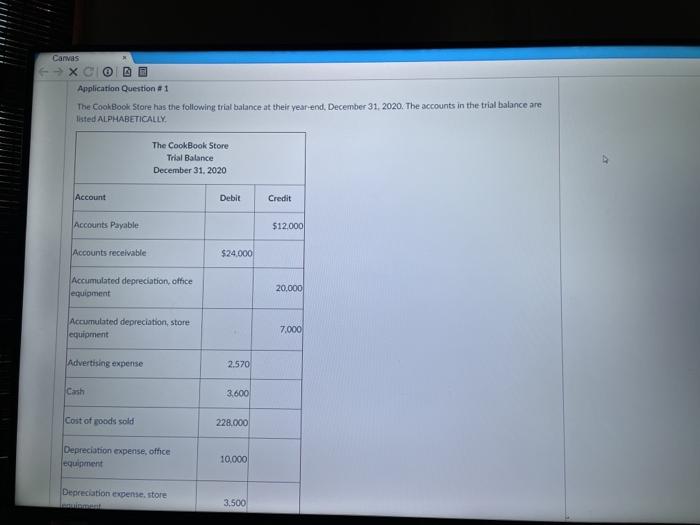

Question: q1 Canvas X GO DE Application Question #1 The Cook Book Store has the following trial balance at their year-end, December 31, 2020. The accounts

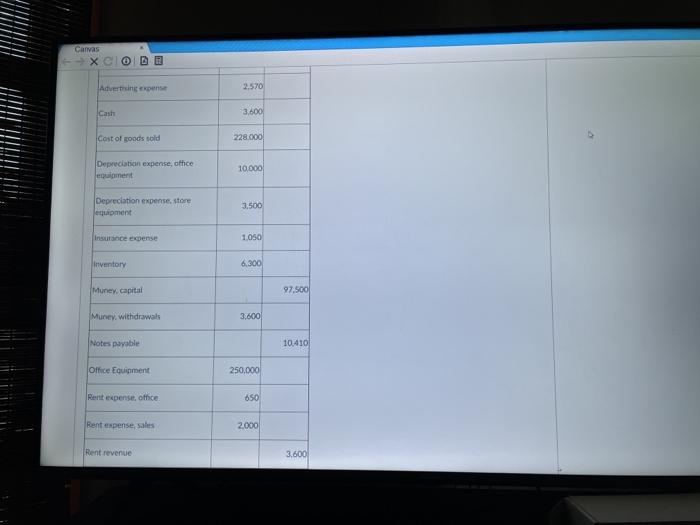

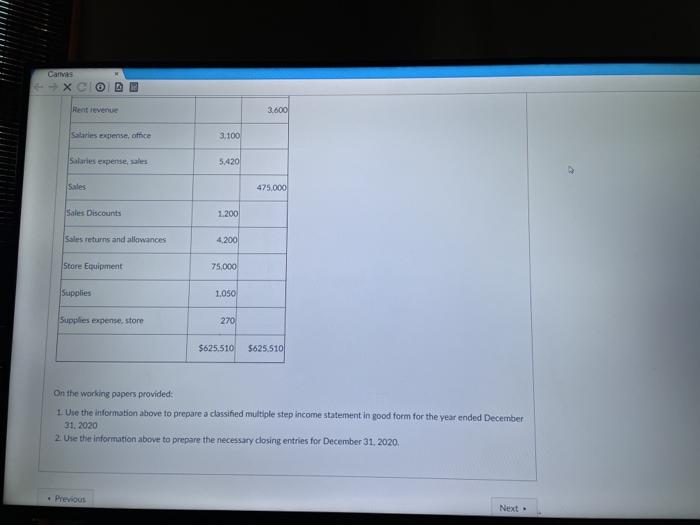

Canvas X GO DE Application Question #1 The Cook Book Store has the following trial balance at their year-end, December 31, 2020. The accounts in the trial balance are listed ALPHABETICALLY The CookBook Store Trial Balance December 31, 2020 Account Debit Credit Accounts Payable $12.000 Accounts receivable $24.000 Accumulated depreciation office equipment 20.000 Accumulated depreciation, store equipment 7.000 Advertising expense 2.570 Cash 3,600 Cost of goods sold 228.000 Depreciation expense, office equipment 10.000 Depreciation expense, store 3.500 Canvas X Advertising expense 2.570 Cash 3.600 Cost of goods sold 228.000 Depreciation expense, ofhce equipment 10.000 Depreciation expense.store equipment 3.500 Insurance expense 1.050 Inventory 6,300 Muney capital 97.500 Muney, withdrawal 3.600 Notes payable 10.410 Office Equipment 250,000 Rent expense, office 650 Rent expense, Sales 2.000 Rent revenue 3,600 Caves @ @ Rent revenue 3.600 Sales expense office 3.100 Salaries expertise, sales 5.420 Sales 475.000 Sales Discounts 1.200 Sales returns and allowances 4200 Store Equipment 75,000 Supplies 1,050 Supplies expense, store 270 $625.510 $625.510 On the working papers provided: 1. Use the information above to prepare a classifed multiple step income statement in good form for the year ended December 31, 2020 2. Use the information above to prepare the necessary closing entries for December 31, 2020, Previous Next

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts