Question: Q: Castle Co Ltd is working on three research projects. Project Jonah is government-sponsored research on synthesising currently available research results on the possible triggers

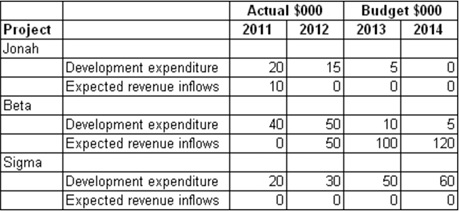

Q: Castle Co Ltd is working on three research projects. Project Jonah is government-sponsored research on synthesising currently available research results on the possible triggers of asthma attacks. Project Beta involves researching the genetic tags associated with heart disease based on the genome project. A test to identify the predisposition to heart disease in children has been developed and will be on the market in 2013. Since 2011 research and development expenditures on this project are applied development costs only. Project Sigma is cutting edge research being conducted to try and discover a means of 'disassembling' molecules and then 'reassembling' them in their original form. The company hopes that this work will lay the foundations for realising dreams of teleportation as a method of transport. Details of expenditures and recoverable amounts expected beyond reasonable doubt at this time are:

A: Jonah: $0; Beta $90 000; Sigma $0 (why)?

Actual $000 Budget $00 Project Jonah 20112012 20132014 Development expenditure Expected revenue inflows 20 10 15 Beta 10 100| 50 Development expenditure Expected revenue inflow/s| 40 50| 120 Sigma Development expenditure | 201 301 501 60 Expected revenue inflows

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts