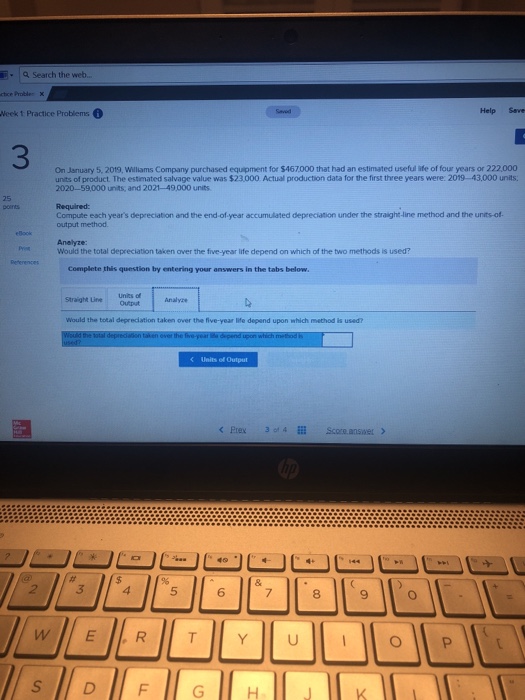

Question: Q Search the web.. Week t Practice Problems Help Save 3 On January 5, 2019, Williams Company purchased equipment for $467000 that had an estimated

Q Search the web.. Week t Practice Problems Help Save 3 On January 5, 2019, Williams Company purchased equipment for $467000 that had an estimated useful ife of four years or 222,000 units of product. The estimated salvage value was $23,000 Actual production data for the first three years were: 2019-43,000 units 2020-59,000 units, and 2021-49,000 units Required: Compute each years depreciation and the end-of year accumulated depreciation under the straight-line method and the unts of output method Anelyze: Would the total depreciation taken over the five-year life depend on which of the two methods is used? Complete this question by entering your answers in the tabs below. Units of Straight Lineoutput Straight Line Analyre Would the total depreciation taken over the five-year life depend upon which method is used? ? Units of Output ?Erex 30, 4 Scoce.ansaer> 5 6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts