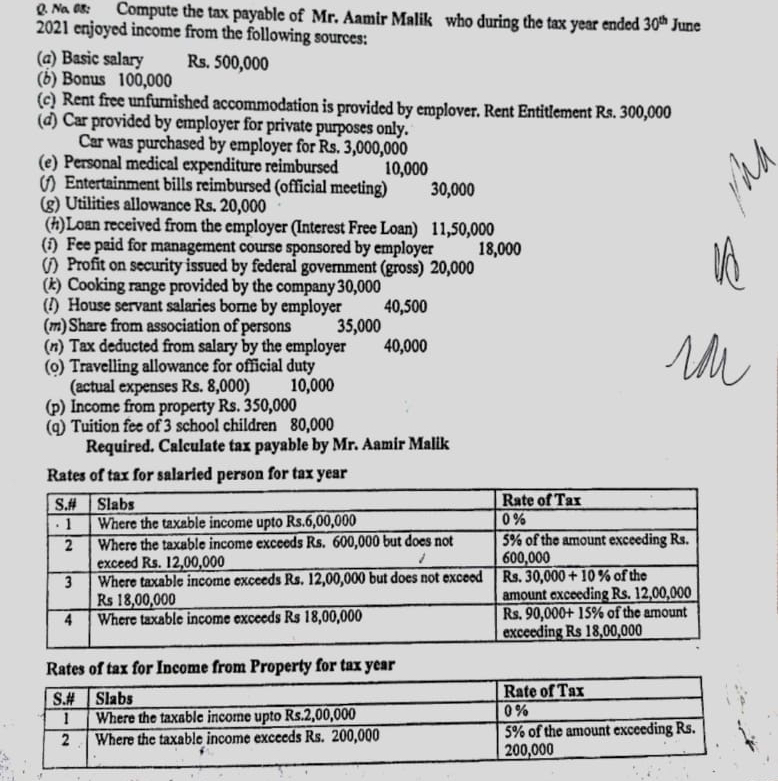

Question: Q . Na 0 5 : Compute the tax payable of Mr . Aamir Malik who during the tax year ended 3 0 t h

Q Na : Compute the tax payable of Mr Aamir Malik who during the tax year ended June enjoyed income from the following sources:

a Basic salary

Rs

b Bonus

c Rent free unfumished accommodation is provided by emplover. Rent Entitlement Rs

d Car provided by employer for private purposes only.

Car was purchased by employer for Rs

e Personal medical expenditure reimbursed

f Entertainment bills reimbursed official meeting

g Utilities allowance Rs

h Loan received from the employer Interest Free Loan

i Fee paid for management course sponsored by employer

j Profit on security issued by federal government gross

k Cooking range provided by the company

l House servant salaries borne by employer

Share from association of persons

n Tax deducted from salary by the employer

o Travelling allowance for official duty actual expenses Rs

p Income from property Rs

q Tuition fee of school children

Required. Calculate tax payable by Mr Aamir Malik

Rates of tax for salaried person for tax year

tableSHSlabs,Rate of TaxWhere the taxable income upto Rs

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock