Question: Q 11-07 Consider the annual returns produced by two different active equity portfolio managers (A and B) as well as those to the stock index

Q 11-07

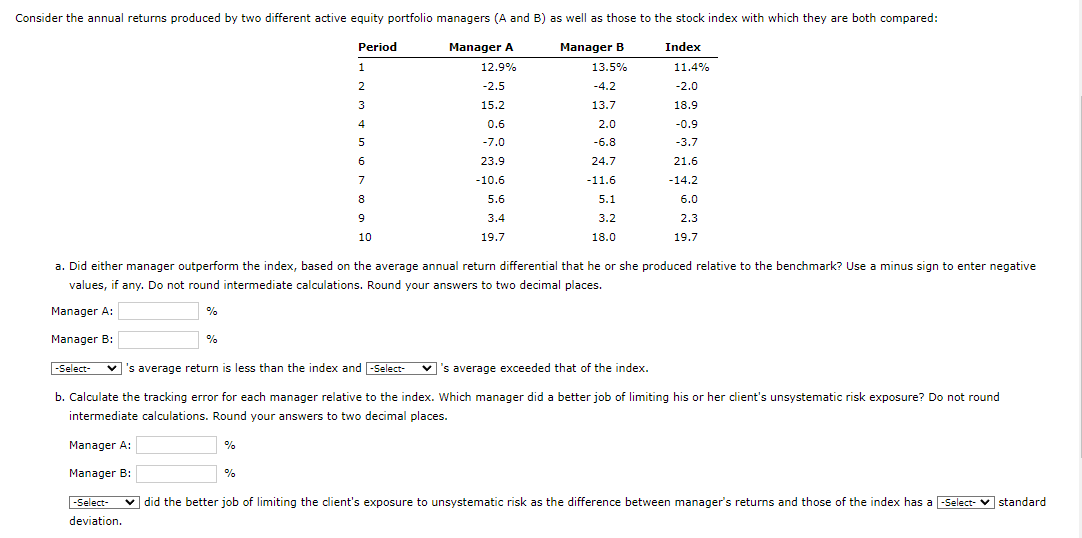

Consider the annual returns produced by two different active equity portfolio managers (A and B) as well as those to the stock index with which they are both compared: Period Index Manager A 12.9% Manager B 13.5% 1 11.4% 2 -2.5 -4.2 -2.0 3 15.2 13.7 4 0.6 2.0 -6.8 18.9 -0.9 -3.7 5 -7.0 23.9 6 24.7 21.6 -14.2 7 -10.6 -11.6 5.1 8 5.6 6.0 9 3.4 3.2 18.0 2.3 19.7 10 19.7 a. Did either manager outperform the index, based on the average annual return differential that he or she produced relative to the benchmark? Use a minus sign to enter negative values, if any. Do not round intermediate calculations. Round your answers to two decimal places. Manager A: % Manager B: % -Select- v 's average return is less than the index and -Select- 's average exceeded that of the index. b. Calculate the tracking error for each manager relative to the index. Which manager did a better job of limiting his or her client's unsystematic risk exposure? Do not round intermediate calculations. Round your answers to two decimal places. Manager A: % % Manager B: -Select- v did the better job of limiting the client's exposure to unsystematic risk as the difference between manager's returns and those of the index has a -Select- standard deviation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts