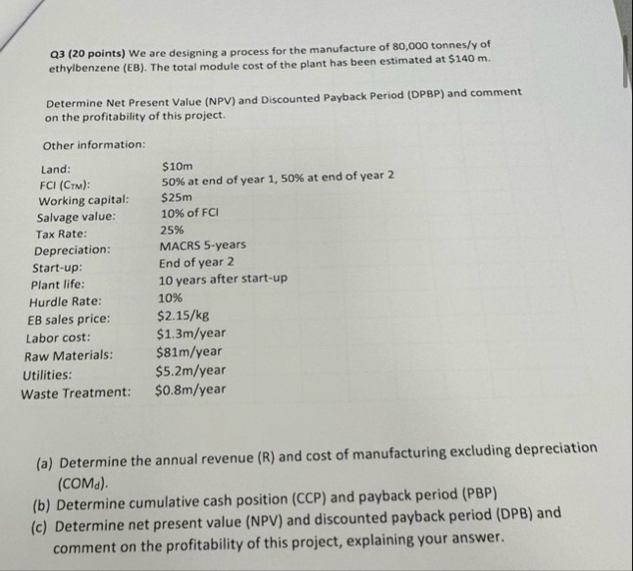

Question: Q 3 ( 2 0 points ) We are designing a process for the manufacture of 8 0 , 0 0 0 tonnes / y

Q points We are designing a process for the manufacture of tonnesy of ethylbenzene EB The total module cost of the plant has been estimated at $

Determine Net Present Value NPV and Discounted Payback Period DPBP and comment on the profitability of this project.

Other information:

tableLand:$m: at end of year at end of year Working capital:,$mSalvage value:, of FClTax Rate:,Depreciation:MACRS yearsStartup:End of year Plant life:, years after startupHurdle Rate:,EB sales price:,$kgLabor cost:$myearRaw Materials:,$myearUtilities:$myearWaste Treatment:,$myear

a Determine the annual revenue and cost of manufacturing excluding depreciation COMd

b Determine cumulative cash position CCP and payback period PBP

c Determine net present value NPV and discounted payback period DPB and comment on the profitability of this project, explaining your answer.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock