Question: Q1) Final Finishing is evaluating two mutually exclusive alternatives for a new piece of equipment, called a polisher. Each alternative has an expected life of

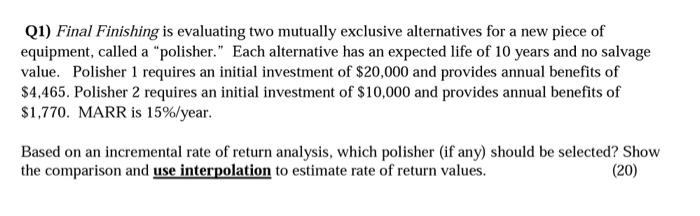

Q1) Final Finishing is evaluating two mutually exclusive alternatives for a new piece of equipment, called a "polisher." Each alternative has an expected life of 10 years and no salvage value. Polisher 1 requires an initial investment of $20,000 and provides annual benefits of $4,465. Polisher 2 requires an initial investment of $10,000 and provides annual benefits of $1,770. MARR is 15%/ year. Based on an incremental rate of return analysis, which polisher (if any) should be selected? Show the comparison and use interpolation to estimate rate of return values. (20)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts