Question: Q 2 : WXB Inc. whose tax rate = 3 2 % , is considering a 2 0 - year project which requires an initial

Q: WXB Inc. whose tax rate is considering a year project which requires an initial

investment of $ and has annual cash flows of $Day Tbills and year government

bonds are currently paying and respectively. Should WXB Inc. undertake this project

assuming the opportunity cost of capital assume the following: CCA and the salvage

value $ How might your answer change if the CFO underestimates the risk by Q: A company can sell prefabricated, standardized cottages for $ for which variable costs

$cottage The company's fixed costs $ The company needs to build a production

facility which would cost $ million year horizon, using the straightline method Assume a $

salvage value and a required rate of return. Projected sales are cottagesyear Calculate:

accounting breakeven, cash breakeven, financial breakeven, the OCF line, and the NPV based on

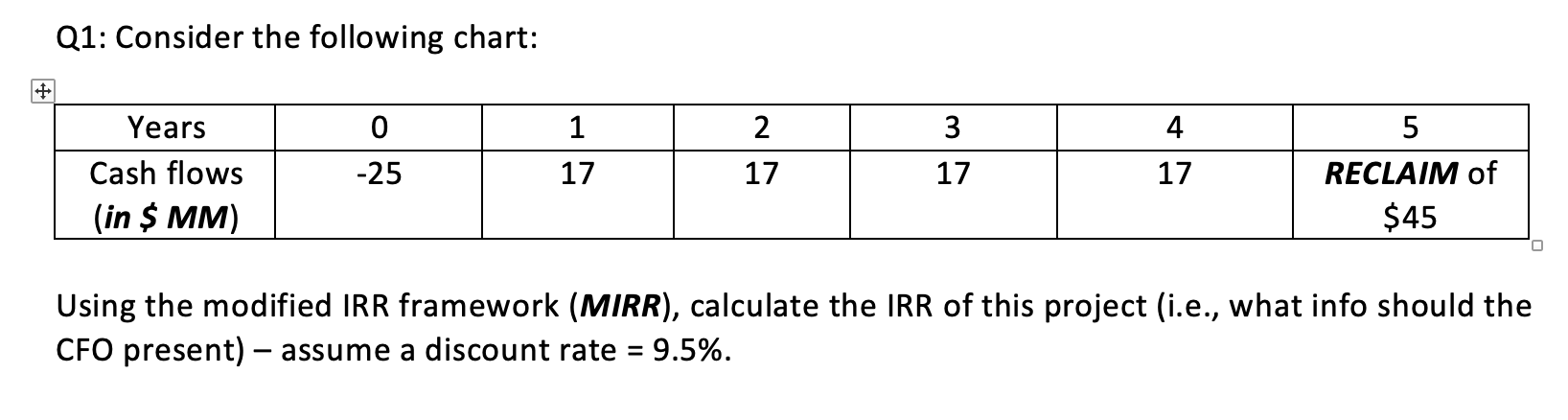

projected salesQ: Consider the following chart:

Using the modified IRR framework MIRR calculate the IRR of this project ie what info should the

CFO present assume a discount rate

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock