Question: Q) choose the correct answer 1 - The expected return on a given share depends on A Potential returns and their probability distribution B) Standard

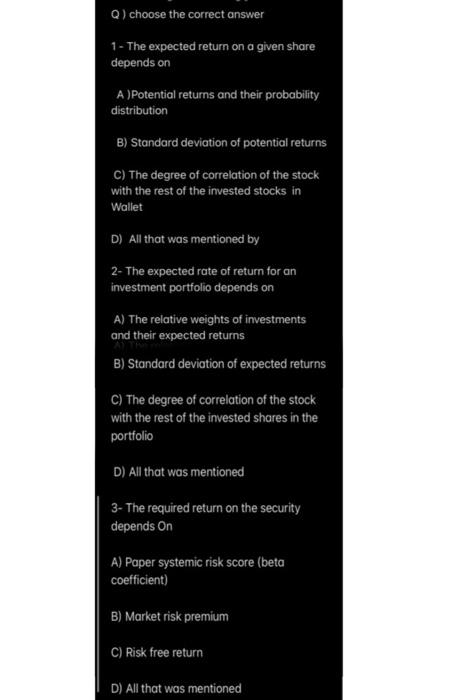

Q) choose the correct answer 1 - The expected return on a given share depends on A Potential returns and their probability distribution B) Standard deviation of potential returns C) The degree of correlation of the stock with the rest of the invested stocks in Wallet D) All that was mentioned by 2- The expected rate of return for an investment portfolio depends on A) The relative weights of investments and their expected returns B) Standard deviation of expected returns C) The degree of correlation of the stock with the rest of the invested shares in the portfolio D) All that was mentioned 3- The required return on the security depends on A) Paper systemic risk score (beta coefficient) B) Market risk premium C) Risk free return D) All that was mentioned

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts