Question: Q . No . 1 . Assuming that the rates of return associated with a given asset investment are normally distributed and that the expected

QNo

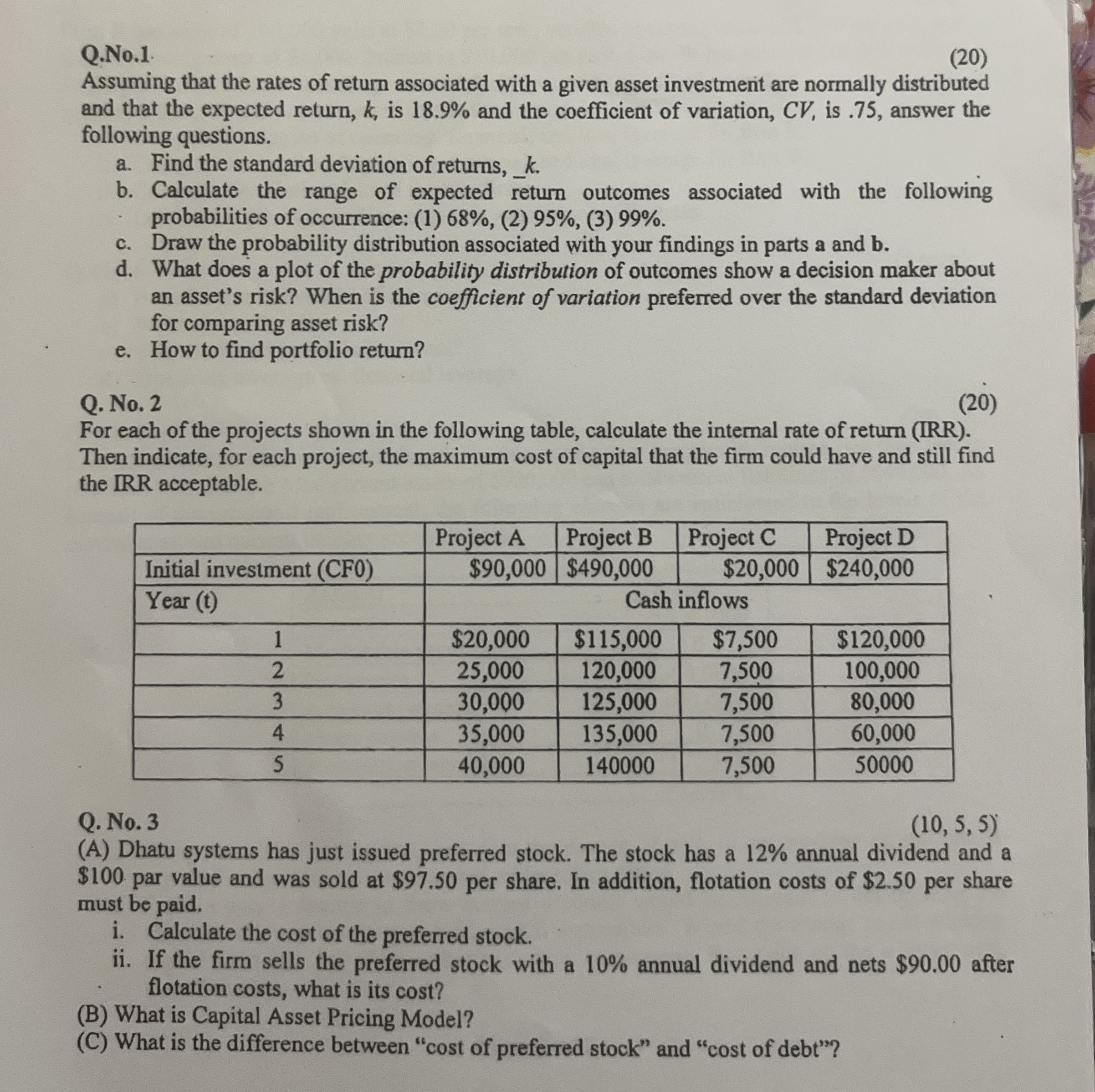

Assuming that the rates of return associated with a given asset investment are normally distributed and that the expected return, is and the coefficient of variation, is answer the following questions.

a Find the standard deviation of returns,

b Calculate the range of expected return outcomes associated with the following probabilities of occurrence:

c Draw the probability distribution associated with your findings in parts a and b

d What does a plot of the probability distribution of outcomes show a decision maker about an asset's risk? When is the coefficient of variation preferred over the standard deviation for comparing asset risk?

e How to find portfolio return?

Q No

For each of the projects shown in the following table, calculate the internal rate of return IRR Then indicate, for each project, the maximum cost of capital that the firm could have and still find the IRR acceptable.

tableProject AProject BProject CProject DInitial investment CF$$$$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock