Question: Q1. Find expected value. Do not use 50% / 50% probabilities as did in past examples because you will get an incorrect answer. Choose the

Q1.

Q1.

Find expected value. Do not use 50% / 50% probabilities as did in past examples because you will get an incorrect answer.

Choose the answer below:

266.6

200

120

166.6

Q2. Suppose the price of the security is equal to the expected value. Would you expect the actual price to be higher or lower than the expected value and why?

Q3. Assuming the price is equal to the expected value, find the returns to this security when the payoff is high and when the payoff is low.

Group of answer choices:

about +80% and -40%

about +50% and -50%

about +100% and -40%

about +120% and -40%

about +40% and -40%

Q4. What is the expected return? (can you do it without calculations?)

Group of answer choices:

+10%

0

-10%

-40%

Q5. What is the formula for the variance? Can you calculate the variance of the returns? If you can, write the answer and show steps.

Please solve all parts to the question, thank you.

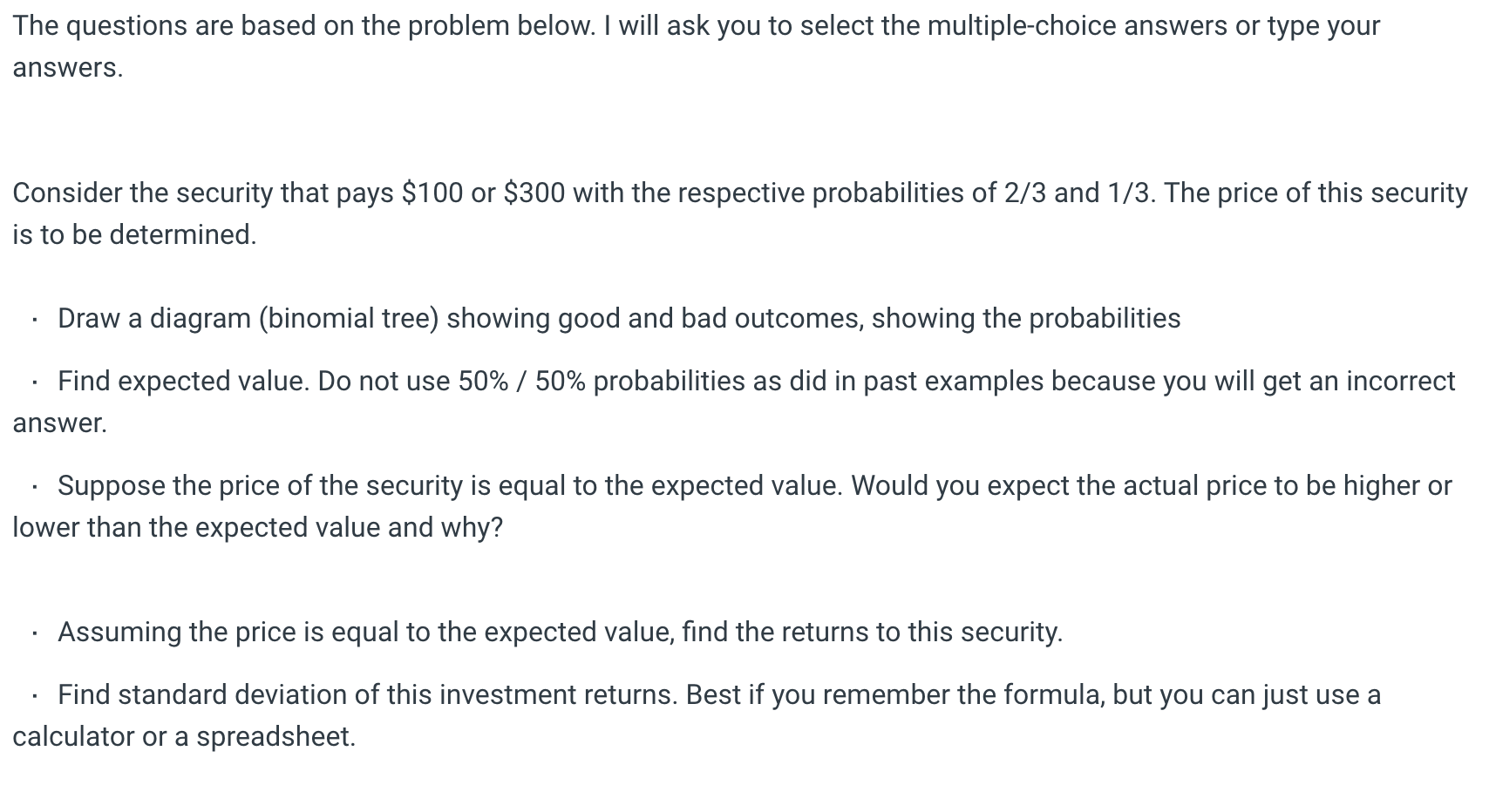

The questions are based on the problem below. I will ask you to select the multiple-choice answers or type your answers. Consider the security that pays $100 or $300 with the respective probabilities of 2/3 and 1/3. The price of this security is to be determined. Draw a diagram (binomial tree) showing good and bad outcomes, showing the probabilities Find expected value. Do not use 50% / 50% probabilities as did in past examples because you will get an incorrect answer. Suppose the price of the security is equal to the expected value. Would you expect the actual price to be higher or lower than the expected value and why? Assuming the price is equal to the expected value, find the returns to this security. Find standard deviation of this investment returns. Best if you remember the formula, but you can just use a calculator or a spreadsheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts