Question: Q . 1 . Consider the data from the lecture notes on the US , UK and Japanese stock market: Correlation matrix: The risk -

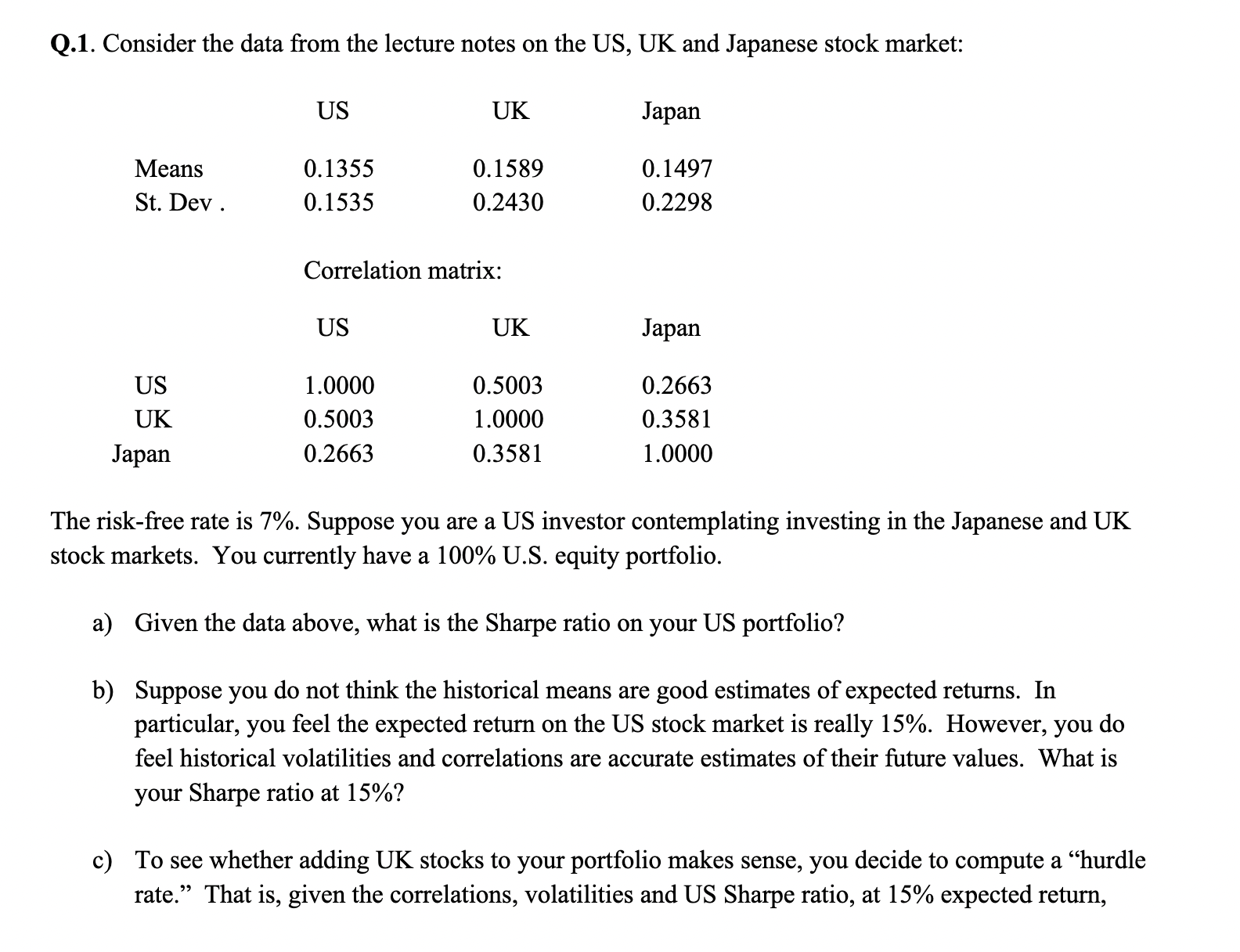

Q Consider the data from the lecture notes on the US UK and Japanese stock market:

Correlation matrix:

The riskfree rate is Suppose you are a US investor contemplating investing in the Japanese and UK

stock markets. You currently have a US equity portfolio.

a Given the data above, what is the Sharpe ratio on your US portfolio?

b Suppose you do not think the historical means are good estimates of expected returns. In

particular, you feel the expected return on the US stock market is really However, you do

feel historical volatilities and correlations are accurate estimates of their future values. What is

your Sharpe ratio at

c To see whether adding UK stocks to your portfolio makes sense, you decide to compute a "hurdle

rate." That is given the correlations, volatilities and US Sharpe ratio, at expected return,

you attempt to determine what expected return on UK stocks you should at least have to improve

your Sharpe ratio. What is the hurdle rate? Show your reasoning and computations.

d Compute a similar hurdle rate for the Japanese equity market. Are the differences between your

answers to c and d surprising? Why or why not?

e Suppose you are allowed to put a small proportion of your portfolio in either Japan or the UK but

not in both. Which country would you pick? Why?

I already know parts a and b please focus on ce Although, giving an answer for parts a and b would be nice so I can check my answers.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock