Question: Q 4(recheck), and Q 5 4. What misconceptions should Maitha correct during her meeting with Salem? Marthat should Correct the misconception that salem has regarding

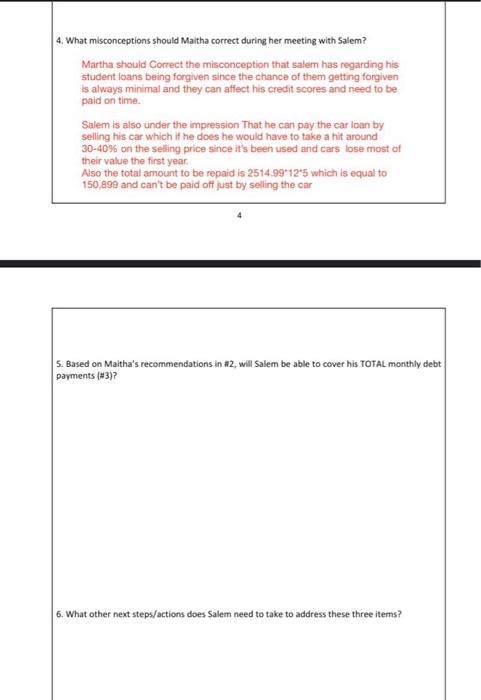

4. What misconceptions should Maitha correct during her meeting with Salem? Marthat should Correct the misconception that salem has regarding his student foans being forgiven since the chance of them getting forgiven is always minimal and they can affect his credit scores and need to be paid on time. Salem is also under the impression That he can pay the car Ioan by selling his car which if he does he would have to take a hit around 3040% on the selling price since it's been used and cars lose most of their value the first year. Aso the total amount to be repaid is 2514.9912.5 which is equal to 150,899 and can't be paid off just by selling the car 4 5. Based on Maitha's recommendations in 12 , will Salem be able to cover his TOTAL monthly debt payments (#3) ? 6. What other next steps/actions does Salem need to take to address these three items? Purchased a new BMNW 5 series as a present to himself after graduating from college and has a 140,000 Aed loan outstanding as 2.99% interest over a 5 year term. He hasn't made a perment in three months. salem had resigned himself to the fact that he could alwavs just sell the car and all would be good if be will continue living in Dubai Marina because he can cake the metro to go working, Answer this: 3. Complete the table below, listing each of Salem's debts and use this loan calculator fioan ralcilatne I hankratel to calrulate hic mnnthliv navmente. TOTAL Moothly Payments 4. What maconceptions should Maitha correct during her meeting with Salem? Maitha shauld Carect the misoonception that salert has regarding his student loans being forgwen eince the chance of them getting forgeven is always minimal and they can atlect his credt scones and need to be paid on time. Saliern is ase under the impression That he can pary the car ioan by seling his car which if he does he would have to take a hit around 30-40\% on the seling price since it's been used and cars lobe moet of their value the first year: Also the total arnount to be repaid is 2514,99+125 wich is equal to 150,899 aod and can't be pisid off just ty selling the car 5. Based on Macha's recommendations in a2, will Salem be able to cover his Total monthly debt payments (il3)? 2. What ideas might Maitha have on how Salem can improve his monthly budget so he can start to pay oft his debts? Be sure to identify how much she thinks that Salem can save in his monthly expenses with your proposal. 2 1,500NED, he could nave about AEDS60 merith Total Gavingt 4 A09 Aed +500 hed + 5ag Aed w 5.00 Amb ger menth After developing some workable ideas on how Salem might improve his monthly budget, Maitha had renewed energy and optimism as she and Sslem discussed his three largest debts: Left college with debt on four credit cards and now has 60,000 Aed outstanding balances at a yearly interest rate of 21.9k. Making a minimum payment of 1200 Aed per month. 5a lem said he was prioritizing this bill since it would have the largest impact on his credit score. He would like to pay oft his credit card within 5 years so he can start saving for other things. Incurred student debt of 140,000 Aed, with a 4.45% interest rate for the 10 year term. He has missed his last three payments, Salem had heard that there was a government plan to forgive student loans after 10 years so he wasn't too concerned about missing those payments

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts