Question: Q1 (Continue from HW3, 3 points) You work for the International Monetary Fund in Washington DC, monitoring Singapore's real consumption expenditures. Using a sample of

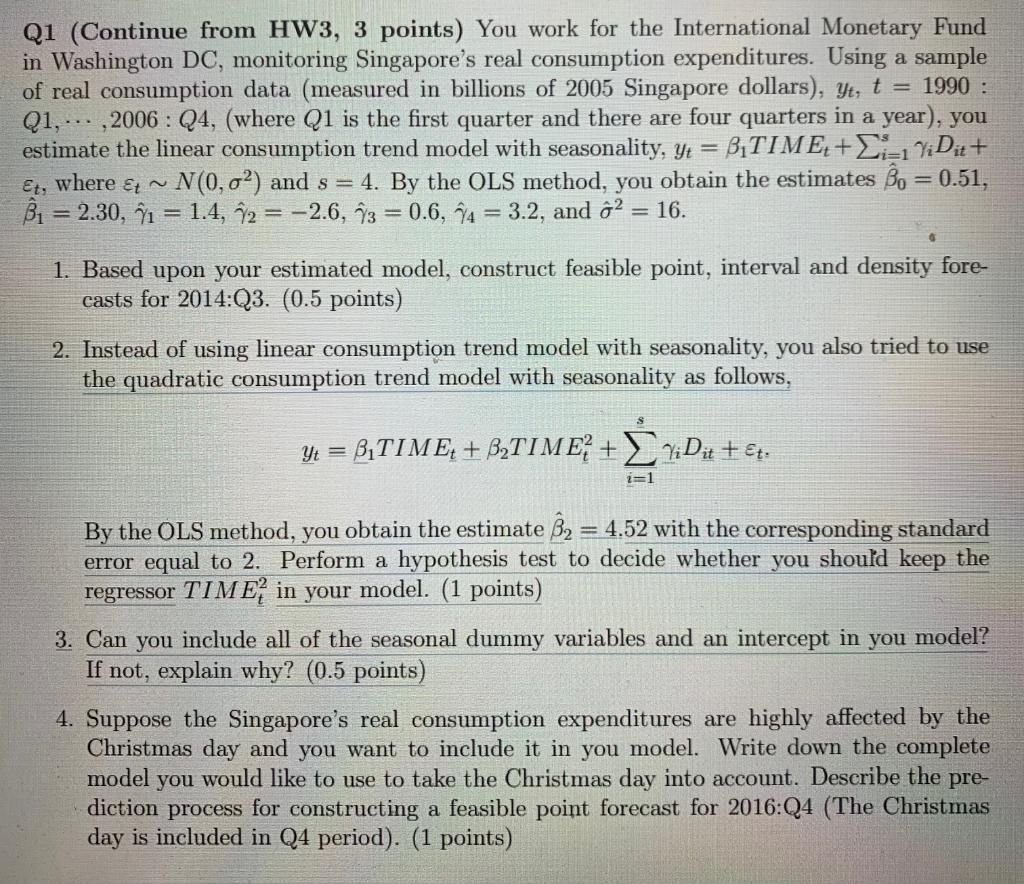

Q1 (Continue from HW3, 3 points) You work for the International Monetary Fund in Washington DC, monitoring Singapore's real consumption expenditures. Using a sample of real consumption data (measured in billions of 2005 Singapore dollars), yt, t = 1990 : Q1, ... , 2006 : Q4, (where Q1 is the first quarter and there are four quarters in a year), you estimate the linear consumption trend model with seasonality, y = BATIME+2= y;Dit + Et, where ~ N(0,0%) and s = 4. By the OLS method, you obtain the estimates Bo = 0.51, Bi = 2.30, 1 = 1.4, 12 = -2.6, ^3 = 0.6, 94 = 3.2, and 2 Et ~ = 16. 1. Based upon your estimated model, construct feasible point, interval and density fore- casts for 2014:Q3. (0.5 points) 2. Instead of using linear consumption trend model with seasonality, you also tried to use the quadratic consumption trend model with seasonality as follows, Y = B,TIME+ B2TIME? + ViDit + et. 21 By the OLS method, you obtain the estimate B2 = 4.52 with the corresponding standard error equal to 2. Perform a hypothesis test to decide whether you should keep the regressor TIME in your model. (1 points) 3. Can you include all of the seasonal dummy variables and an intercept in you model? If not, explain why? (0.5 points) 4. Suppose the Singapore's real consumption expenditures are highly affected by the Christmas day and you want to include it in you model. Write down the complete model you would like to use to take the Christmas day into account. Describe the pre- diction process for constructing a feasible point forecast for 2016:Q4 (The Christmas day is included in Q4 period). (1 points) Q1 (Continue from HW3, 3 points) You work for the International Monetary Fund in Washington DC, monitoring Singapore's real consumption expenditures. Using a sample of real consumption data (measured in billions of 2005 Singapore dollars), yt, t = 1990 : Q1, ... , 2006 : Q4, (where Q1 is the first quarter and there are four quarters in a year), you estimate the linear consumption trend model with seasonality, y = BATIME+2= y;Dit + Et, where ~ N(0,0%) and s = 4. By the OLS method, you obtain the estimates Bo = 0.51, Bi = 2.30, 1 = 1.4, 12 = -2.6, ^3 = 0.6, 94 = 3.2, and 2 Et ~ = 16. 1. Based upon your estimated model, construct feasible point, interval and density fore- casts for 2014:Q3. (0.5 points) 2. Instead of using linear consumption trend model with seasonality, you also tried to use the quadratic consumption trend model with seasonality as follows, Y = B,TIME+ B2TIME? + ViDit + et. 21 By the OLS method, you obtain the estimate B2 = 4.52 with the corresponding standard error equal to 2. Perform a hypothesis test to decide whether you should keep the regressor TIME in your model. (1 points) 3. Can you include all of the seasonal dummy variables and an intercept in you model? If not, explain why? (0.5 points) 4. Suppose the Singapore's real consumption expenditures are highly affected by the Christmas day and you want to include it in you model. Write down the complete model you would like to use to take the Christmas day into account. Describe the pre- diction process for constructing a feasible point forecast for 2016:Q4 (The Christmas day is included in Q4 period). (1 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts