Question: Q1 (50%) Please read the attached case. Use the Hooke-Jeeves, Nelder-Mead, or stochastic search algorithms in Lecture 8 to find the best decision. Compare

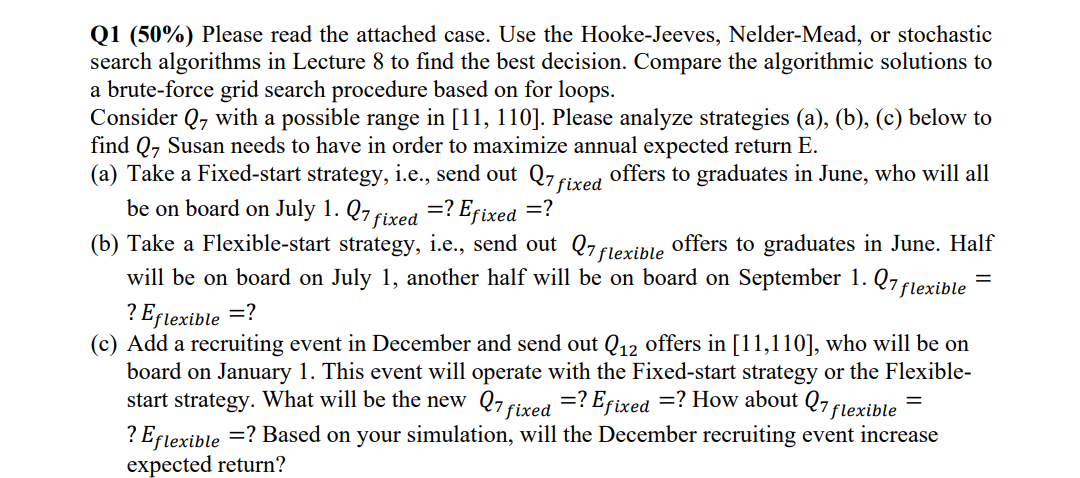

Q1 (50%) Please read the attached case. Use the Hooke-Jeeves, Nelder-Mead, or stochastic search algorithms in Lecture 8 to find the best decision. Compare the algorithmic solutions to a brute-force grid search procedure based on for loops. Consider Q7 with a possible range in [11, 110]. Please analyze strategies (a), (b), (c) below to find Q7 Susan needs to have in order to maximize annual expected return E. (a) Take a Fixed-start strategy, i.e., send out Q7 fixed' offers to graduates in June, who will all be on board on July 1. Q7 fixed =? Efixed =? flexible (b) Take a Flexible-start strategy, i.e., send out Q7 offers to graduates in June. Half will be on board on July 1, another half will be on board on September 1. Q7 flexible ? Eflexible =? (c) Add a recruiting event in December and send out Q12 offers in [11,110], who will be on board on January 1. This event will operate with the Fixed-start strategy or the Flexible- flexible start strategy. What will be the new Q7 fixed =? Efixed =? How about Q7f = ? Eflexible =? Based on your simulation, will the December recruiting event increase expected return? =

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts