Question: During fiscal 2021, how much did the company recognize as its estimate for new expected claims? The Company is primarily self-insured for costs related to

During fiscal 2021, how much did the company recognize as its estimate for new expected claims?

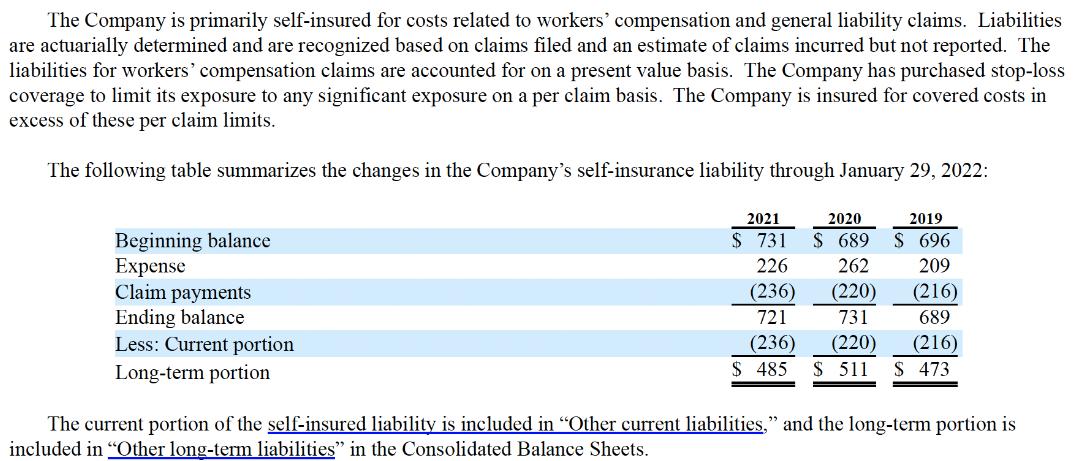

The Company is primarily self-insured for costs related to workers' compensation and general liability claims. Liabilities are actuarially determined and are recognized based on claims filed and an estimate of claims incurred but not reported. The liabilities for workers' compensation claims are accounted for on a present value basis. The Company has purchased stop-loss coverage to limit its exposure to any significant exposure on a per claim basis. The Company is insured for covered costs in excess of these per claim limits. The following table summarizes the changes in the Company's self-insurance liability through January 29, 2022: Beginning balance Expense Claim payments Ending balance Less: Current portion Long-term portion 2021 2020 $ 731 $ 689 226 262 (220) (236) 721 (236) (220) 731 $ 485 $ 511 2019 $ 696 209 (216) 689 (216) S 473 The current portion of the self-insured liability is included in Other current liabilities," and the long-term portion is included in "Other long-term liabilities" in the Consolidated Balance Sheets.

Step by Step Solution

3.45 Rating (148 Votes )

There are 3 Steps involved in it

In the given table the change in the selfinsurance liability for 2021 is represented by the diff... View full answer

Get step-by-step solutions from verified subject matter experts