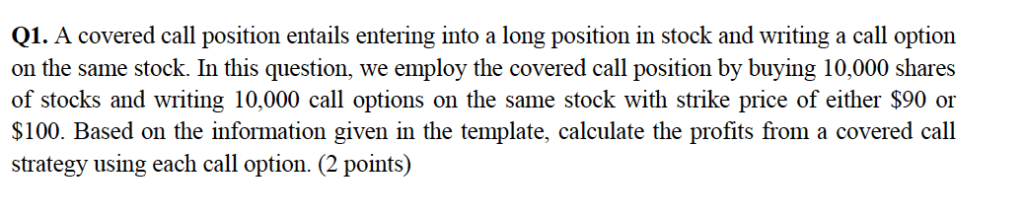

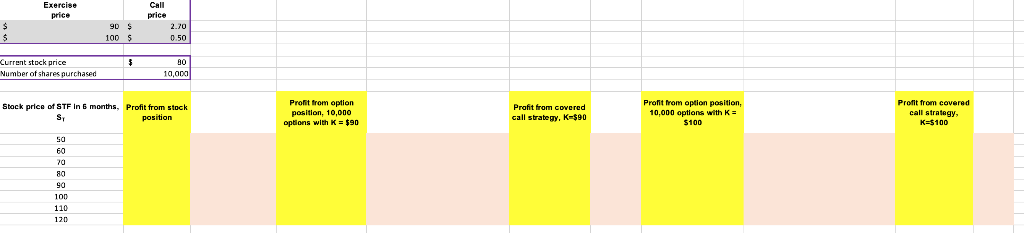

Question: Q1. A covered call position entails entering into a long position in stock and writing a call option on the same stock. In this question,

Q1. A covered call position entails entering into a long position in stock and writing a call option on the same stock. In this question, we employ the covered call position by buying 10,000 shares of stocks and writing 10,000 call options on the same stock with strike price of either $90 or $100. Based on the information given in the template, calculate the profits from a covered call strategy using each call option. (2 points) Exercise price Call price 2.70 0.50 100 Current stock price Number ot shares purchased 90 Pront trom option position, 10,000 options with K$90 Profit from option position, 10,000 options with K $100 Stock price of STF in 6 months, Profit from stock Profit from covered call strategy, K-$9 call strategy K $100 Sy 60 90 100 110 120

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts