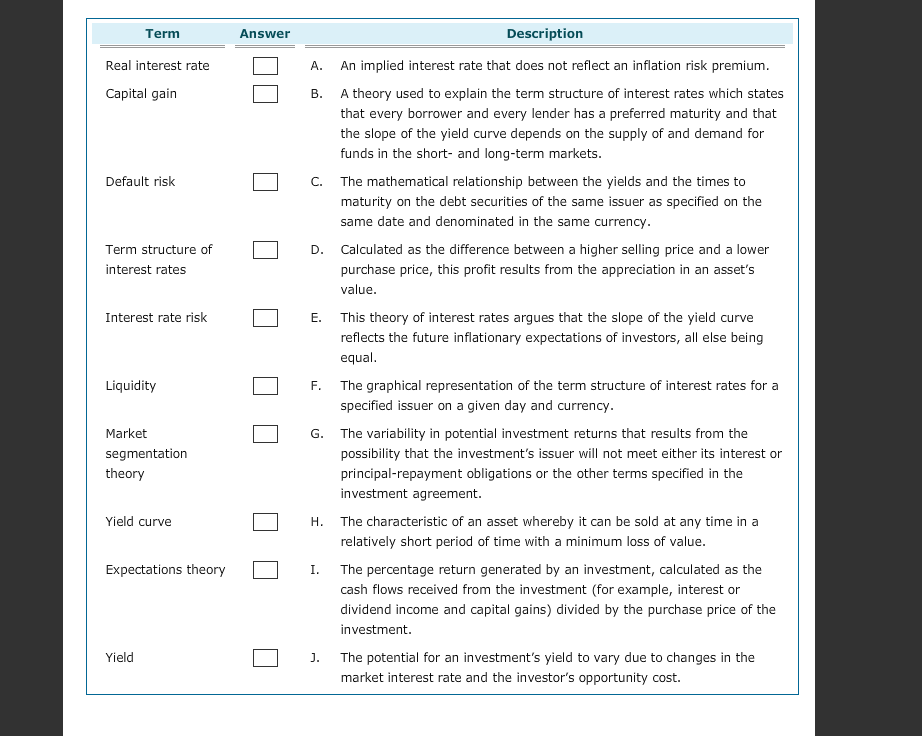

Question: Description Term Answer An implied interest rate that does not reflect an inflation risk premium Real interest rate A. Capital gain A theory used to

Description Term Answer An implied interest rate that does not reflect an inflation risk premium Real interest rate A. Capital gain A theory used to explain the term structure of interest rates which states B. that every borrower and every lender has a preferred maturity and that the slope of the yield curve depends on the supply of and demand for funds in the short- and long-term markets. Default risk The mathematical relationship between the yields and the times to C. maturity on the debt securities of the same issuer as specified on the same date and denominated in the same currency. Term structure of Calculated as the difference between a higher selling price and a lower D. purchase price, this profit results from the appreciation in an asset's value interest rates Interest rate risk This theory of interest rates argues that the slope of the yield E. curve reflects the future inflationary expectations of investors, all else being equal Liquidity The graphical representation of the term structure of interest rates for a F. specified issuer on a given day and currency. Market The variability in potential investment returns that results from the G. segmentation possibility that the investment's issuer will not meet either its interest or theory principal-repayment obligations or the other terms specified in the investment agreement Yield curve The characteristic of an asset whereby it can be sold at any time in a H. relatively short period of time with a minimum loss of value Expectations theory The percentage return generated by an investment, calculated as the cash flows received from the investment (for example, interest or L dividend income and capital gains) divided by the purchase price of the investment Yield The potential for an investment's yield to vary due to changes in the J. market interest rate and the investor's opportunity cost

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts