Question: Q 1 - Network Optimization Problem: Canada 1 Steel Production's Expansion Strategy ( 1 4 points total ) Canada 1 Steel Production, a leading manufacturer

Q Network Optimization Problem: Canada Steel Production's Expansion Strategy points total

Canada Steel Production, a leading manufacturer of steel products in Canada, operates two production plantsone in Toronto and the other in Vancouver. Each plant has an annual production capacity of metric tons. These two plants serve the entire market, which is divided into four regional demand centers:

Eastern Canada, with a demand of metric tons,

Western Canada, with a demand of metric tons,

Northern Canada, with a demand of metric tons.

USA, with a demand of metric tons,

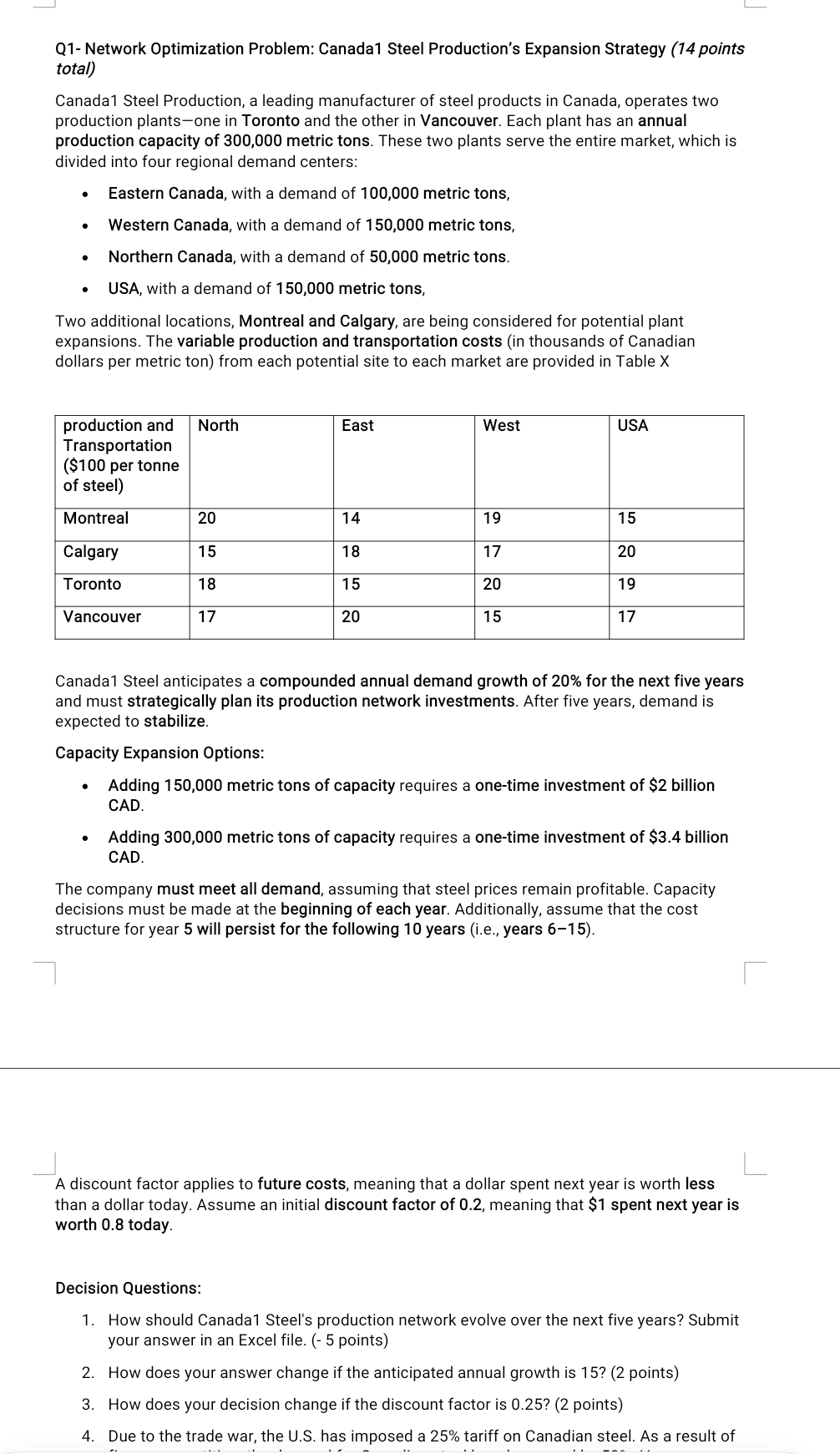

Two additional locations, Montreal and Calgary, are being considered for potential plant expansions. The variable production and transportation costs in thousands of Canadian dollars per metric ton from each potential site to each market are provided in Table X

tabletableproduction andTransportation$ per tonneof steelNorth,East,West,USAMontrealCalgaryTorontoVancouver

Canada Steel anticipates a compounded annual demand growth of for the next five years and must strategically plan its production network investments. After five years, demand is expected to stabilize.

Capacity Expansion Options:

Adding metric tons of capacity requires a onetime investment of $ billion CAD.

Adding metric tons of capacity requires a onetime investment of $ billion CAD.

The company must meet all demand, assuming that steel prices remain profitable. Capacity decisions must be made at the beginning of each year. Additionally, assume that the cost structure for year will persist for the following years ie years

A discount factor applies to future costs, meaning that a dollar spent next year is worth less than a dollar today. Assume an initial discount factor of meaning that $ spent next year is worth today.

Decision Questions:

How should Canada Steel's production network evolve over the next five years? Submit your answer in an Excel file. points

How does your answer change if the anticipated annual growth is points

How does your decision change if the discount factor is points

Due to the trade war, the US has imposed a tariff on Canadian steel. As a result of

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock