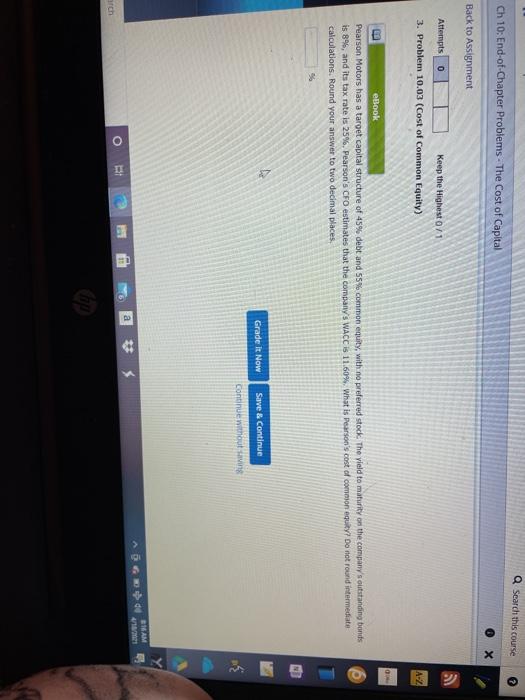

Question: Q Search this course Ch 10: End-of-Chapter Problems - The Cost of Capital Back to Assignment Attempts 0 Keep the Highest 0/1 3. Problem 10.03

Q Search this course Ch 10: End-of-Chapter Problems - The Cost of Capital Back to Assignment Attempts 0 Keep the Highest 0/1 3. Problem 10.03 (Cost of Common Equity) A-Z eBook Pearson Motors has a target capital structure of 45% debt and 55% common equity, with no preferred stock. The vield to maturity on the company's outstanding bonds is 8%, and its tax rate is 25%. Pearson's CFO estimates that the company's WACC is 11.60%. What is Pearson's cost of common equity? Do not round intermediate calculations. Round your answer to two decimal places, Grade it Now Save & Continue Continue without ang 31 AM dd is a * O B arch

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts