Question: Q1. Consolidation, Post-Acquisition, Fair Value Differential & Goodwill, Equity method investment On January 1, 2011, Father Company acquired an 80 percent interest in Sun Company

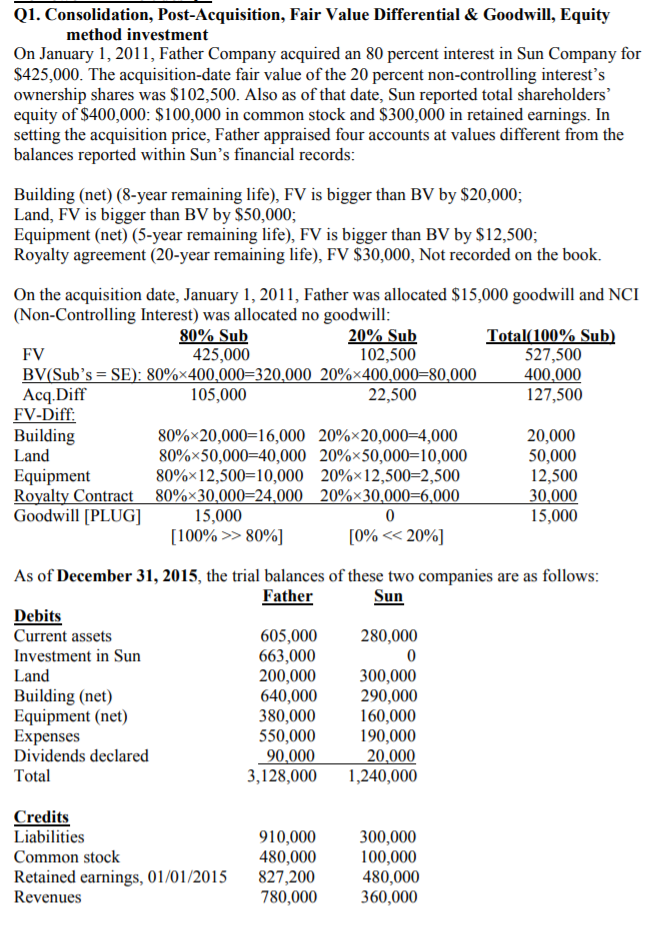

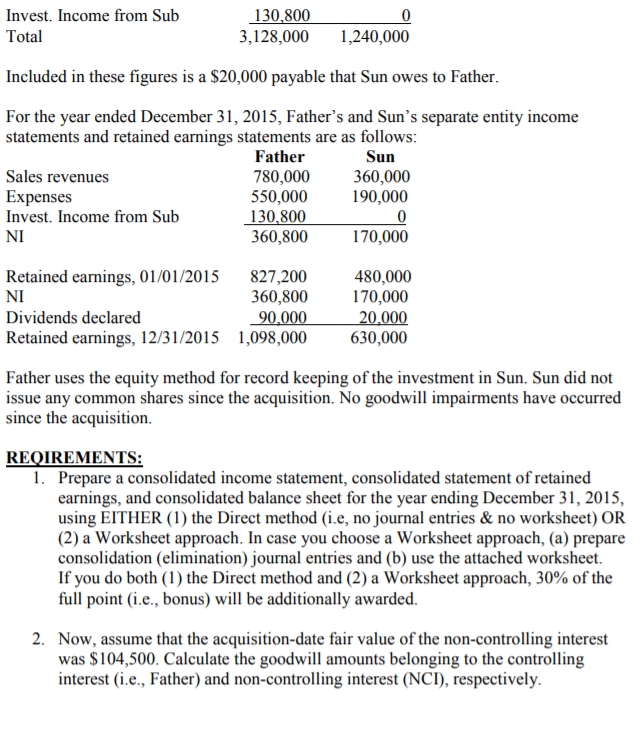

Q1. Consolidation, Post-Acquisition, Fair Value Differential & Goodwill, Equity method investment On January 1, 2011, Father Company acquired an 80 percent interest in Sun Company for $425,000. The acquisition-date fair value of the 20 percent non-controlling interest's ownership shares was $102,500. Also as of that date, Sun reported total shareholders' equity of $400,000: $100,000 in common stock and $300,000 in retained earnings. In setting the acquisition price, Father appraised four accounts at values different from the balances reported within Sun's financial records: Building (net) (8-year remaining life), FV is bigger than BV by $20,000; Land, FV is bigger than BV by $50,000; Equipment (net) (5-year remaining life), FV is bigger than BV by $12.500: Royalty agreement (20-year remaining life), FV $30,000, Not recorded on the book. On the acquisition date, January 1, 2011, Father was allocated $15,000 goodwill and NCI (Non-Controlling Interest) was allocated no goodwill: 80% Sub 20% Sub Total(100% Sub) FV 425,000 102,500 527,500 BV(Sub's = SE): 80%x400,000=320,000 20%x400.000=80,000 400,000 Acq.Diff 105,000 22,500 127,500 FV-Diff: Building 80%x20,000=16,000 20% 20,000=4,000 20,000 Land 80% 50,000=40,000 20% 50,000=10,000 50,000 Equipment 80%x12,500=10,000 20%x12,500=2,500 12,500 Royalty Contract 80%*30,000=24,000 20% 30,000=6,000 30,000 Goodwill [PLUG] 15,000 15,000 [100% >> 80%] [0% > 80%] [0%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts