Question: Q 2 : You work for a hedge fund and your job is to profit from possible arbitrages. You have the following information today from

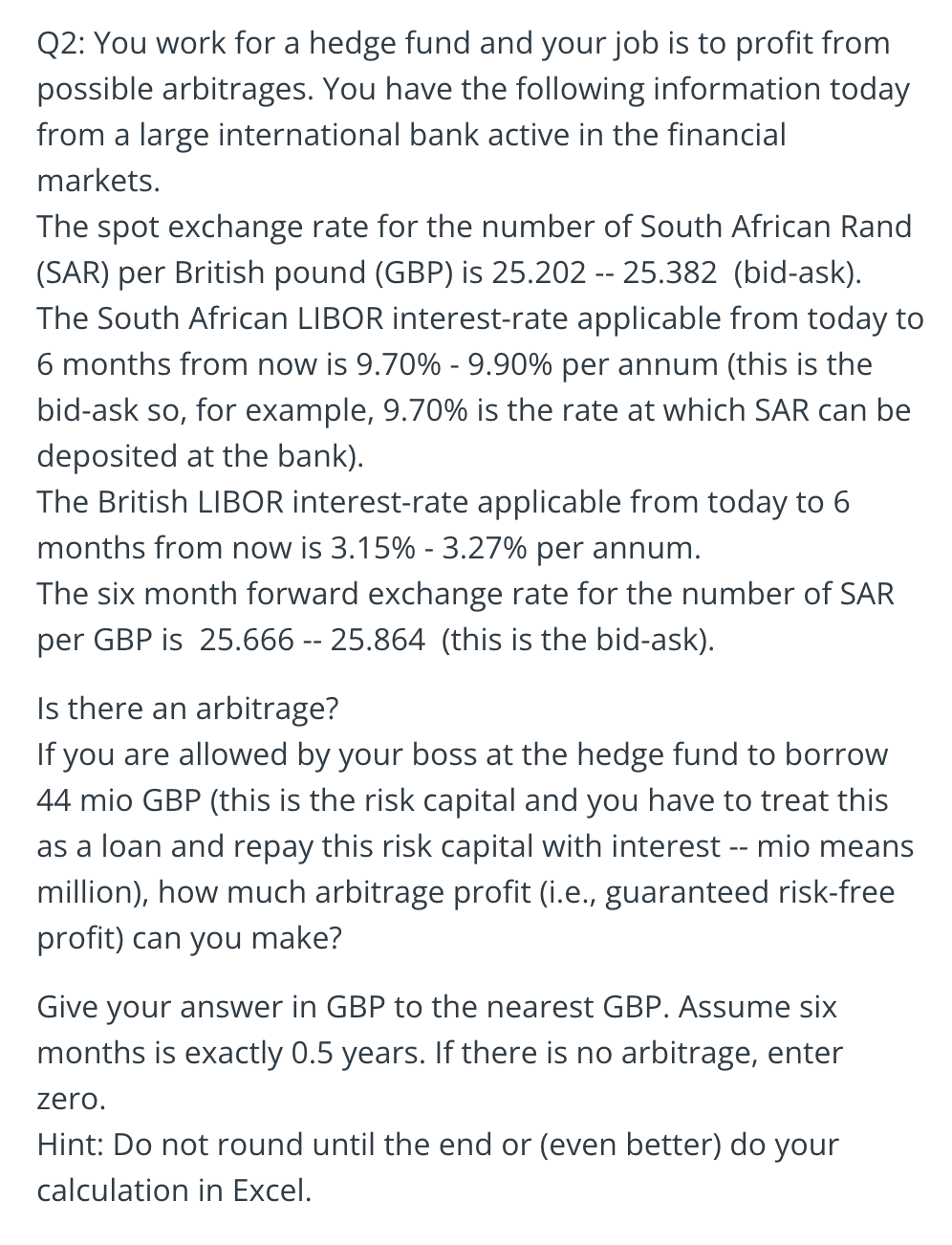

Q: You work for a hedge fund and your job is to profit from possible arbitrages. You have the following information today from a large international bank active in the financial markets. The spot exchange rate for the number of South African Rand SAR per British pound GBP is bidask The South African LIBOR interestrate applicable from today to months from now is per annum this is the bidask so for example, is the rate at which SAR can be deposited at the bank The British LIBOR interestrate applicable from today to months from now is per annum. The six month forward exchange rate for the number of SAR per GBP is this is the bidask Is there an arbitrage? If you are allowed by your boss at the hedge fund to borrow mio GBP this is the risk capital and you have to treat this as a loan and repay this risk capital with interest mio means million how much arbitrage profit ie guaranteed riskfree profit can you make? Give your answer in GBP to the nearest GBP Assume six months is exactly years. If there is no arbitrage, enter zero. Hint: Do not round until the end or even better do your calculation in Excel.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock