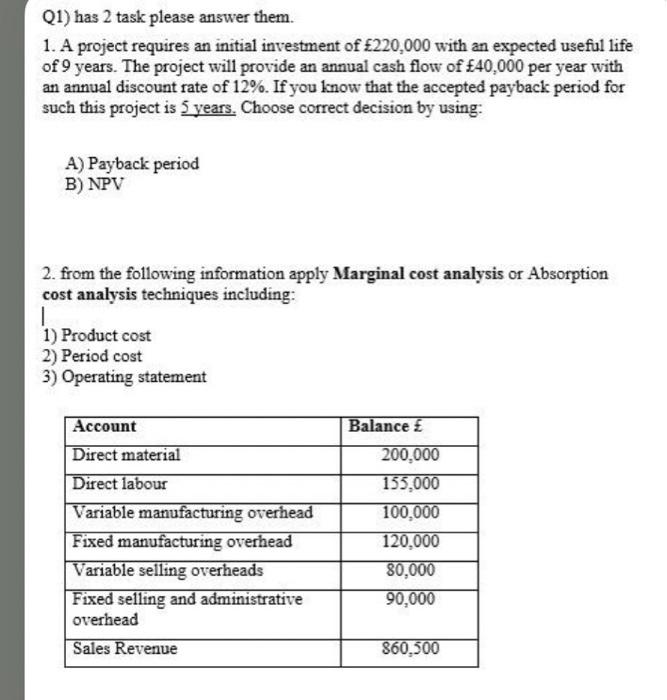

Question: Q1) has 2 task please answer them. 1. A project requires an initial investment of 220,000 with an expected useful life of 9 years. The

Q1) has 2 task please answer them. 1. A project requires an initial investment of 220,000 with an expected useful life of 9 years. The project will provide an annual cash flow of 40,000 per year with an annual discount rate of 12%. If you know that the accepted payback period for such this project is 5 years. Choose correct decision by using: A) Payback period B) NPV 2. from the following information apply Marginal cost analysis or Absorption cost analysis techniques including: 1) Product cost 2) Period cost 3) Operating statement Account Direct material Direct labour Variable manufacturing overhead Fixed manufacturing overhead Variable selling overheads Fixed selling and administrative overhead Balance & 200,000 155,000 100,000 120.000 80,000 90,000 Sales Revenue 860.500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts