Question: Q1 (4 points) Interest rate risks You predict that interest rates are about to raise. Which bond of the followings expect to respond the most

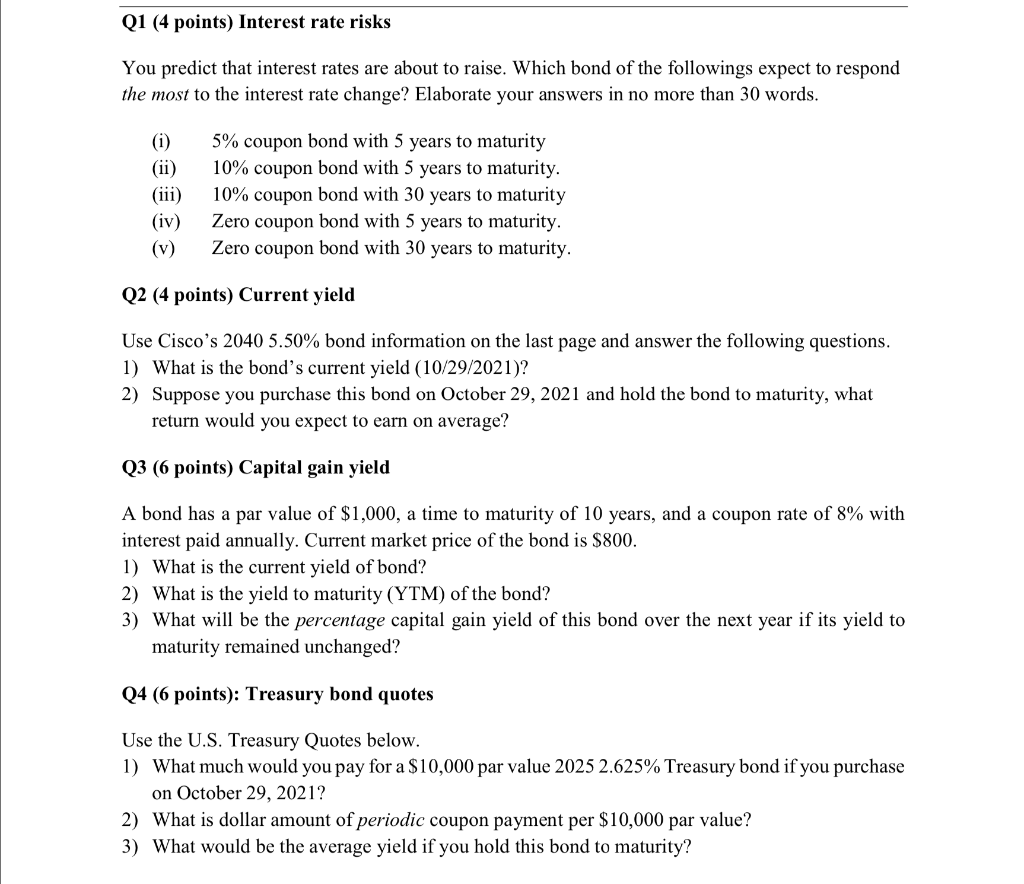

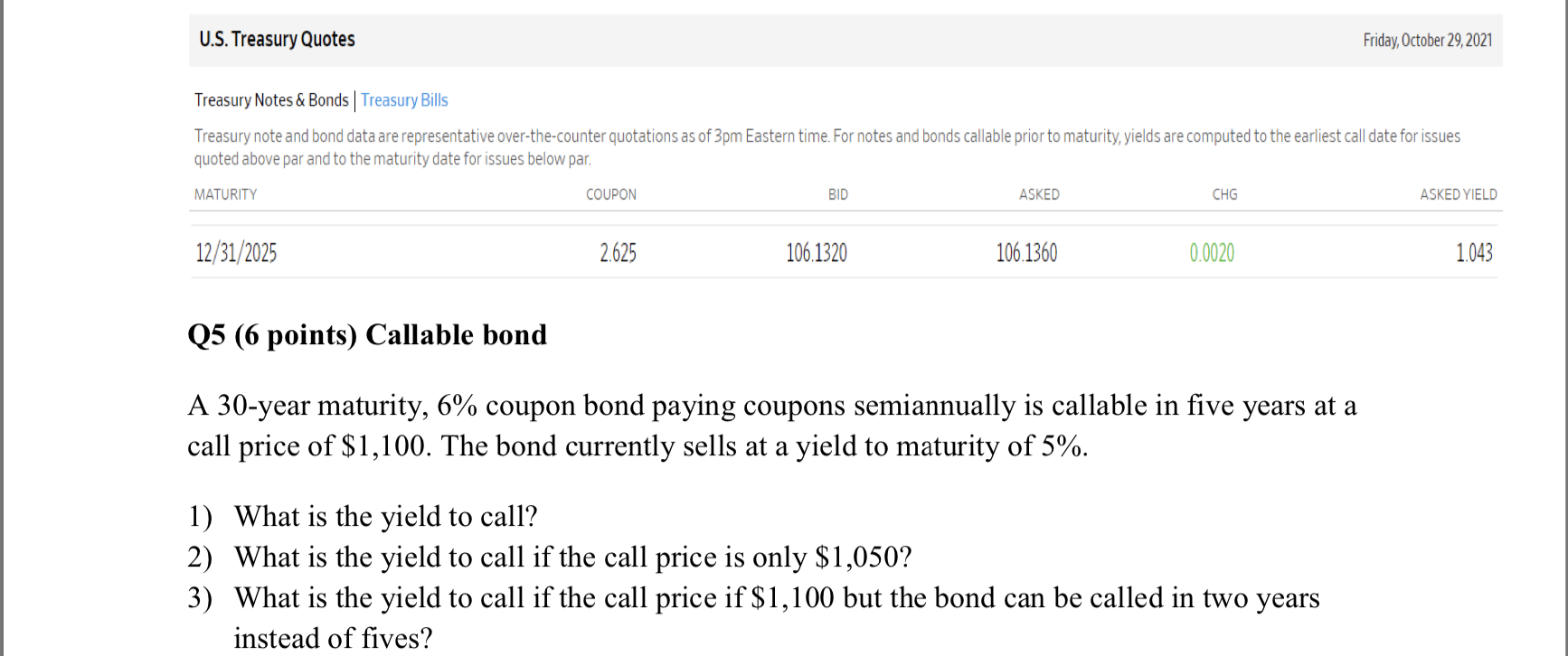

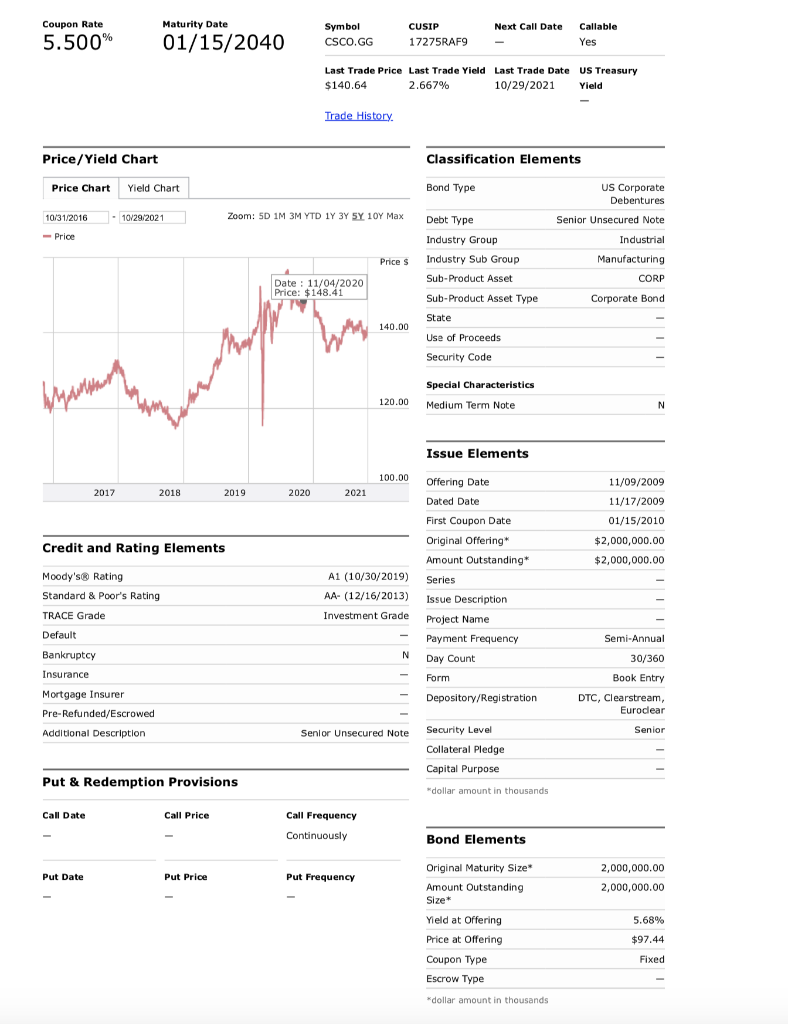

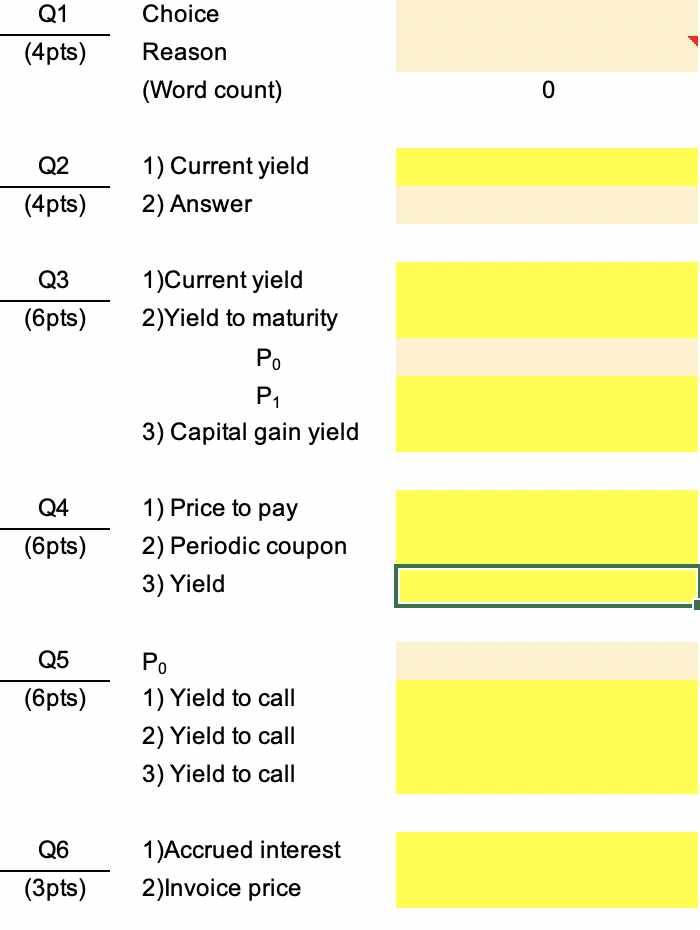

Q1 (4 points) Interest rate risks You predict that interest rates are about to raise. Which bond of the followings expect to respond the most to the interest rate change? Elaborate your answers in no more than 30 words. (i) (ii) (iii) (iv) (v) 5% coupon bond with 5 years to maturity 10% coupon bond with 5 years to maturity. 10% coupon bond with 30 years to maturity Zero coupon bond with 5 years to maturity. Zero coupon bond with 30 years to maturity. Q2 (4 points) Current yield Use Cisco's 2040 5.50% bond information on the last page and answer the following questions. 1) What is the bond's current yield (10/29/2021)? 2) Suppose you purchase this bond on October 29, 2021 and hold the bond to maturity, what return would you expect to earn on average? Q3 (6 points) Capital gain yield A bond has a par value of $1,000, a time to maturity of 10 years, and a coupon rate of 8% with interest paid annually. Current market price of the bond is $800. 1) What is the current yield of bond? 2) What is the yield to maturity (YTM) of the bond? 3) What will be the percentage capital gain yield of this bond over the next year if its yield to maturity remained unchanged? Q4 (6 points): Treasury bond quotes Use the U.S. Treasury Quotes below. 1) What much would you pay for a $10,000 par value 2025 2.625% Treasury bond if you purchase on October 29, 2021? 2) What is dollar amount of periodic coupon payment per $10,000 par value? 3) What would be the average yield if you hold this bond to maturity? U.S. Treasury Quotes Friday, October 29, 2021 Treasury Notes & Bonds | Treasury Bills Treasury note and bond data are representative over-the-counter quotations as of 3pm Eastern time. For notes and bonds callable prior to maturity, yields are computed to the earliest call date for issues quoted above par and to the maturity date for issues below par. MATURITY COUPON BID ASKED CHG ASKED YIELD 12/31/2025 2.625 106.1320 106.1360 0.0020 1.043 Q5 (6 points) Callable bond A 30-year maturity, 6% coupon bond paying coupons semiannually is callable in five years at a call price of $1,100. The bond currently sells at a yield to maturity of 5%. 1) What is the yield to call? 2) What is the yield to call if the call price is only $1,050? 3) What is the yield to call if the call price if $1,100 but the bond can be called in two years instead of fives? Next Call Date Coupon Rate 5.500% Maturity Date 01/15/2040 Symbol CSCO.GG CUSIP 17275RAF9 Callable Yes Last Trade Price Last Trade Yield Last Trade Date US Treasury $140.64 $ 2.667% 10/29/2021 Yield Trade History Price/Yield Chart / Classification Elements Price Chart Yield Chart Bond Type 10/31/2016 - 10/29/2021 Zoom: 5D 1M 3M YTD 1Y 3Y 5Y 10Y Max -Price US Corporate Debentures Senior Unsecured Note Industrial Manufacturing CORP Debt Type Industry Group Industry Sub Group Sub-Product Asset Sub-Product Asset Type State Prices Date : 11/04/2020 Price: $148.41 Corporate Bond 140.00 Use of Proceeds Security Code 120.00 Special Characteristics Medium Term Note N Issue Elements 2017 2018 2019 2020 100.00 Offering Date 2021 Dated Date First Coupon Date Original Offering* Amount Outstanding* A1 (10/30/2019) Series AA- (12/16/2013) Issue Description Investment Grade Project Name Payment Frequency 11/09/2009 11/17/2009 01/15/2010 $2,000,000.00 $2,000,000.00 Credit and Rating Elements Semi-Annual Moody's Rating Standard & Poor's Rating & TRACE Grade Default Bankruptcy Insurance Mortgage Insurer Pre-Refunded/Escrowed / Additional Description N Day Count 30/360 Book Entry Form Depository/Registration / DTC, Clearstream, Eurodear Senior Unsecured Note Senior Security Level Collateral Pledge Capital Purpose *dollar amount in thousands Put & Redemption Provisions Call Date Call Price Call Frequency Continuously Bond Elements Put Date Put Price Put Frequency 2,000,000.00 2,000,000.00 Original Maturity Size* Amount Outstanding Size* Yield at Offering Price at Offering Coupon Type Escrow Type 5.68% $97.44 Fixed *dollar amount in thousands Q1 Choice (4pts) Reason (Word count) O Q2 1) Current yield 2) Answer (4pts) Q3 (6pts) 1)Current yield 2) Yield to maturity Po PA 3) Capital gain yield Q4 1) Price to pay 2) Periodic coupon (6pts) 3) Yield Q5 Po (6pts) 1) Yield to call 2) Yield to call 3) Yield to call Q6 1)Accrued interest 2)Invoice price (3pts)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts