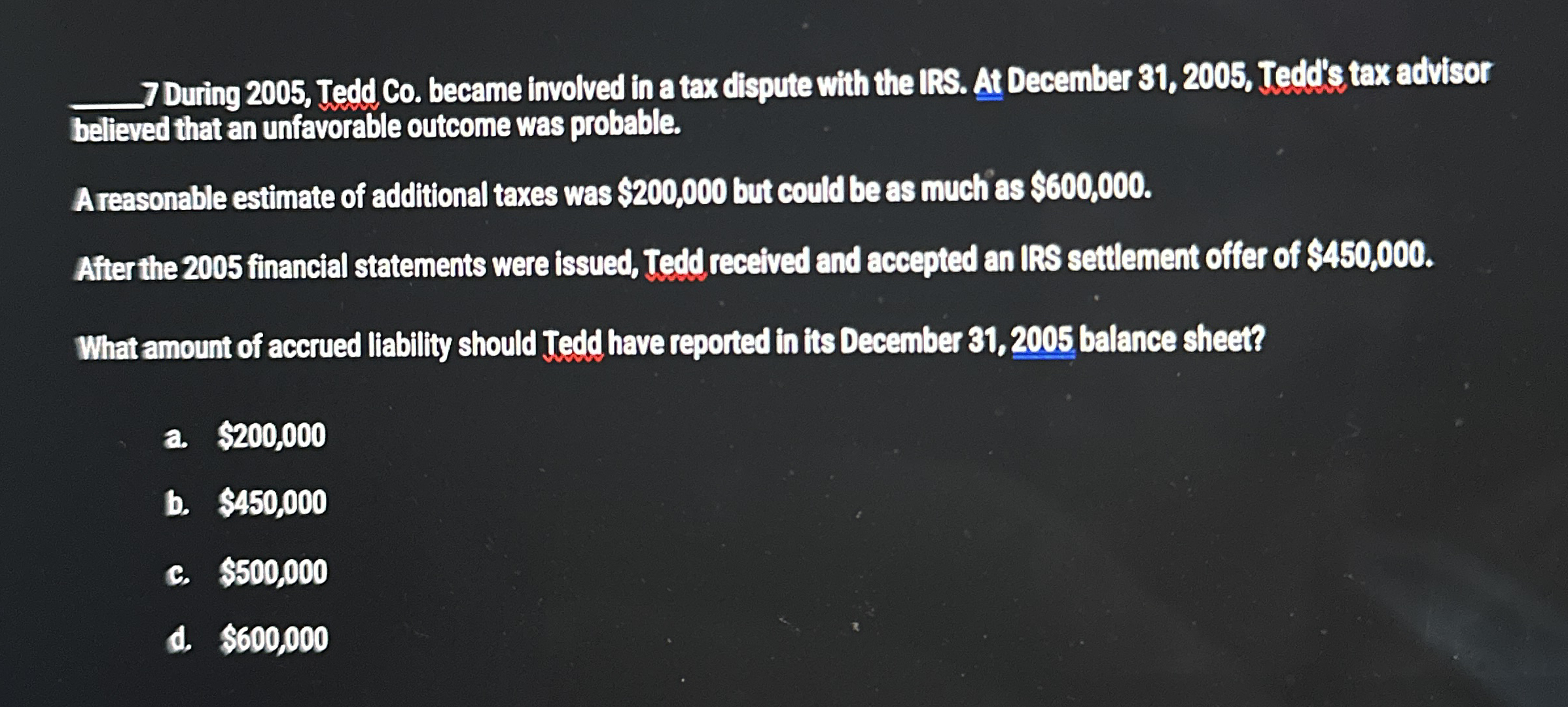

Question: q , 7 During 2 0 0 5 , Tedd Co . became involved in a tax dispute with the IRS. At December 3 1

During Tedd Co became involved in a tax dispute with the IRS. At December Teddis tax advisor believed that an unfavorable outcome was probable.

A reasonable estimate of additional taxes was $ but could be as much as $

After the financial statements were issued, Tedd received and accepted an IRS settlement offer of $

What amount of accrued liability should Tedd have reported in its December balance sheet?

a $

b $

c $

d $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock