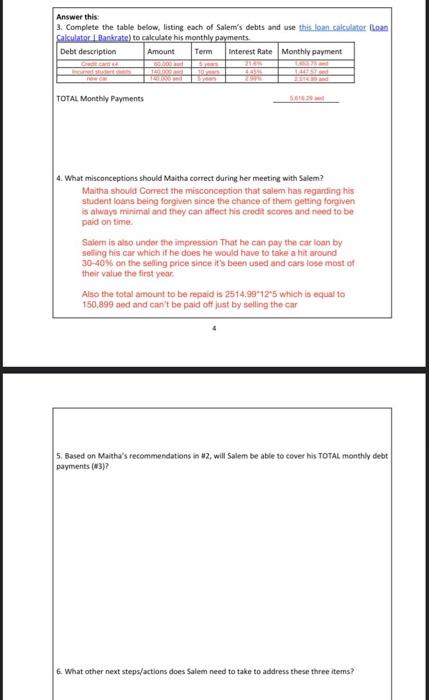

Question: Q5 Answer this 3. Complete the table below, listing each of Salem's debts and use thith loan calculator fioan ralruiatine I Aankratel in ralrilate bic

Answer this 3. Complete the table below, listing each of Salem's debts and use thith loan calculator fioan ralruiatine I Aankratel in ralrilate bic monthlu namente TOTAL Monthly Payments 4. What misconceptions should Maitha correct during her meeting with Salem? Maitha should Correct the misconception that salem has regarding his student loths being forgiven since the chance of them getting forgiven is ahways minimal and they can affect his crechit scores and noed to be paid on time. Salern is alto under the impression That he can pay the car ioan by sesing his car which if he does he would have to take a hit around M0-40\%6 on the seling price since it's been used and cars lose most of their value the first year, Asso the total amount to be repaid is 2514,992125 which is equal to 150,899 ned and can't be paid off just by selling the car 4 5. Dased on Maitha's recommendations in 12 , will Salem be able to cever his TOTAL, monthly debt payments (w3) ? 6. What other next steps/actions does Salem need to take to address these three items? 02. Question 2 Maitha could advise Salem temporarily to move back in with his parents. This would eliminate his monthly rental cost of 4,800AED. Maitha might advise Salem to eat out less often and opt for less expensive meals. By eating out only once a week or preparing his meals at home, Salem could potentially save more money. If he reduced his spending on dining out by 50% or more, he could save about AED 1000 monthly. Maitha could suggest cheaper entertainment options to Salem, such as going to free or low-cost events, looking into discounts, or using streaming services rather than frequently attending pricey sporting and concert events. If Salem cut his entertainment costs from 2000 to 1500 , he could save around 500AED monthly. Total Savings: 4,800Aed+1000Aed+500Aed+200 (surplus of initial budget) = 6,500 ied per month. Answer this 3. Complete the table below, listing each of Salem's debts and use thith loan calculator fioan ralruiatine I Aankratel in ralrilate bic monthlu namente TOTAL Monthly Payments 4. What misconceptions should Maitha correct during her meeting with Salem? Maitha should Correct the misconception that salem has regarding his student loths being forgiven since the chance of them getting forgiven is ahways minimal and they can affect his crechit scores and noed to be paid on time. Salern is alto under the impression That he can pay the car ioan by sesing his car which if he does he would have to take a hit around M0-40\%6 on the seling price since it's been used and cars lose most of their value the first year, Asso the total amount to be repaid is 2514,992125 which is equal to 150,899 ned and can't be paid off just by selling the car 4 5. Dased on Maitha's recommendations in 12 , will Salem be able to cever his TOTAL, monthly debt payments (w3) ? 6. What other next steps/actions does Salem need to take to address these three items? 02. Question 2 Maitha could advise Salem temporarily to move back in with his parents. This would eliminate his monthly rental cost of 4,800AED. Maitha might advise Salem to eat out less often and opt for less expensive meals. By eating out only once a week or preparing his meals at home, Salem could potentially save more money. If he reduced his spending on dining out by 50% or more, he could save about AED 1000 monthly. Maitha could suggest cheaper entertainment options to Salem, such as going to free or low-cost events, looking into discounts, or using streaming services rather than frequently attending pricey sporting and concert events. If Salem cut his entertainment costs from 2000 to 1500 , he could save around 500AED monthly. Total Savings: 4,800Aed+1000Aed+500Aed+200 (surplus of initial budget) = 6,500 ied per month

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts