Question: Q. 1 (Max. Marks:35) John Smith, a college student, plans to sell CD players over the internet 8: by mail order during the semester to

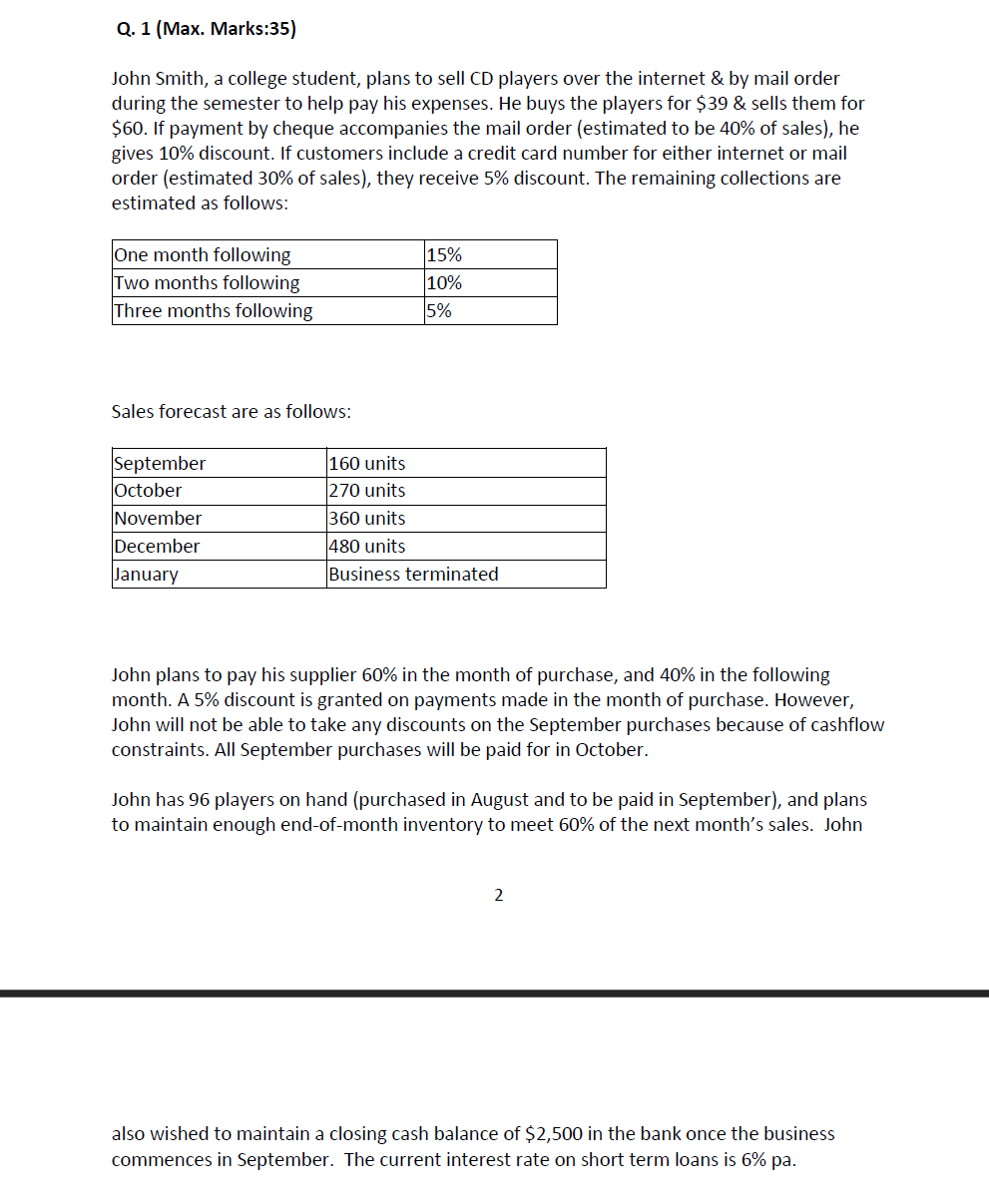

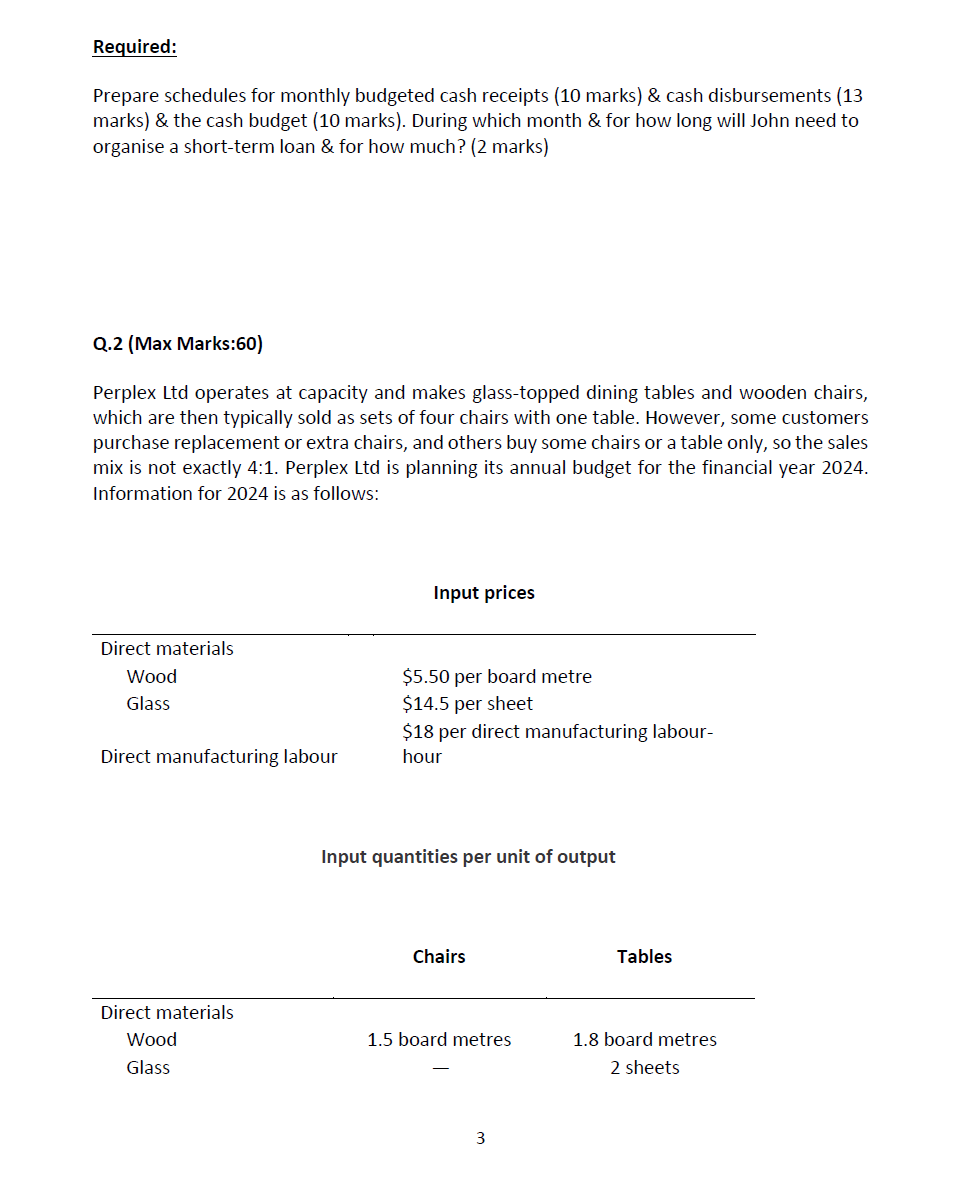

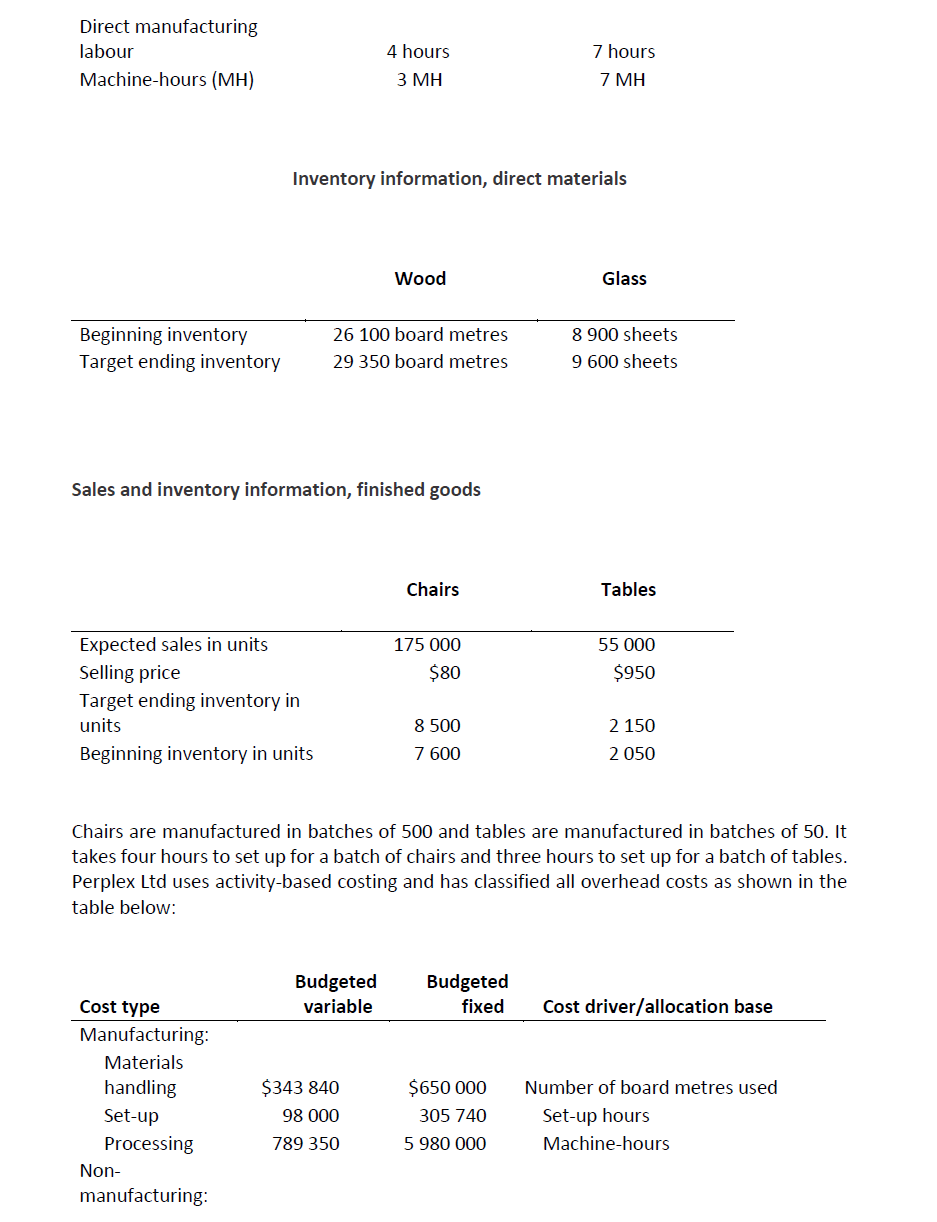

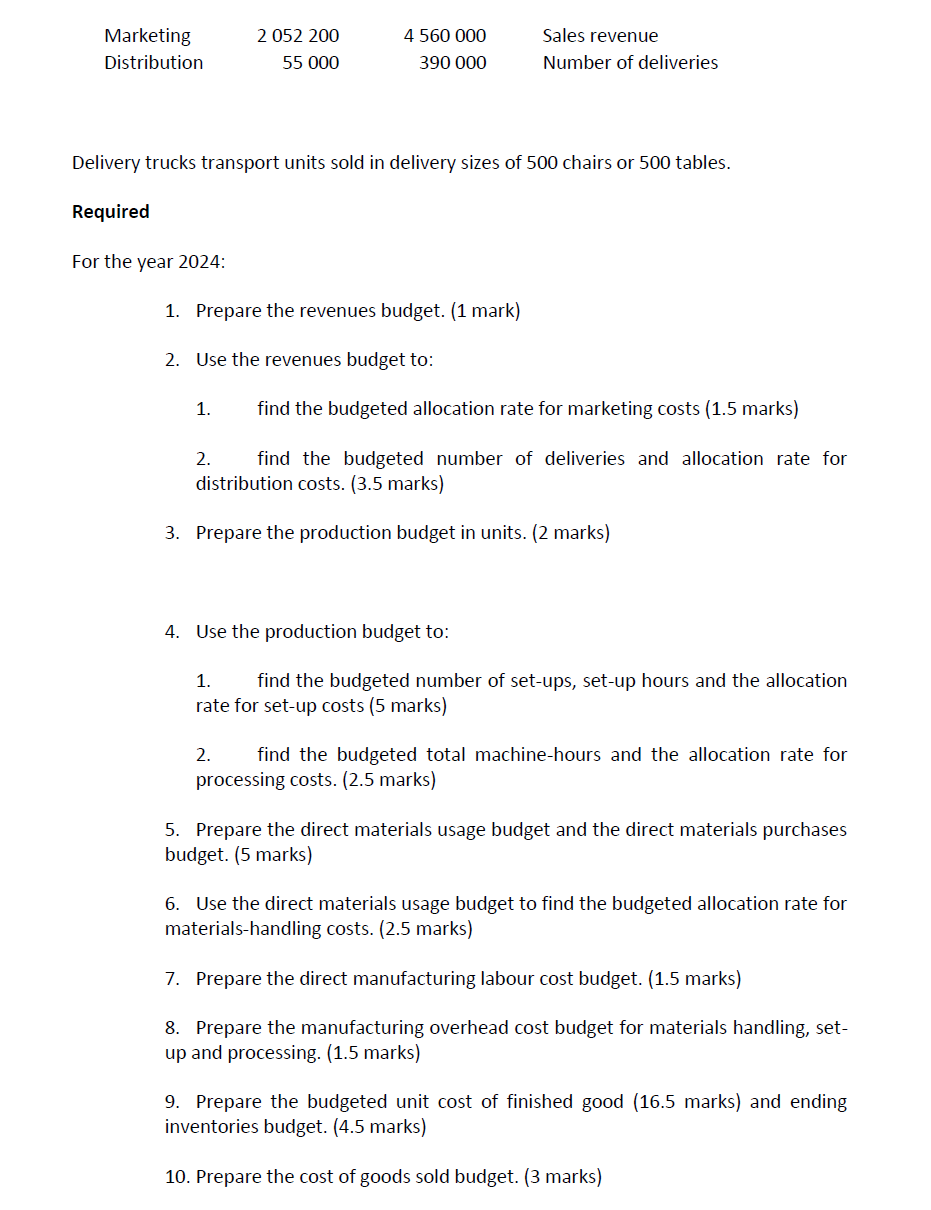

Q. 1 (Max. Marks:35) John Smith, a college student, plans to sell CD players over the internet 8: by mail order during the semester to help pay his expenses. He buys the players for $39 & sells them for S60. If payment by cheque accompanies the mail order (estimated to be 40% of sales), he gives 10% discount. lf customers include a credit card number for either internet or mail order {estimated 30% of sales}, they receive 5% discount. The remaining collections are estimated as follows: One month following 15% Two months following 10% Three months following 5% Sales forecast are as follows: September 160 units October 270 units November 360 units December 480 units January Business terminated John plans to pay his supplier 60% in the month of purchase, and 40% in the following month. A 5% discount is granted on payments made in the month of purchase. However, John will not be able to take any discounts on the September purchases because of cashflow constraints. All September purchases will be paid for in October. John has 96 players on hand [purchased in August and to be paid in September), and plans to maintain enough end-of-month inventory to meet 60% of the next month's sales. John also wished to maintain a closing cash balance of $2,500 in the bank once the business commences in September. The current interest rate on short term loans is 6% pa. Required: Prepare schedules for monthly budgeted cash receipts (10 marks} & cash disbursements {13 marks) 8: the cash budget [10 marks}. During which month &for how long will John need to organise a shortterm loan & for how much? (2 marks) (1.2 (Max Marks:60) Perplex Ltd operates at capacity and makes glasstopped dining tables and wooden chairs, which are then typically sold as sets of four chairs with one table. However, some customers purchase replacement or extra chairs, and others buy some chairs or a table only, sothe sales mix is not exactly 4:1. Perplex Ltd is planning its annual budget for the financial year 2024. Information for 2024 is as follows: Input prices Direct materials Wood 55.50 per board metre Glass 514.5 per sheet 518 per direct manufacturing labour Direct manufacturing labour hour Input quantities per unit of output Chairs Tables Direct materials Wood 1.5 board metres 1.8 board metres Glass 2 sheets Direct manufacturing labour 4 hours 7 hours Machinehours (MH) 3 MH 7 MH Inventory information, direct materials Wood Glass Beginning inventory 26 100 board metres I 8 900 sheets Target ending inventory 29 350 board metres 9 600 sheets Sales and inventory information, finished goods Chairs Tables Expected sales in units 175 000 55 000 Selling price $80 5950 Target ending inventory in units 8 500 2 150 Beginning inventory in units 7 600 2 050 Chairs are manufactured in batches of 500 and tables are manufactured in batches of 50. It takes four hours to set up for a batch of chairs and three hours to set up for a batch of tables. Perplex Ltd uses activitybased costing and has classified all overhead costs as shown in the table below: Budgeted Budgeted Cost type variable fixed Cost driver/allocation base Manufacturing: Materials handling $343 840 $650 000 Number of board metres used Set-up 98 000 305 740 Setup hours Processing 789 350 5 980 000 Machinehours Non manufacturing: Marketing 2 052 200 4 560 000 Sales revenue Distribution 55 000 390 000 Number of deliveries Delivery trucks Required transport units sold in delivery sizes of 500 chairs or 500 tables. For the vear 2024: 1. 2. 5. bud 6. Prepare the revenues budget. (1 mark) Use the revenues budget to: 1. find the budgeted allocation rate for marketing costs (1.5 marks) 2. find the budgeted number of deliveries and allocation rate for distribution costs. (3.5 marks) Prepare the production budget in units. (2 marks) Use the production budget to: 1. find the budgeted number of setups, setup hours and the allocation rate for set-up costs (5 marks) 2. find the budgeted total machine-hours and the allocation rate for processing costs. (2.5 marks) Prepare the direct materials usage budget and the direct materials purchases get. (5 marks) Use the direct materials usage budget to find the budgeted allocation rate for materialshandling costs. (2.5 marks) 7. 8. Prepare the direct manufacturing labour cost budget. (1.5 marks) Prepare the manufacturing overhead cost budget for materials handling, set up and processing. [1.5 marks) 9. Prepare the budgeted unit cost of finished good (16.5 marks) and ending inventories budget. (4.5 marks) 10. Prepare the cost of goods sold budget. (3 marks) 11. Prepare the nonmanufacturing overhead costs budget for marketing and distribution. {1 mark} 12. Prepare a budgeted income statement (ignore income taxes). {3 marks] 13. Compare the budgeted unit cost of a chairto its budgeted selling price. Why might Perplex Ltd continue to sell the chairs for only $80? {6 marks}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts