Question: Q. 9 & Q.10 Please answer with the formula sheet Ford Motor Company is considering an early retirement buyout package for some employees. The package

Q. 9 & Q.10

Please answer with the formula sheet

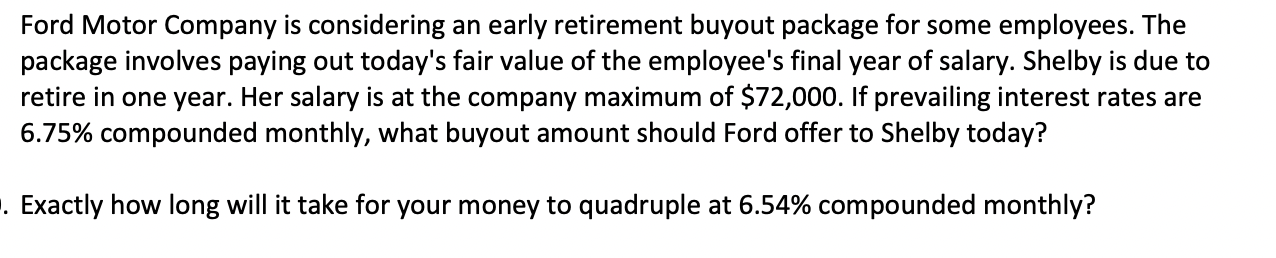

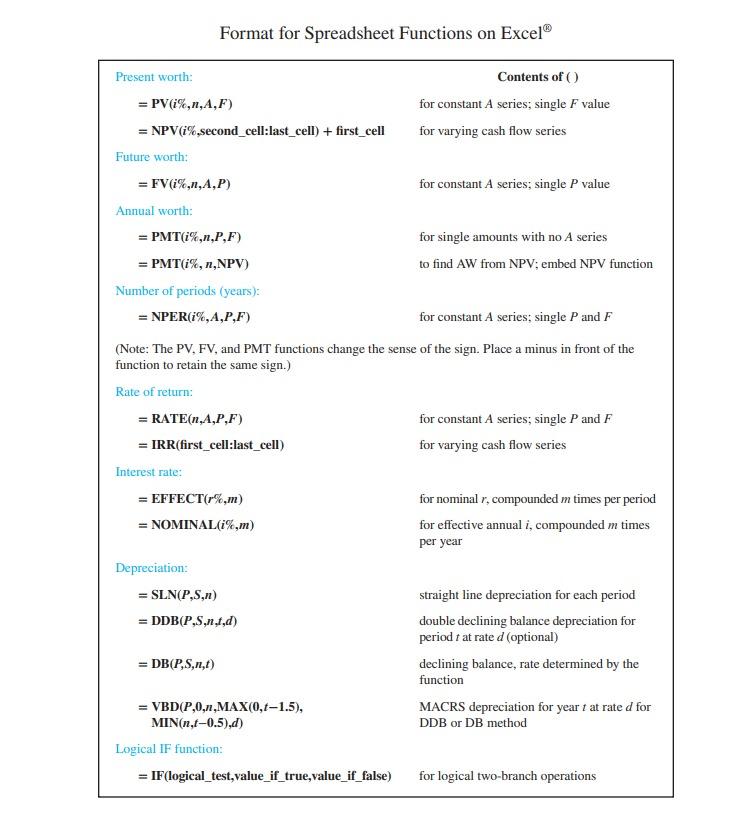

Ford Motor Company is considering an early retirement buyout package for some employees. The package involves paying out today's fair value of the employee's final year of salary. Shelby is due to retire in one year. Her salary is at the company maximum of $72,000. If prevailing interest rates are 6.75% compounded monthly, what buyout amount should Ford offer to Shelby today? . Exactly how long will it take for your money to quadruple at 6.54% compounded monthly? Format for Spreadsheet Functions on Excel Present worth: Contents of = PV(%,n,A,F) for constant A series; single F value = NPV (%.second_cell:last_cell) + first_cell for varying cash flow series Future worth: = FV(%,1,A,P) for constant A series; single P value Annual worth: = PMT(%,n,P,F) for single amounts with no A series = PMT(i%, n,NPV) to find AW from NPV; embed NPV function Number of periods (years): = NPER(%,A,P,F) for constant A series: single P and F (Note: The PV. FV, and PMT functions change the sense of the sign. Place a minus in front of the function to retain the same sign.) Rate of return; = RATE(n,A,P,F) for constant A series; single P and F = IRR(first_cell:last_cell) for varying cash flow series Interest rate: = EFFECT(r%,m) for nominal r, compounded m times per period = NOMINAL(i%,m) for effective annual i, compounded m times per year Depreciation: = SLN(P,S,11) straight line depreciation for each period = DDB(P,5,n,1,d) double declining balance depreciation for period t at rated (optional) = DB(P,S,n,1) declining balance, rate determined by the function = VBD(P,0,1,MAX(0,t-1.5), MACRS depreciation for year t at rated for MIN(n,t-0.5),d) DDB or DB method Logical IF function: = IF(logical_test,value_if_true,value_if_false) for logical two-branch operations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts