Question: Q1) Joogle is high tech start up that is not expected to pay a dividend for 10 years. At year 11, you expect it to

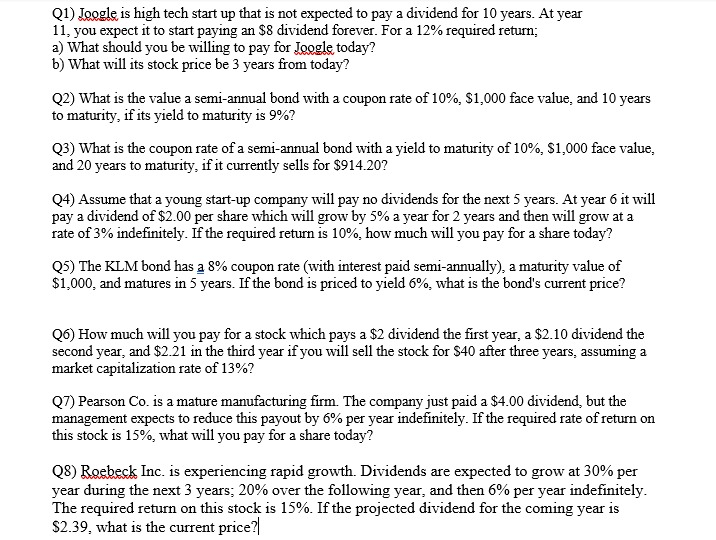

Q1) Joogle is high tech start up that is not expected to pay a dividend for 10 years. At year 11, you expect it to start paying an $8 dividend forever. For a 12% required return; a) What should you be willing to pay for Joogle today? b) What will its stock price be 3 years from today? (2) What is the value a semi-annual bond with a coupon rate of 10%, $1,000 face value, and 10 years to maturity, if its yield to maturity is 9%? Q3) What is the coupon rate of a semi-annual bond with a yield to maturity of 10%, $1,000 face value, and 20 years to maturity, if it currently sells for $914.20? Q4) Assume that a young start-up company will pay no dividends for the next 5 years. At year 6 it will pay a dividend of $2.00 per share which will grow by 5% a year for 2 years and then will grow at a rate of 3% indefinitely. If the required return is 10%, how much will you pay for a share today? Q5) The KLM bond has a 8% coupon rate (with interest paid semi-annually), a maturity value of $1,000, and matures in 5 years. If the bond is priced to yield 6%, what is the bond's current price? Q6) How much will you pay for a stock which pays a $2 dividend the first year, a $2.10 dividend the second year, and $2.21 in the third year if you will sell the stock for $40 after three years, assuming a market capitalization rate of 13%? (7) Pearson Co. is a mature manufacturing firm. The company just paid a $4.00 dividend, but the management expects to reduce this payout by 6% per year indefinitely. If the required rate of return on this stock is 15%, what will you pay for a share today? Q8) Reebeck Inc. is experiencing rapid growth. Dividends are expected to grow at 30% per year during the next 3 years: 20% over the following year, and then 6% per year indefinitely. The required return on this stock is 15%. If the projected dividend for the coming year is $2.39, what is the current price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts