Question: q , 9 9 . In Lawrence County, the real property tax year is the calendar year. The real property tax becomes a personal liability

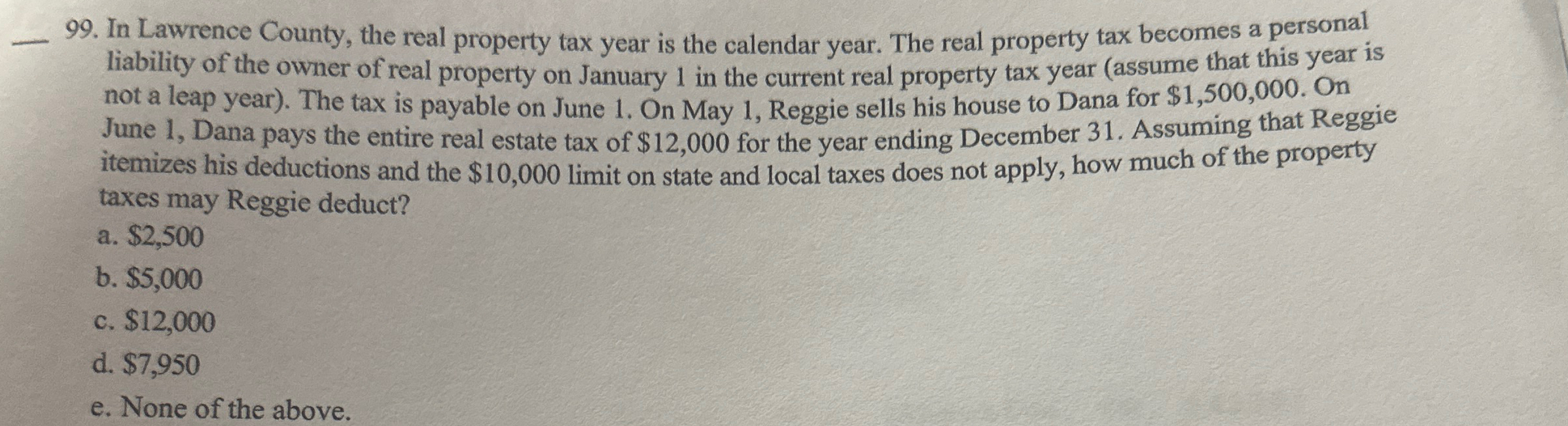

In Lawrence County, the real property tax year is the calendar year. The real property tax becomes a personal liability of the owner of real property on January in the current real property tax year assume that this year is not a leap year The tax is payable on June On May Reggie sells his house to Dana for $ On June Dana pays the entire real estate tax of $ for the year ending December Assuming that Reggie itemizes his deductions and the $ limit on state and local taxes does not apply, how much of the property taxes may Reggie deduct?

a $

b $

c $

d $

e None of the above.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock