Question: Q1. Cuu= Select one: a) 159 b) 149 c) 169 d) 129 e) 139 Q2. Cud= Select one: a) 111 b) 91 c) 108 d)

Q1. Cuu= Select one:

a) 159

b) 149

c) 169

d) 129

e) 139

Q2. Cud= Select one:

a) 111

b) 91

c) 108

d) 120

e) 0

Q3. Cdd=

Select one:

a) 34

b) 0

c) 22

d) 3

e) 5

Q4. To calculate Cu, the hedge ratio is Select one:

a) 0.3333

b) 0.4657

c) 0.2876

d) 0.8846

e) 0.7865

Q5. Cu= Select one:

a) 67.77

b) 45.66

c) 23.33

d) 77.89

e) 41.82

Q6. To calculate Cd, the hedge ratio is

a) 0.111

b) 0

c) 0.475

d) 0.222

e) 0.243

Q7. Cd=

a) 3.333

b) 2.222

c) 1.222

d) 0

e) 3.983

Q8. To calcuate C0, the hedge ratio is

a) 0.222

b) 0.567

c) 0

d) 0.697

e) 0.345

Q9. C0=

a) 24.3

b) 28.7

c) 23.4

d) 25.3

e) 29.2

Q10. The value of Cu at time 1 is

a) 33.4

b) 45.7

c) 43.4

d) 23.4

e) 56.7

Q11. The value of Cd at time 1 is

a) 4.55

b) 2.38

c) 1.22

d) 3.33

e) 0.89

Q12. The value of C0 at time 0 is

a) 34.4

b) 29.4

c) 23.3

d) 15.2

e) 4.4

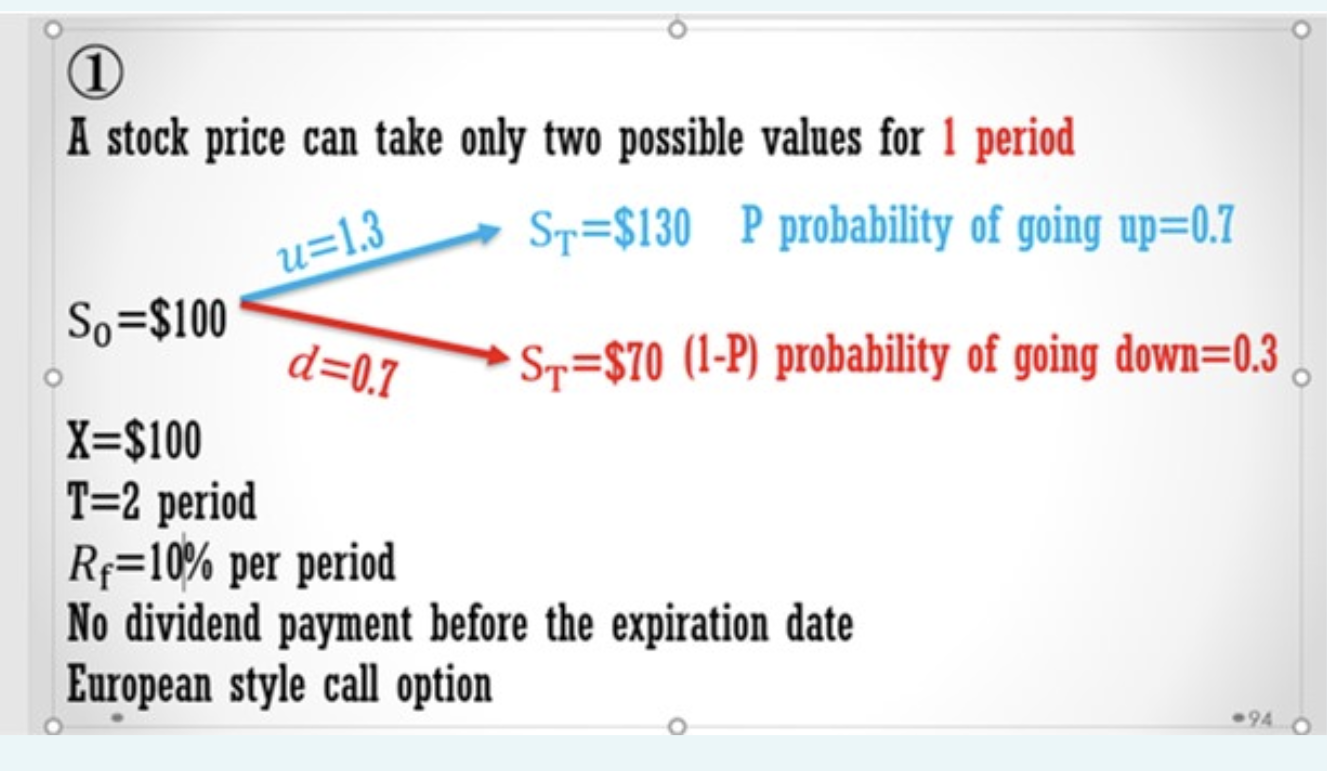

A stock price can take only two possible values for 1 period X=$100T=2periodRf=10%perperiod No dividend payment before the expiration date European style call option

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts