others? Explain why.

What additional information resources would you need to complete the analysis?

Did your group reach consensus on a recommendation it would make to management?

After picking a public dataset look at what variables are available in the data.

Explore how variables confound and interact with each other through exploratory analysis - you may use any data exploratory software like Excel, Tableau (free for students, see the links below), Python, etc.).

Based on the exploratory analysis in the dataset, come up with 3 different questions, or hypothesizes, an organization you are familiar with may have concerning stakeholders the data examines - suggest what kind of statistical learning analysis might answer that question.

Submit a short report concerning your insights and future questions about consumer to ask with the data.

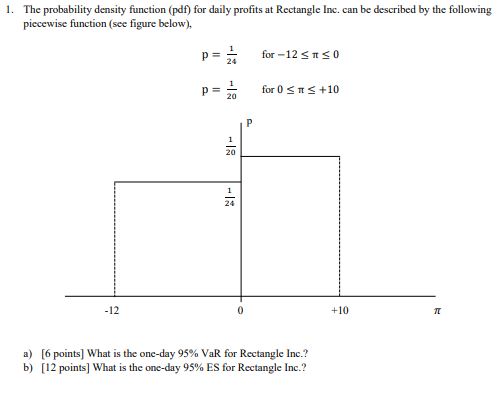

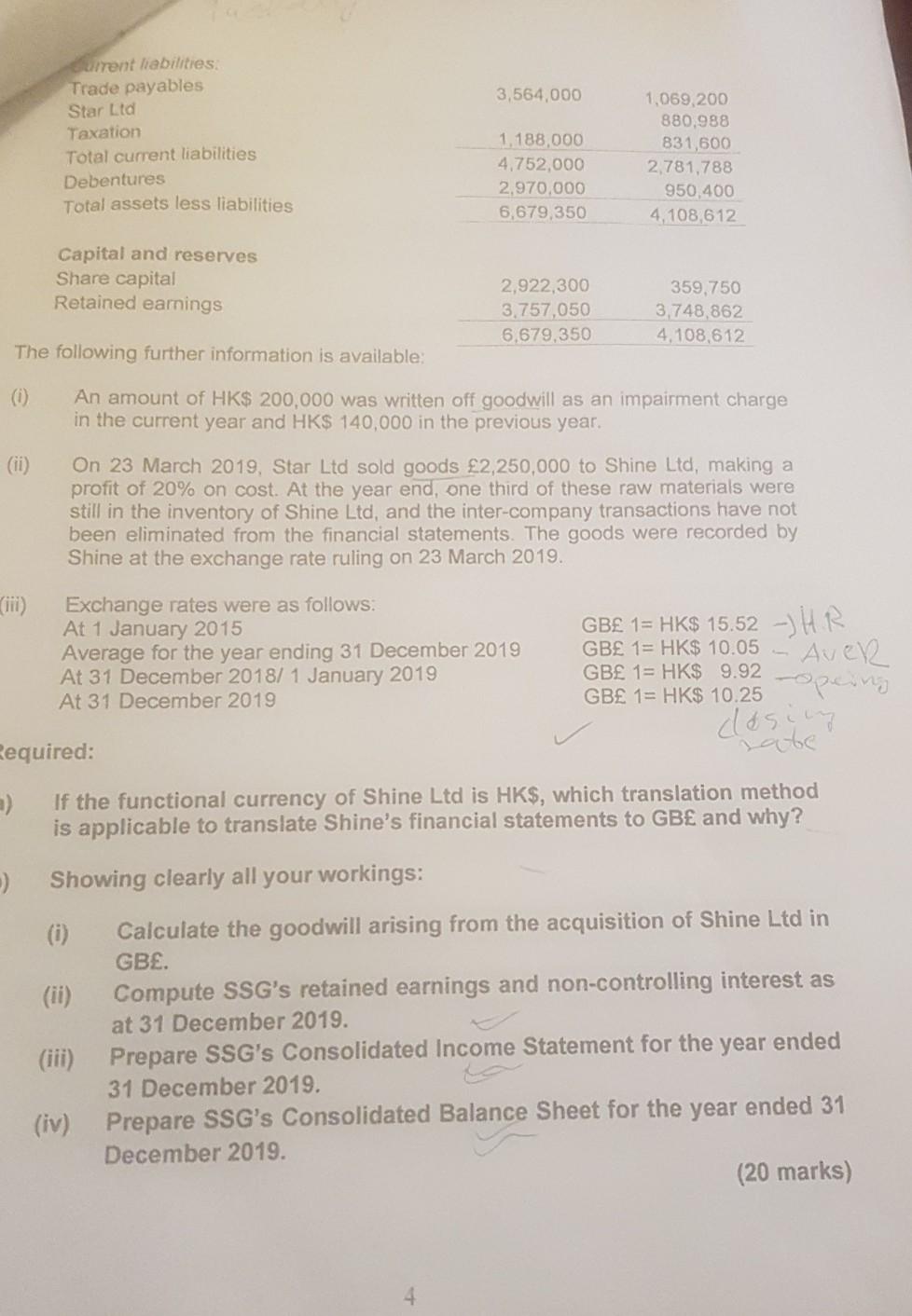

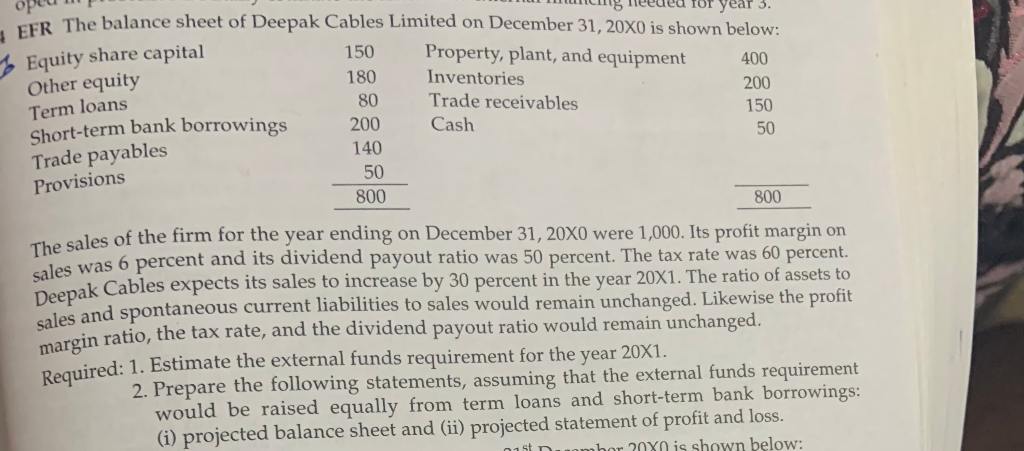

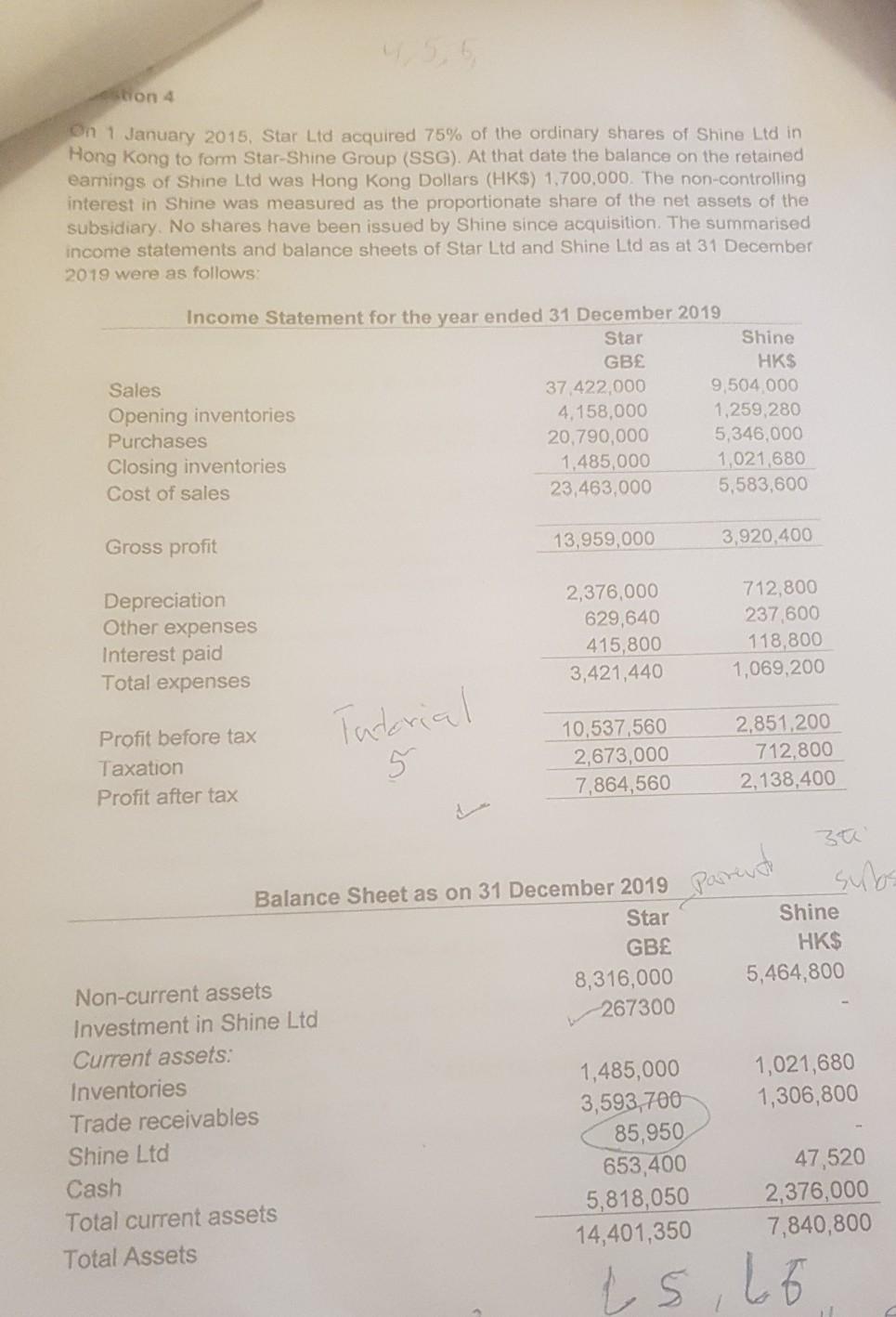

1. The probability density function (pdf) for daily profits at Rectangle Inc. can be described by the following piecewise function (see figure below), P= 1 24 for -12 $ 1 5 0 for 0 $ 1 5 +10 24 -12 +10 a) [6 points] What is the one-day 95% VaR for Rectangle Inc.? b) [12 points] What is the one-day 95% ES for Rectangle Inc.?Current liabilities. Trade payables 3,564,000 Star Lid 1,069,200 Taxation 880,988 1,188,000 Total current liabilities 831,600 4,752,000 Debentures 2,781,788 2,970,000 Total assets less liabilities 950,400 6,679,350 4, 108,612 Capital and reserves Share capital 2,922,300 359,750 Retained earnings 3,757,050 3,748,862 6.679,350 4, 108,612 The following further information is available: (i) An amount of HK$ 200,000 was written off goodwill as an impairment charge in the current year and HK$ 140,000 in the previous year. (ii) On 23 March 2019, Star Ltd sold goods $2,250,000 to Shine Lid, making a profit of 20% on cost. At the year end, one third of these raw materials were still in the inventory of Shine Lid, and the inter-company transactions have not been eliminated from the financial statements. The goods were recorded by Shine at the exchange rate ruling on 23 March 2019. (ifi) Exchange rates were as follows: At 1 January 2015 GBE 1= HK$ 15.52 -) HR Average for the year ending 31 December 2019 GBE 1= HK$ 10.05 - Aven At 31 December 2018/ 1 January 2019 GBE 1= HK$ 9.92 GBE 1= HK$ 10.25 -opeing At 31 December 2019 equired: If the functional currency of Shine Ltd is HK$, which translation method is applicable to translate Shine's financial statements to GBE and why? Showing clearly all your workings: (i) Calculate the goodwill arising from the acquisition of Shine Ltd in GBE. (ii) Compute SSG's retained earnings and non-controlling interest as at 31 December 2019. (ifi) Prepare SSG's Consolidated Income Statement for the year ended 31 December 2019. (iv) Prepare SSG's Consolidated Balance Sheet for the year ended 31 December 2019. (20 marks)op EFR The balance sheet of Deepak Cables Limited on December 31, 20X0 is shown below: for year 3. Equity share capital 150 Property, plant, and equipment Other equity 180 400 Inventories Term loans 80 200 Trade receivables Short-term bank borrowings 200 Cash 150 Trade payables 140 50 Provisions 50 800 800 The sales of the firm for the year ending on December 31, 20X0 were 1,000. Its profit margin on sales was 6 percent and its dividend payout ratio was 50 percent. The tax rate was 60 percent. Deepak Cables expects its sales to increase by 30 percent in the year 20X1. The ratio of assets to sales and spontaneous current liabilities to sales would remain unchanged. Likewise the profit margin ratio, the tax rate, and the dividend payout ratio would remain unchanged. Required: 1. Estimate the external funds requirement for the year 20X1. 2. Prepare the following statements, assuming that the external funds requirement would be raised equally from term loans and short-term bank borrowings: (i) projected balance sheet and (ii) projected statement of profit and loss. Y0 is shown below:4 , 5, 6, ston 4 On 1 January 2015, Star Lid acquired 75% of the ordinary shares of Shine Lid in Hong Kong to form Star-Shine Group (SSG). At that date the balance on the retained earnings of Shine Lid was Hong Kong Dollars (HK$) 1,700.000. The non-controlling interest in Shine was measured as the proportionate share of the net assets of the subsidiary. No shares have been issued by Shine since acquisition. The summarised income statements and balance sheets of Star Lid and Shine Lid as at 31 December 2019 were as follows: Income Statement for the year ended 31 December 2019 Star Shine GBE HK$ Sales 37.422,000 9,504.000 Opening inventories 4. 158,000 1,259,280 Purchases 20,790,000 5,346,000 Closing inventories 1,485,000 1,021,680 Cost of sales 23,463,000 5,583,600 Gross profit 13,959,000 3,920,400 Depreciation 2,376,000 712,800 Other expenses 629,640 237 600 Interest paid 415,800 118,800 Total expenses 3,421,440 1,069,200 Profit before tax Tarterial 10.537,560 2,851,200 Taxation 2,673,000 712,800 Profit after tax 7,864,560 2, 138,400 Balance Sheet as on 31 December 2019 sub Star Shine GBE HK$ Non-current assets 8,316,000 5,464,800 Investment in Shine Ltd 267300 Current assets: Inventories 1,485,000 1,021,680 Trade receivables 3,593,700 1,306,800 Shine Ltd 85,950 Cash 653,400 47 520 Total current assets 5,818,050 2,376,000 Total Assets 14,401,350 7,840,800